EUR/USD has posted slight gains in the Wednesday session. Currently, the pair is trading at 1.1453, up 0.11% on the day. On the release front, German and Eurozone numbers were stronger than expected. German’s trade surplus jumped to EUR 19.0 billion, above the estimate of EUR 17.9 billion and hit a 5-month high. As well, the yield on German 10-year bonds continues to fall, with a reading of just 0.29%, its lowest yield since June 2017. The Eurozone unemployment rate unexpectedly fell to 7.9%, its lowest level since October 2008. In the U.S., today’s highlight is the FOMC minutes from the December meeting. On Thursday, the ECB releases the accounts of its December meeting. The U.S. will post unemployment claims and Federal Reserve Chair Powell speaks at an event in Washington.

The Federal Reserve will be in the spotlight, with the release of the FOMC minutes later on Monday. At the December policy meeting, the Fed raised rates by a quarter point, to a range between 2.25% and 2.50%. This ended a very aggressive 2018 for the Fed, which hiked rates four times. The December rate statement hinted that further rates were in the works for 2019, but a sharp drop in the stock markets has forced the Fed to adjust, and Fed Chair Powell was quite dovish in remarks last week, which were well received by investors. The Fed forecast is calling for two more hikes this year, but the markets are doubtful, with some analysts predicting a rate cut late in the year. It will be interesting to see the views of policymakers in the minutes and the reaction of the markets.

The German manufacturing sector has taken a hit due to an ongoing global trade war, and this week’s manufacturing numbers are pointing to a slowdown. Factory orders fell 1.0%, well of the estimate of -0.2%. This was followed by a decline of 1.9% in industrial production, much weaker than the forecast of 0.3%. This marked the fifth decline in the past six months. Unless the ongoing trade war eases soon, we can expect German manufacturing data to struggle.

EUR/USD Fundamentals

Wednesday (January 9)

- 2:00 German Trade Balance. Estimate 17.9B. Actual 19.0B

- 4:00 Italian Monthly Unemployment Rate. Estimate 10.5%. Actual 10.5%

- 5:00 Eurozone Unemployment Rate. Estimate 8.1%. Actual 7.9%

- 5:32 German 10-year Bond Auction. Actual 0.29/1.6

- 9:00 FOMC Member Evan Speaks

- 10:30 US Crude Oil Inventories. Estimate -2.4M

- 11:30 US FOMC Member Rosengren Speaks

- 13:01 US 10-year Bond Auction

- 14:00 US FOMC Meeting Minutes

Thursday (January 10)

- 7:30 ECB Monetary Policy Meeting Accounts

- 8:30 US Unemployment Claims

- 12:00 US Fed Chair Powell Speaks

*All release times are EST

*Key events are in bold

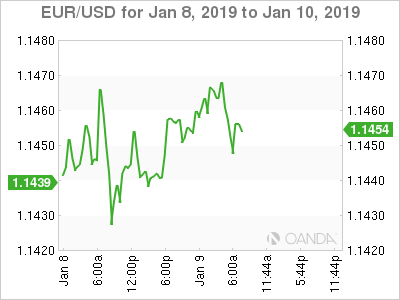

EUR/USD for Wednesday, January 9, 2019

EUR/USD for January 9 at 6:50 EST

Open: 1.1440 High: 1.1478 Low: 1.1437 Close: 1.1453

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.12112 | 1.1300 | 1.1434 | 1.1553 | 1.1685 | 1.1803 |

EUR/USD posted small gains in the Asian session but has retracted in European trade.

- 1.1434 remains a weak support line

- 1.1553 is the next resistance line

- Current range: 1.1434 to 1.1533

Further levels in both directions:

- Below: 1.1434, 1.1300, 1.1212 and 1.1120

- Above: 1.1553, 1.1685 and 1.1803