Investing.com’s stocks of the week

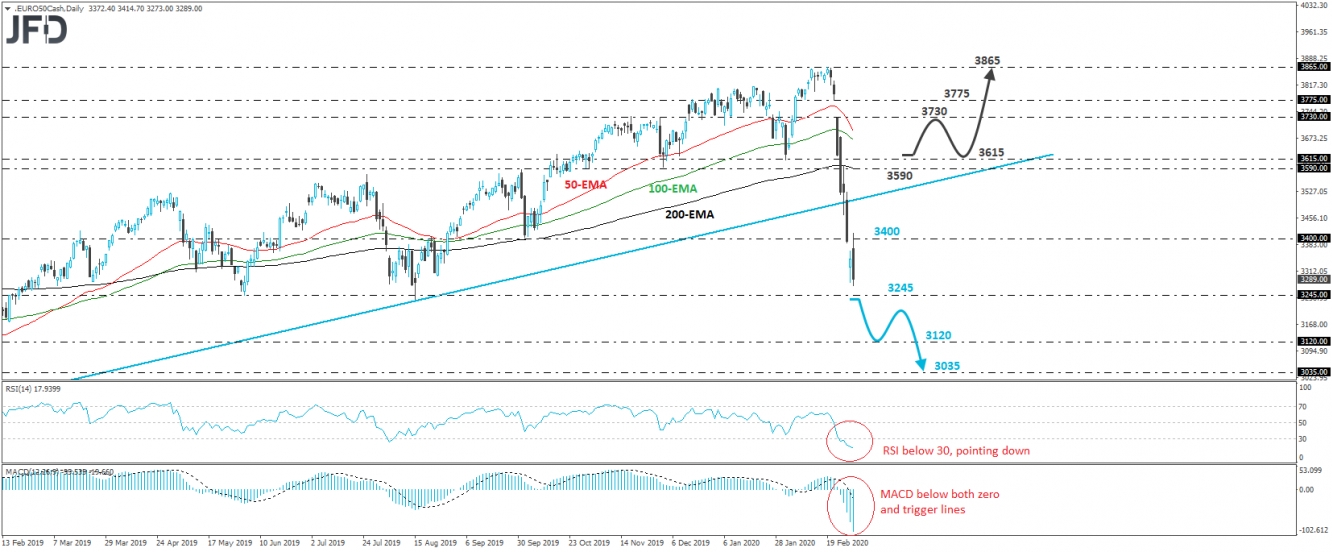

The Euro Stoxx 50 index collapsed last week, alongside the other global stock indices, due to concerns that the effects of the fast-spreading coronavirus could lead to another recession. What’s more, on Friday, the index fell below an upside support line drawn from the low of December 27th, 2018, which in our view, turned the near-term outlook even more bearish. The cash index opened with a negative gap today, rebounded somewhat during the Asian morning, but the recovery stayed limited slightly above 3400, and then the index resumed its free fall.

Now, it is trading slightly above the 3245 barrier, which is marked as a support by the low of June 6th, and is also marginally above the low of August 15th. If the bears are willing to stay in the driver’s seat, we could see them overcoming that barrier soon, something that may allow the dive to extend towards the 3120 area, which provided support on February 8th, 2019. If that zone does not hold either, then the bears may put the 3035 area on their radars, marked by the low of January 2nd, 2019.

Shifting attention to our daily oscillators, we see that the RSI lies within its below-30 zone, and keeps pointing down, while the MACD stands well below both its zero and trigger lines, pointing south as well. These indicators detect accelerating downside speed and corroborate our view that there is room for further declines in this index.

On the upside, we would like to see a strong recovery above 3615 before we totally abandon the bearish case. Such a move would confirm the price’s return above the aforementioned upside line and may initially pave the way towards last Monday’s peak, at around 3730. Slightly higher we have the low of Friday, February 21st, which if broken may set the stage for another test near the highs of February 12th and 19th, near 3865.