Yen slammed lower as bets of BoJ tightening this week get unwound

Euro bruised by PMI surveys, gold undecided, Nasdaq awaits rebalancing

Huge week lies ahead, featuring ‘big 3’ central banks and tech earnings

Yen suffers in quiet trading

Global markets were caught in a holding pattern on Monday, with most assets trading in a relatively quiet manner. Investors seem reluctant to make any portfolio adjustments ahead of what promises to be a volatile week, featuring central bank decisions in the major economies and a cascade of corporate earnings.

Fed and ECB officials are almost certain to raise interest rates by another 25bps this week, having telegraphed their intentions very clearly. Since the rate hikes are already fully priced in, there is little scope for any surprises. Instead the emphasis will be on any guidance about future moves, leaving euro/dollar at the mercy of whether Powell or Lagarde sound more hawkish.

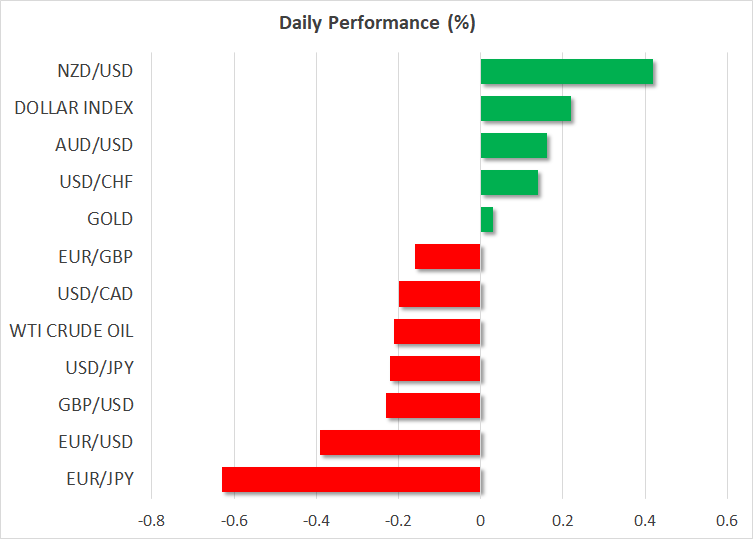

The wildcard this week is the Bank of Japan decision. The yen fell victim to some heavy selling on Friday, following media reports that the BoJ is unlikely to roll out any policy changes this week. Judging by the steep retreat in Japanese yields and the decline in USDJPY implied volatility, investors have unwound bets of an immediate adjustment in the yield control strategy.

While market expectations of a BoJ shift appear low, the economic conditions for such a move are slowly falling into place. Inflationary pressures and wage growth are heating up, complemented by improving business morale. This suggests that a policy shift is drawing closer, even if it doesn’t happen this week.

