Investing.com’s stocks of the week

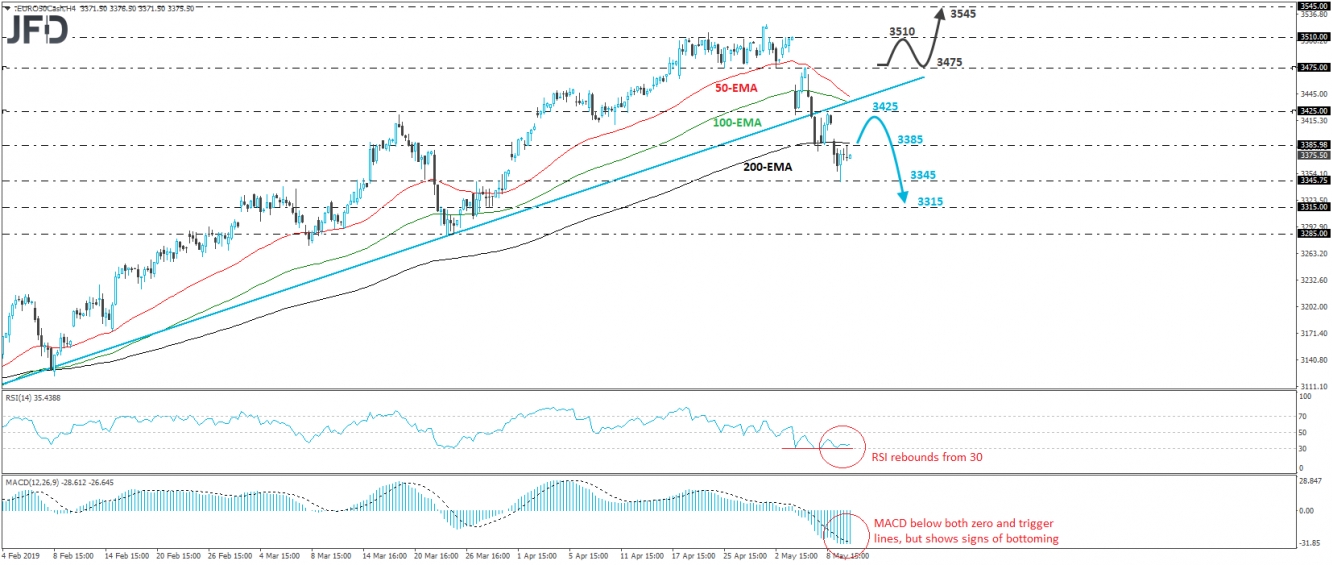

Euro Stoxx 50 tumbled on Thursday, breaking below the support (now turned into resistance) barrier at 3385. That said, the index hit support near the 3345 zone, and then it rebounded somewhat. Although the rebound may continue for a while more, the fact that the price remains below the upside line drawn from the low of January 7th, suggests a negative near-term picture. Therefore, as long as this is the case, we would see a decent chance for the bears to jump back into the action soon and push the index lower.

A break back above 3385 could confirm the case for further recovery, perhaps towards the 3425 zone, defined by Wednesday’s high. This is where the bears may decide to take charge again and perhaps drive the battle all the way down for another test at the 3345 hurdle. If they don’t hit the brakes near that zone, then we may see them aiming for the 3315 territory, defined by the low of March 28th.

Shifting attention to our short-term oscillators, we see that the RSI rebounded again from near its 30 line, while the MACD, although below both its zero and trigger lines, shows signs of bottoming. These indicators detect slowing downside speed and support the notion for some further corrective recovery before the next leg south.

However, in order to abandon the bearish case, we would like to see the recovery extending above 3475. This would bring the index back above the aforementioned upside line and may initially aim for the key resistance obstacle of 3510. If the bulls are strong enough to overcome it, then they may set the stage for extensions towards 3545, near the high of June 14th.