EUR/USD: Waiting for Yellen testimony

Macroeconomic overview: San Francisco Federal Reserve Bank President John Williams said he believed a recent softening in U.S. inflation was transitory and that inflation would pick up to around 2% over the coming year. Williams emphasised that if inflation did not accelerate as expected, that would argue for a much slower pace of rate rises than currently projected. He also noted that raising rates and trimming the balance sheet were complimentary forms of tightening and his projections for policy took that into account.

U.S. Federal Reserve chief Janet Yellen gives two days of testimony to lawmakers on Wednesday and Thursday and this event will dominate market attention.

At a news conference after the Fed raised interest rates in mid-June, Yellen downplayed inflation weakness as transitory and said she expects the sub-5% unemployment rate to eventually trigger sharper increases in earnings and prices. We expect her to "strike the same tone" before the House panel on Wednesday. She also could confirm market expectations that the Fed will start to shrink its USD 4.5 trillion balance sheet in September, a move likely to push up long-term rates.

The retreat in inflation magnifies attention on the Labor Department's consumer price index for June, due Friday. Annual price increases fell to 1.9% in May from 2.4% in March. Core price gains, which exclude volatile food and energy items, slipped to 1.7% from 2%. Yet declining gasoline prices have pushed down the overall index. And core prices have been restrained by new unlimited wireless plans and other trends. That is why we should expect that inflation should pick up gradually as these factors fade.

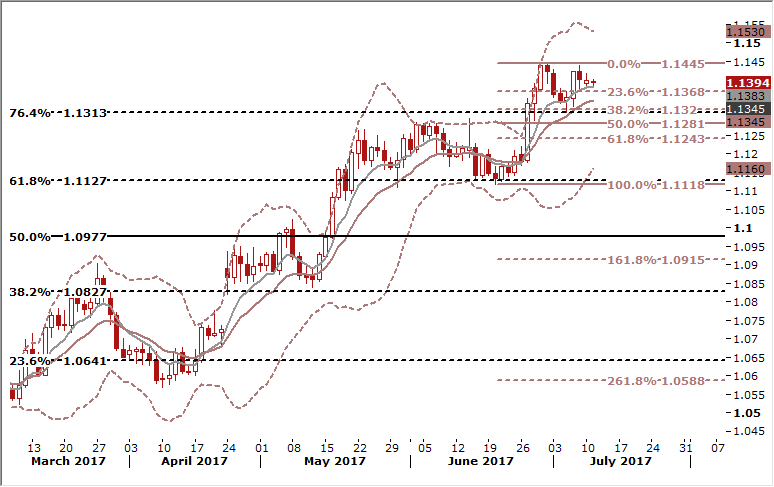

Technical analysis: EUR/USD looks due for some deeper corrective action. 7-day exponential moving average and base of the hourly cloud is under threat. The nearest support level is 38.2% fibo of June’s rise at 1.1320. The fibo was pierced on July 5 (1.1313 low). A close bellow should trigger a further decline towards 50% retracement of the above-mentioned move.

Short-term signal: We have cancelled our bid, because technical analysis suggests stronger corrective move. We think that another long position could be risky now.

Long-term outlook: Bullish

AUD/JPY goes up on carry trades

Macroeconomic overview: A measure of Australian business conditions climbed to its highest since early 2008 in June as sales and profits picked up across a range of industries, another sign the economy had regained its feet after stumbling early in the year.

National Australia Bank surveyed more than 400 firms to compile its index of business conditions which rose 4 points to +15 in June, and far above the long-run average of +5. National Australia Bank said that outcome was consistent with annual job creation of around 240k, or around 20k per month, and was enough to nudge the unemployment rate lower from the current level of 5.5%.

The run of upbeat surveys holds out hope for a bounce in economic activity after bad weather kept growth to just 0.3% in the first quarter. The Reserve Bank of Australia argued that growth would revive when it held interest rates steady at 1.5% following a policy meeting last week.

Markets are pricing in almost zero chance of a rise in Australian rates this year. But the carry trades in AUD/JPY market could remain popular, as the Bank of Japan which last week offered to buy an unlimited amount of bonds to ensure yields stay low.

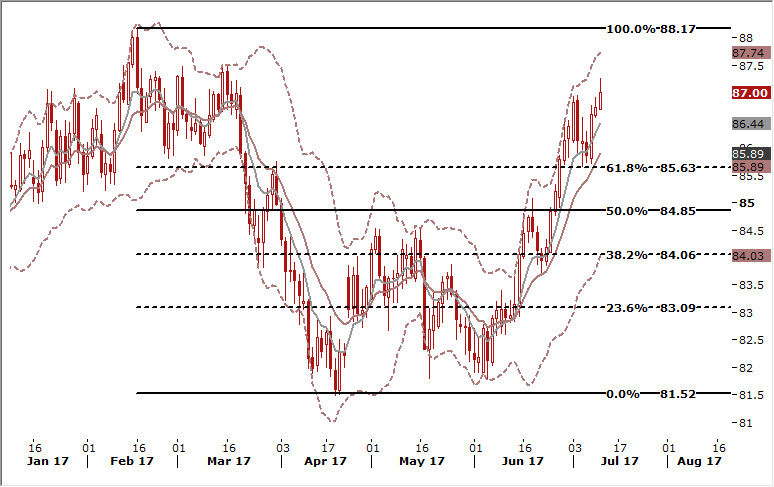

Technical analysis: The AUD/JPY remains above short-term moving averages, which keeps bullish view intact. The nearest resistance level is 87.48 high on March 16. Breaking above this level would open the way towards February high at 88.17.

Short-term signal: We have raised our bid to 86.00

Long-term outlook: Bullish

Source: GrowthAces.com - your daily forex signals newsletter