The financial markets are relatively steady today so far. Asian stocks opened higher today but the Nikkei pared back the gains and is trading up around 0.2% at the time of writing. That followed slight gain in DJIA by 0.10% and the S&P 500 by 0.28%. In the currency markets, the yen extends this week's pull back against other major currencies but again losses were limited. Improvement in sentiments was also seen in the strong recovery in the USD/CHF. Fresh selling is seen in Sterling in Asian session today with the GBP/USD dipping through last week's low. Meanwhile, the euro is mildly softer against the greenback as markets await German confidence data.

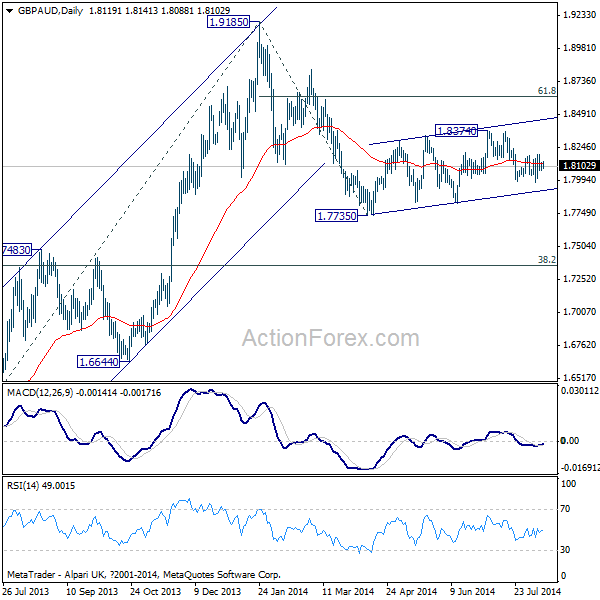

Released today so far, the UK BRC retail sales monitor dropped -0.3% yoy in July. Japan industrial production dropped -3.4% mom in June. Australia NAB business confidence rose to 11 in July and house price index rose 1.8% in Q2, beating expectation of 1.1.%. The Aussie received no support from the better than expected data and stays soft in tight range against the greenback. Sterling and Aussie are among the weakest currencies this month. Some time ago, we pointed out that the GBP/AUD is in a consolidation pattern since 1.7735 and the fall from 1.9185 might resume soon. But that haven't happened yet. Overall, we're still favoring an eventual downside breakout. But it looks like the sideway pattern would continue for a while above 1.7735 in near term.

As for today, German ZEW economic sentiment is expected drop for the eighth straight month to 22.0 in August, from December's top of 62.0. Current situation gauge is expected to drop for the second month to 55.0 after hitting a high of 67.7 in June. Eurozone ZEW is expected to drop for the seventh month to 41.3. Euro showed sign of reversal in crosses, against Sterling, Aussie and Canadian. Stronger than expected data today could trigger further rebound in the common currency.