On Tuesday morning the markets are again dominated by purchases of risky assets. MSCI All Country Asia Pacific ex Japan jumped 1.6% and the Nikkei 225 rose 1.5%. The media attributed this increase to the market reaction of the strong data from China. That's a bit of a stretch, as the Chinese data was already available a day earlier and at that time, the market reaction was a very mixed bag.

The rally is more likely a buying attempt after a slight downturn. Confident about the prospects of global economic recovery and the impending new stimulus in the US and other countries, investors are buying risky assets, assuming that ultra-low interest rates will continue for a long time, combined with accelerating inflation.

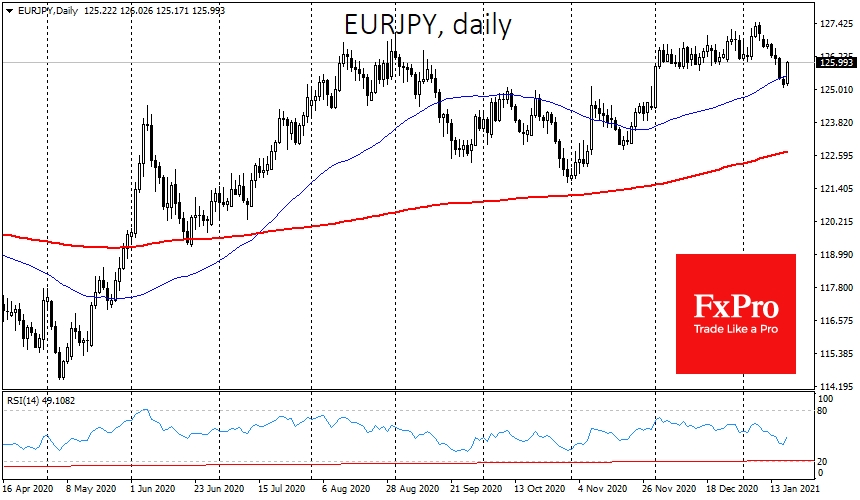

Interest in risky assets can be seen in the weakening of the yen against major competitors. The USDJ/PY rose above 104 in the morning. However, this rebound should be taken as a sign of market optimism and not a demonstration of dollar strength, as EUR/JPY made an even more elegant reversal.

The single currency successfully withstood the bears' attack on Monday, staying above the 50-day average against the dollar and the yen. On EUR/JPY, buying intensified on the downside towards 125, bringing the pair back to 125.80 now.

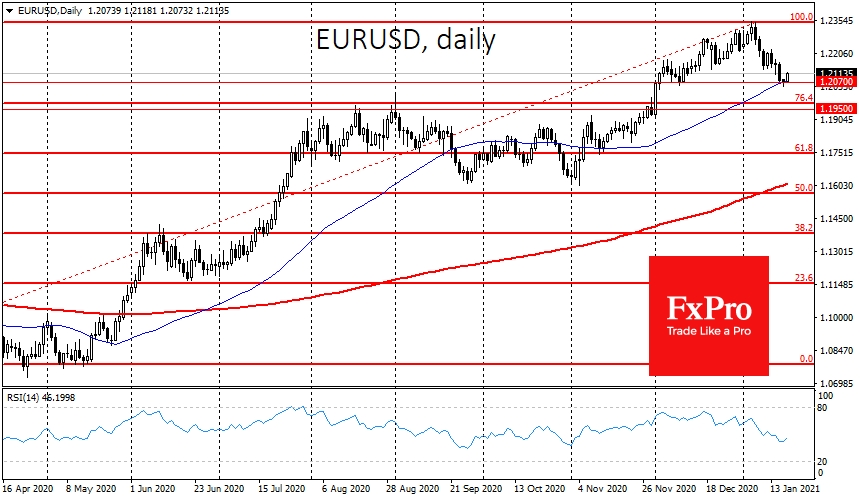

Similarly, EUR/USD received support on Monday on the decline towards the 50-day moving average, encountering an avalanche of buying after touching 1.2050, which sent the pair above 1.2100 this morning.

GBP/USD increased on Tuesday morning from the lower boundary of the rising channel formed in late September.

Markets are finding the strength to stay within the strong upward momentum occurring since late September. The ability to bounce back from the 50-day average and stay within the established momentum at the end of the day today could be an important signal that this bullish momentum will remain in force for some time to come, despite the overbought stock market.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro Returns To Growth On The Demand For Risk Rebound

Published 01/19/2021, 05:15 AM

Euro Returns To Growth On The Demand For Risk Rebound

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.