Investing.com’s stocks of the week

Major European Stock Indices have created “look alike” patterns of late. Could they be sending an important message to stocks around the world? Sure could be.

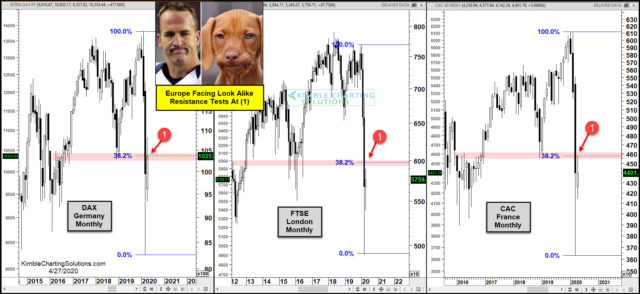

The DAX in Germany, the FTSE 100in London and the CAC 40in France have reflected relative weakness when compared with the S&P 500 over the past few years. Have they been sending a bearish divergence message to stocks for a good while? Sure could be.

Each index peaked the first of the year and each fell more than the S&P 500 in the first quarter.

The counter-trend rally has each testing old support as new resistance as well as each is testing its 38% Fibonacci retracement level of the 2020 highs and lows at each (1).

What would send a bullish message to stocks around the world? A breakout above each of the resistance tests at each (1).

What would send a bearish case to stocks in Europe and the states? Each of these stock indices creates a bearish reversal pattern as they kiss dual resistance at each (1).

{{youtube|{"id":"FJdWJN1bvEI"}}}

We put together this video that details what the four largest bear markets of the past 100 years looked and acted like.