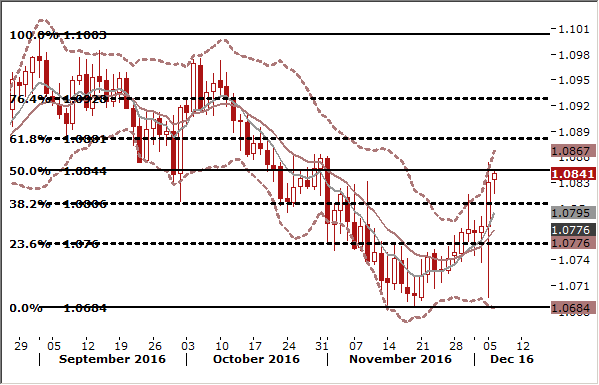

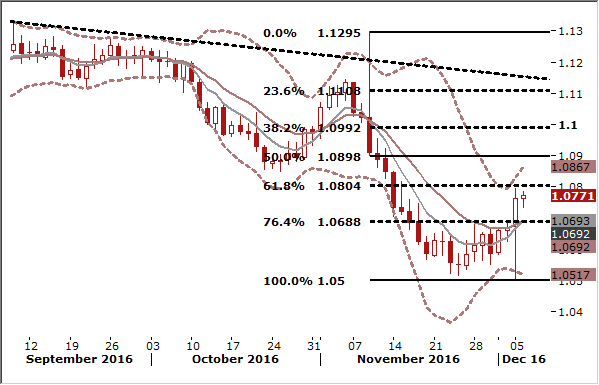

EUR/USD: Focus turns to ECB now, initial target at 1.0840

- U.S. ISM Non-Manufacturing for November rose 2.4 points to 57.2, beating the market consensus of 55.4 and achieving a 13-month high. While the survey likely benefited from the post-election relief that's showed up in just about every other survey of market conditions, the word "election" did not show up in the ISM's press release, with respondent comments instead focusing on real activity and orders. Only two industries (real estate and public administration) reported contraction, while 14 indicated growth.

- The business activity index rose to 61.7, beating its whole range of forecasts. Employment index went up 5.1 to 58.2, 13-month high. Inventories grew more sluggishly, that index down 0.5 to 52.0, while fewer businesses indicated that inventories are excessive, that index down 1.5 to 60.5, second-lowest of the past 18 months. Price growth was still uncomfortably fast, that index at 56.3, down only 0.3 from last month's 26-month high.

- Despite much-better-than-expected data from the U.S. the EUR/USD bounced from a near 21-month low set the previous day after Italian Prime Minister Matteo Renzi's loss in a referendum over constitutional reform, an outcome that had been widely expected.

- The focus now turns to the European Central Bank's policy meeting on Thursday . The ECB is expected to extend its QE programme by six months and keep the size of monthly asset purchases unchanged. The decision to keep buying assets at the pace of EUR 80bn per month would be mainly intended to preserve the current substantial degree of monetary accommodation, at a time of limited progress towards a sustained adjustment in the path of inflation consistent with the Governing Council’s inflation aim. Any other policy option, be it tapering or a one-step reduction in the monthly purchases, would inevitably lead to tighter financial conditions and strengthen the EUR against the USD. Because of this risk bearish bets against the EUR would be unjustified now.

- We opened EUR/USD at 1.0650 yesterday for 1.0840, but we are considering an extension towards 1.0950.

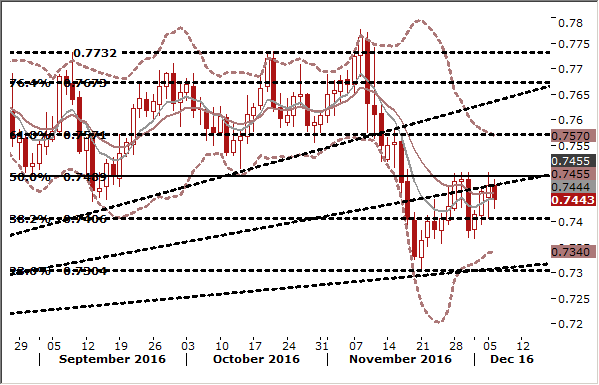

AUD/USD under pressure of Australian Q3 GDP today, medium-term outlook remains bullish

- The Reserve Bank of Australia ended Tuesday's meeting with rates at a record low of 1.5% following two easings this year, but conceded the annual pace of growth was set to slow.

- RBA Governor Philip Lowe said:

-

Some slowing in the year-ended growth rate is likely, before it picks up again. The outlook for business investment remains subdued, although measures of business sentiment remain above average.

- Interbank futures implied a probability of 22% for a cut by mid-2017, up from 14% before the RBA decision. In our opinion the monetary easing cycle has been already ended and the next change in rates will be a hike.

- Earlier in the session, figures on net exports and government spending proved softer than expected. Net exports trimmed 0.2 percentage points from GDP in the third quarter. The drag came even as rising commodity prices helped sharply narrow the country's current account deficit to AUD 11.4 billion, from AUD 15.9 billion in the second quarter.

- A report on Australia's GDP is due on Wednesday and there is a risk of a small contraction, the first since early 2011. That is why the AUD/USD may be under pressure in the coming hours. In our opinion this would be a good opportunity to open AUD/USD long. We think that commodity prices will become the dominant driver for AUD/USD again, leaving room for Aussie appreciation over the medium term.

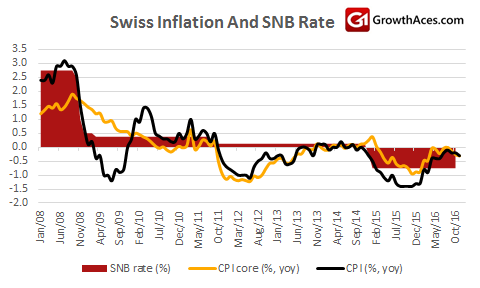

EUR/CHF: Switzerland still in deflation mode

- Swiss headline national CPI inflation slowed from -0.2% yoy to -0.3% yoy in November. The dip meant that inflation was weaker than the consensus forecast, which had anticipated an unchanged reading. Core inflation, which excludes fresh and seasonal products and energy prices, was stable, but remained negative at -0.3% yoy.

- Despite the general upward trend in energy inflation, so far at least the increases have not fed through to broader price pressures. Indeed, note that Swiss annual wage growth was just 0.6% in the third quarter despite the low rate of unemployment. We suspect that the economy has yet to feel the full effects of the franc’s strength and we may see growth slowing in 2017. What’s more, households’ inflation expectations have remained at very low levels, consistent with sustained negative core inflation.

- Accordingly, the SNB will retain a loosening bias. As the franc has been fairly stable recently, it will probably keep policy on hold in December. But it will continue to intervene in FX markets if needed, especially if political events in the euro-zone prompt safe haven flows.

- The EUR/CHF made a huge swing yesterday and the short-term outlook is bullish. We now look to buy a dip. We have placed a bid at 1.0775.