When high-quality bull markets happen, banks are historically on board and along for the ride.

Below looks at the Power of the Pattern on banks in Europe and Italy.

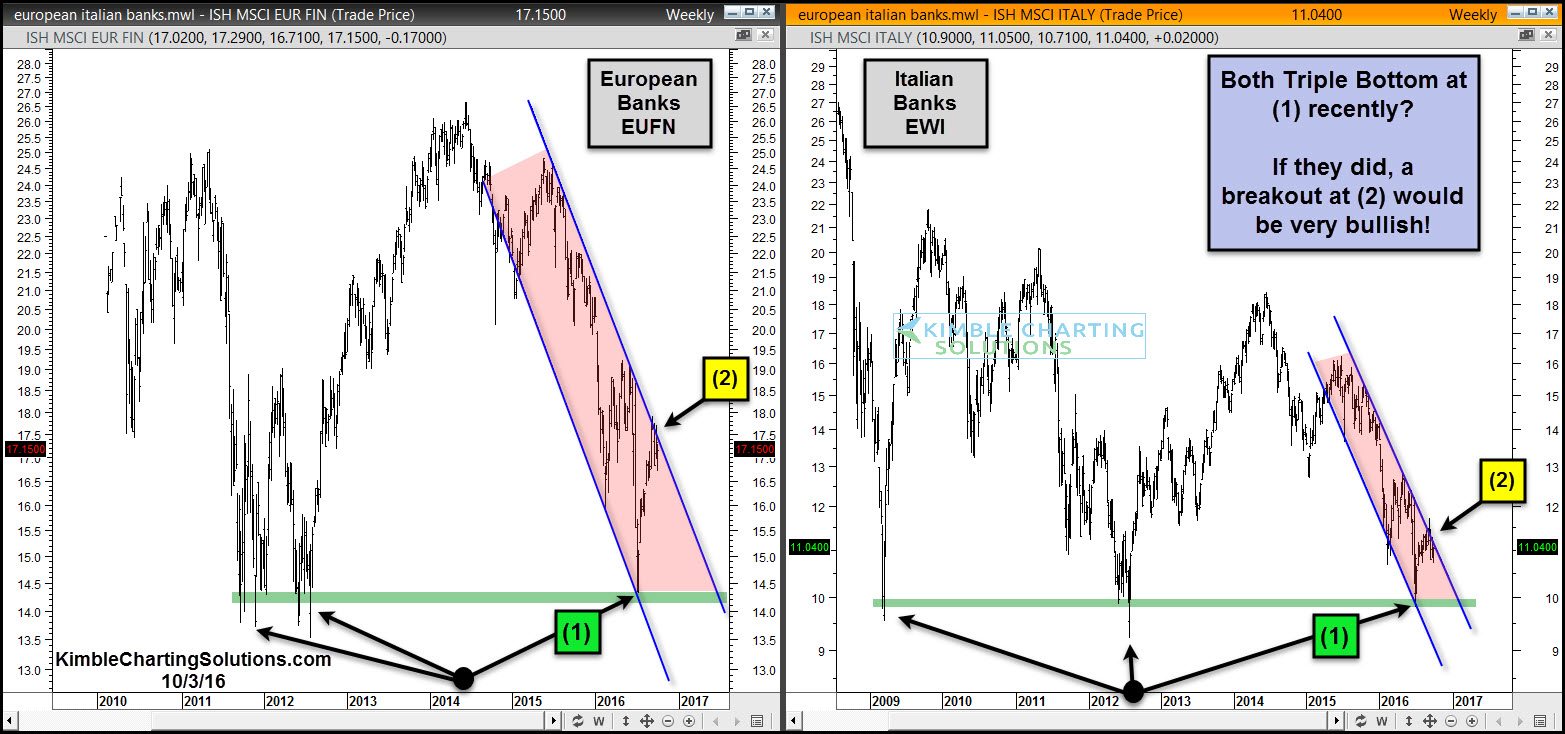

European bank ETFs in general and Italian bank ETFs in particular remain in uniform falling channels.

Did both create triple bottoms at (1)? It's possible.

The risk-on trade in Europe and Italy are testing uniform falling channel resistance at (2). The first step to proving that a triple bottom is in place is to watch what happens at (2).

For the risk-on trade in the states and around the world to keep moving higher, investors want and need to see these ETF’s breakout at (2).

If EUFN and EWI turn sharply lower at (2), odds are high that the S&P 500 will struggle at the 2,150 zone.