Talking Points:

- Yen, Euro Drop on China Stimulus But Risk Appetite Boost May Be Fleeting

- US Durables Data, Fed Commentary in Focus as Markets Look for Guidance

The Japanese Yen and the Euro faced selling pressure in overnight trade as stocks recovered across Asian bourses, reflecting a recovery in risk appetite. Both units had capitalized on slumping sentiment earlier in the week amid the unwinding of carry trades funded in the two low-yielding currencies. On the other side of the spectrum, the risk-geared Australian, Canadian and New Zealand Dollars traded higher.

The Deutsche X-trackers MSCI Asia Pacific ex Japan Hedged Equity (NYSE:DBAP) regional benchmark equity index rose 0.7 percent in a move that seemed to reflect relief after China delivered a much-anticipated dose of monetary stimulus. The PBOC cut the one-year benchmark and deposit lending rates as well as lowered the reserve requirement ratio for banks. Optimism may prove fleeting however. Indeed, news of Chinese easing drove US shares higher but gains evaporated into the session close, with the S&P 500 delivering a sixth consecutive day of losses.

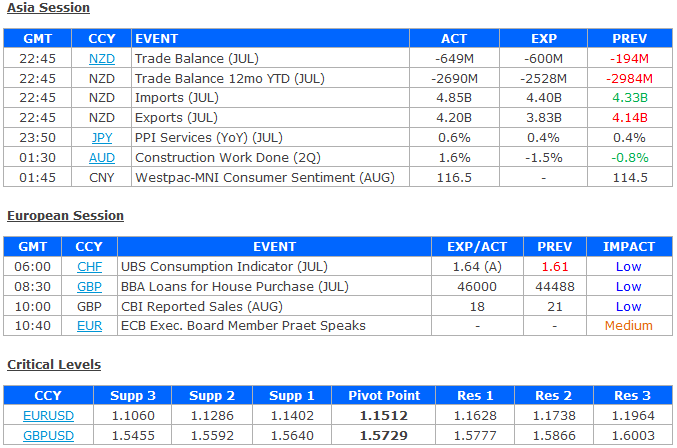

Still, futures tracking the US equities benchmark are trading meaningfully higher in late Asian hours, hinting the chipper may yet carry on through the hours ahead. On the data front, a quiet calendar in Europe will probably see investors looking to July’s US Durable Goods Orders report. Expectations point to a 0.4 percent decline. US news-flow has deteriorated relative to consensus forecasts in recent weeks, opening the door for a downside surprise that may rekindle worries about global growth and fuel renewed risk aversion.

The spotlight then turns to a scheduled speech from New York Fed President Bill Dudley. The influential central bank official is often seen as being at the heart of consensus on the policy-setting FOMC committee. With that in mind, traders will be keen to hear anything that illuminates how recent market turmoil has influenced the likely timing of the US central bank’s first post-QE interest rate hike.

Fed Funds futures now reflect a delay until January 2016 for the onset of tightening. Rhetoric suggesting a hike this year may yet materialize will probably amount to a risk-negative development. Alternatively, a more dovish lean reinforcing the downshift in policy bets may prove supportive for sentiment-geared assets.