EUR/USD is trading at 1.1030 in the European session on Tuesday. On the release front, German Industrial Production posted a strong gain of 3.3%, well above the forecast of 0.6%. Eurozone Revised GDP for the fourth quarter climbed 0.3%, matching the forecast. In the US, the sole event on the schedule is the NFIB Small Business Index.

Weak global economic conditions, particularly the Chinese slowdown, have taken a toll on the Eurozone manufacturing sector, as European manufacturers are struggling to cope with less demand for their products. German manufacturers are also facing tough times, as China is a major export market for the Eurozone’s largest economy. Given this bleak background, German Industrial Production was a pleasant surprise in January, surging 3.3%. This was the indicator’s strongest gain since July 2011. German Factory Orders were not as strong, with the reading of -0.1% marking a second straight decline.

With the Eurozone continuing to experience weak growth and inflation levels, the markets are expecting the ECB to announce easing measures at its policy meeting on Thursday. Possible measures include expanding the EUR 1.1 trillion euro bond-purchase program (QE), or pushing the benchmark interest rate into negative territory. If the ECB balks and remains on the sidelines, we could see a repeat of what occurred after the January policy meeting, when the lack of any moves by the ECB resulted in huge gains by the euro.

This week’s US job data was mixed. Nonfarm Payrolls impressed with a reading of 242 thousand in January, much higher than the estimate of 195 thousand. This was much stronger than the previous (revised) reading of 171 thousand. The US economy has added an average of 225,000 jobs per month since December, an impressive number considering that the economy has softened in the early part of 2016. Still, employment news was mixed, as wage growth declined by 0.1%, shy of the estimate of a 0.2% gain. This marked the first drop in wages since December 2014. This indicator is closely linked to inflation, since an increase in wages means workers have more money to spend. The indicator’s decline means that that Federal Reserve’s inflation target of about 2.0% remains far off, so the Fed, which is keeping a close eye on the weak inflation picture, is unlikely to press the rate trigger at its policy meeting later this month.

Tuesday (March 8)

- 2:00 German Industrial Production. Estimate 0.6%. Actual 3.3%

- 2:45 French Government Budget Balance. Actual -9.2B.

- 2:45 French Trade Balance. Estimate -3.7B. Actual -3.7B

- 5:00 Eurozone Revised GDP. Estimate 0.3%. Actual 0.3%

- All Day – ECOFIN Meetings

- 6:00 US NFIB Small Business Index. Estimate 94.5

*Key events are in bold

*All release times are EST

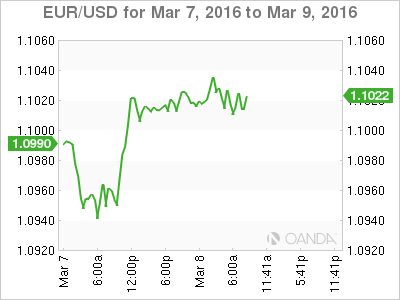

EUR/USD for Tuesday, March 8, 2016

EUR/USD March 8 at 4:05 EST

Open: 1.0991 Low: 1.0944 High: 1.0997 Close: 1.0957

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0708 | 1.0847 | 1.0941 | 1.1087 | 1.1172 | 1.1278 |

- EUR/USD has shown marginal movement in the Asian and European sessions

- There is resistance at 1.1087

- 1.0941 is providing support

Further levels in both directions:

- Below: 1.0941, 1.0847, 1.0708 and 1.0616

- Above: 1.1087, 1.1172 and 1.1278

OANDA’s Open Positions Ratio

EUR/USD ratio continues to show little movement, consistent with the lack of activity from EUR/USD. Long and short positions are close to an even split, indicative of a lack of trader bias as to what direction the pair will take next.