The US stock market has been on fire since the election in November. That and the strength of the US Dollar around the world has many looking at taking a European Vacation this summer. If you are among them enjoy your planning and have a great time. If you are not going to explore Europe on foot this summer there may be an alternative. Try the Euro Stoxx 50 Index.

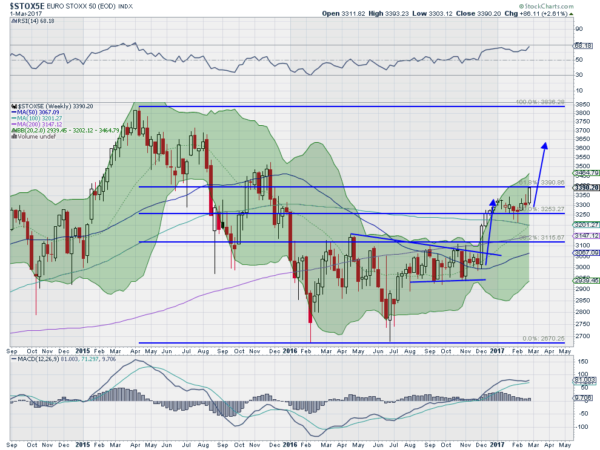

The SPDR Euro Stoxx 50 (NYSE:FEZ) is made up of the 50 largest Euro Zone companies. So maybe you can experience even more of Europe than your friends will in person. And the ETF that tracks it has also been moving higher since our election. The chart below shows the price action on a weekly basis over the last two years.

After a drawn out pullback that found a bottom in February of 2016, the Stoxx 50 consolidated most of the rest of the year. It broke above consolidation in November and ran to a high at the end of the year. It consolidated there, at a 50% retracement of the move lower for the next 2 months. This week it is making a secondary move to the upside.

The strong candle gives a target move to 3650 on the index for this leg. That would be close to a 88.6% retracement. Momentum supports a further move higher with the RSI rising and bullish and the MACD avoiding a cross and turning back higher. Even the Bollinger Bands® are pointing higher. Perhaps you can still enjoy the pleasures of visiting Europe this summer and fatten your wallet while doing so.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.