Euro retreats on gloomy PMIs, gold directionless

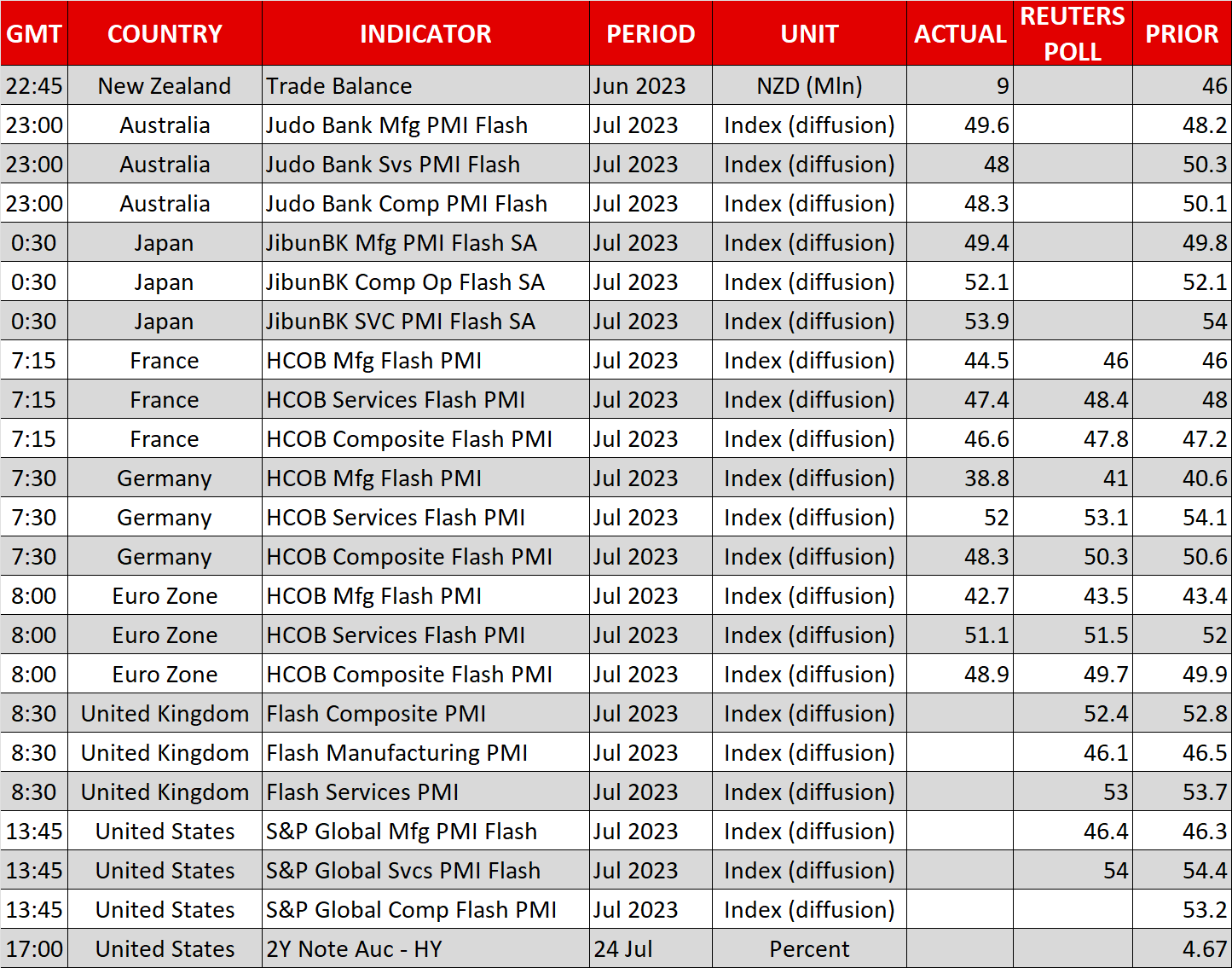

Storm clouds are gathering over the Eurozone economy according to the latest round of business surveys. The PMIs revealed a sharp slowdown in business activity, with new orders declining at an alarming pace, which is a warning sign that economic growth is likely to struggle in the months ahead.

Euro/dollar fell on the news, slicing below the critical $1.11 region as the business surveys revived concerns the Eurozone is slowly descending into a recession, fueling speculation that the ECB might adopt a more cautious tone with respect to future rate increases.

Over in the commodity sphere, gold prices were almost flat on Monday. The yellow metal is being pulled in different directions by opposing forces, with a stronger US dollar countering the drop in global yields following the disappointing business surveys from Europe. Looking ahead, the Fed meeting on Wednesday will likely decide whether gold can resume its recent rally.

Nasdaq rebalances, earnings season fires up

Stock markets lost some steam late last week, with tech shares in particular underperforming as a batch of encouraging US economic data reinforced the notion that the Fed won’t be cutting interest rates anytime soon. A couple of unsatisfactory earnings reports from Netflix (NASDAQ:NFLX) and Tesla (NASDAQ:TSLA) also helped to calm the euphoria.

Another element that has put the brakes on the scorching rally in big tech shares has been the "special rebalancing" of the Nasdaq 100 index that will go into effect today. The Nasdaq exchange announced it will reduce the weights of the biggest tech giants and increase the weight of smaller stocks, to avoid overconcentration.

There are two ways this rebalancing can influence trading dynamics. It will reduce demand for mega-cap tech shares through passive investment flows and help shield the index from a selloff, mitigating some damage in case the largest companies that have spearheaded the rally this year suffer a correction.

In terms of earnings releases, the show will get started with Dominos today, before Microsoft (NASDAQ:MSFT) and Google (NASDAQ:GOOGL) take centre stage tomorrow.