- Softer dollar bolsters euro as ECB anticipated to frontload rate hikes

- But pound remains pressured amid angst about Truss’ energy bailout

- Aussie dips after RBA’s Lowe makes dovish tilt; loonie firmer after BoC

- Wall Street in surprise bounce back as yields and oil prices take a plunge

Euro flirts with parity ahead of ECB decision

The energy crisis and the pace of monetary tightening look set to dictate market sentiment once again as a busy day looms with a policy decision by the European Central Bank, Fed Chair Jerome Powell is due to speak, and new UK Prime Minister Liz Truss will unveil her much-anticipated energy support package.

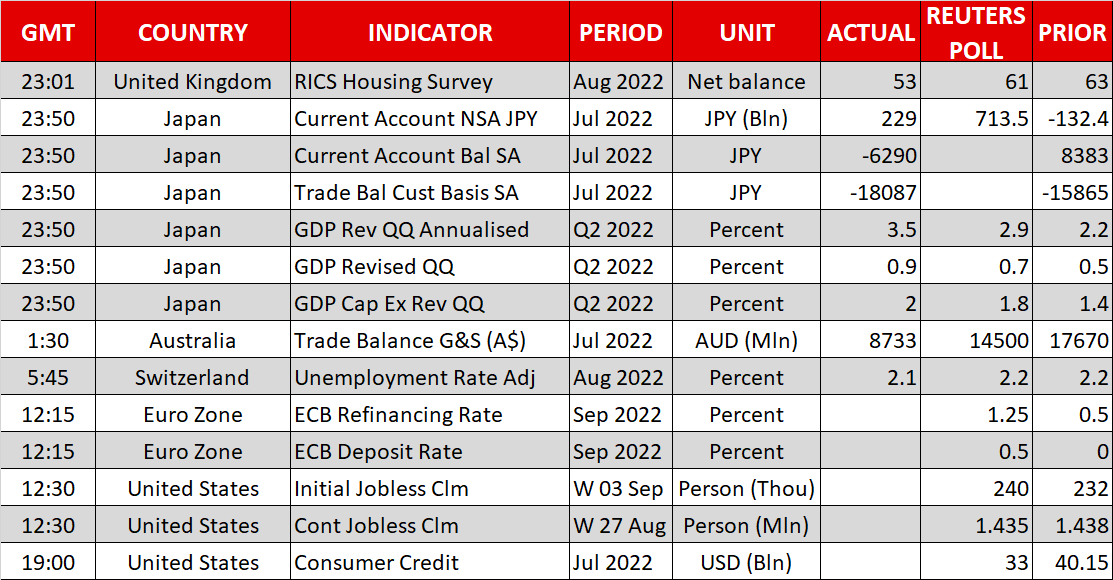

The US dollar was drifting lower ahead of these crucial events, pulling back from fresh 20-year highs scaled only yesterday against a basket of currencies, mirroring the retreat in Treasury yields. In contrast, the euro gained support as investors upped their bets that the ECB will hike interest rates by as much as 75 basis points when it announces its decision at 12:15 GMT.

The pause in the dollar rally has clearly provided the euro with an opportunity to reclaim the parity level as the ECB looks set to take a leaf out of the Fed’s book and frontload policy tightening.

However, even if the ECB does not disappoint today and flags more rate increases over the coming months, a meaningful rebound might be difficult for the euro when the energy crisis is wreaking havoc across Europe.

The European Union has stepped up its efforts to tackle the continent’s worsening energy crunch so if leaders are able to agree on some concrete measures on curtailing the exponential surge in gas prices, a less gloomy outlook might be more positive for the euro than an ECB hiking into a recession.

A sinking pound greets Truss’ government

But as the euro demonstrated some signs of a revival, sterling plumbed the lowest level since 1985 amid deep unease about how Britain’s newly appointed prime minister, Liz Truss, and her revamped cabinet will ease the pain of the cost of living crisis.

Truss is expected to set out her plans today on freezing energy bills and providing help to businesses, as well as lifting the ban on fracking. The package of measures could cost more than £100 billion, which is likely to be financed entirely by borrowing.

The worry for investors is that even if the price cap is deflationary in the short run, the higher borrowing combined with the strong possibility of tax cuts, as this is something that Truss has also pledged to do, could end up being a lot more inflationary in the long run and force interest rates even higher.

The pound came close to breaching $1.14 yesterday as confidence in the UK economy on the first day of the Truss government hit a low point. In the meantime, Bank of England policymakers appeared to add to the uncertainty by failing to send a clear signal about the speed of rate hikes.

Aussie and loonie follow RBA’s and BoC’s diverging rhetoric

The Australian dollar was another underperformer today, giving up a chunk of Wednesday’s gains after RBA Governor Philip Lowe appeared to hint at a change in the pace of rate hikes. Speaking earlier today, Lowe said that the case for a slower rate increase was becoming “stronger”.

But it was the opposite case for the Canadian dollar, which was boosted yesterday by a 75-bps rate rise by the Bank of Canada. Far from suggesting that the tightening cycle is coming to an end, the BoC surprised investors by signalling that rates will need to continue to go higher.

Stocks on a firmer footing ahead of Powell

In equity markets, there was a sense of calm, with shares in Europe and Asia mixed following a rally on Wall Street yesterday. The S&P notched up gains of 1.8% despite an underwhelming response in Apple (NASDAQ:AAPL) stock to the company’s latest iPhone models.

A sharp pullback in the 10-year Treasury yield from a near three-month high of 3.365% as well as crude oil prices slumping to their lowest since January likely boosted sentiment. Ongoing lockdowns in China continue to weigh on the demand outlook for oil, while a sluggish growth picture in the Fed’s latest Beige Book might have raised hopes that it’s only a matter of time before the Fed makes a dovish pivot.

Nevertheless, expectations for another 75-bps Fed rate hike in September have firmed significantly over the last couple of weeks, with Vice Chair Lael Brainard repeating the hawkish message yesterday. There’s likely to be more of the same from Powell when he speaks today, and US futures were pointing to a cautious start on Wall Street.