Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Market Brief

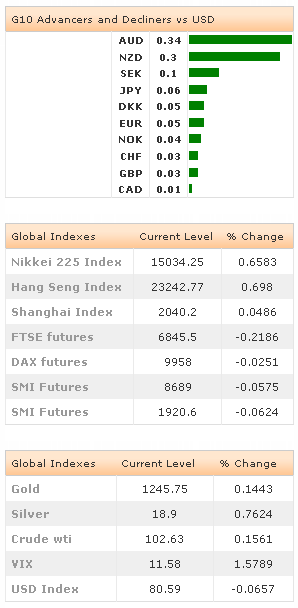

The RBA kept its cash rate target at the historical low of 2.5% as widely expected. The Governor Stevens said there are signs of improvement in non-resources industries, while dismissing comments on weak jobs market. The AUD is still high he said, “particularly given the further decline in commodity prices”. In addition to optimistic tone, the current account deficit narrowed from AUD -11.7bn (revised) to AUD -5.7bn in Q1, the exports surged from 0.60% to 1.40%. AUD/USD rebounded from 0.9230 in Sydney to 0.9278 (at the time of writing). The faster expansion in Chinese non-manufacturing sector in May (from 54.8 to 55.5) helped lifting the Aussie. Option barriers trail below 0.9275/0.9300 for today expiry, light stops are eyed above.

In New Zealand, the terms of trade rose to 40-year high, giving a lift to NZD/USD from 12-week lows (0.8440). Technically, NZD/USD tests an important support at 0.8432/40 area (Jan high & Mar 10-12th support), if broken will place the 200-dma (currently at 0.8359) at risk. Technicals favor the downside. AUD/NZD remains offered pre-200-dma (1.0986), trend momentum remains strongly bullish. Given the overbought conditions, the breach of 1.1000 psychological level looks challenging before correction.

EUR/USD holds ground, with EZ core and peripheral bonds still in good demand pre-ECB. The inflation estimates for May (due at 09:00 GMT) should trigger volatility, given that a lower CPI estimate (as expected) will raise probability of an ECB action on June 5th, thus increasing selling pressures in EUR-complex. Option bets are mixed at about 1.3600, offers abound below 1.3550. The key support stands at 1.3477 (2014 low). EUR/GBP trades soft, offers trail above 21-dma (0.81419). Option bids with today expiry stand at 0.81100/700, large offers stand at 0.80850/0.80600/0.80500.

The Cable sees demand in London opening as nationwide house prices grew faster-than-expected in May. GBP/USD remains in the bearish consolidation zone. Resistance is seen at 1.6780 / 1.6800 (Fibo 61.8% on Mar-April rally & optionality), if breached should send the pair back into Nov-May bullish channel.

In Japan, Nikkei stocks rallied as Japan’s GPIF said 20% equity allocation is not “that high”, before partially pairing gains through Tokyo close. USD/JPY and EUR/JPY followed the movement in stock markets. USD/JPY surged to 102.45 before heading down to 102.27. Technical indicators are now marginally bullish, the MACD( 12, 26) will remain in the green zone for a daily close above 101.00. Importers remain buyers at dips above 200-dma (101.45). EUR/JPY is offered pre-21-dma (139.51), although the technicals turn positive, the pair carries important EUR risk.

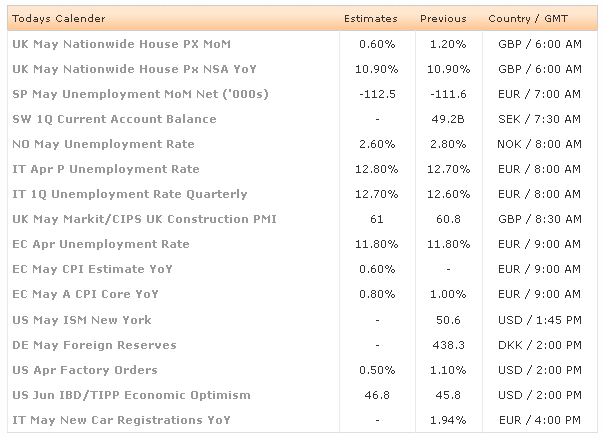

Today, the economic calendar consists of Norwegian, Spanish, Italian end Euro-zone Unemployment rates, Swedish 1Q Current Account Balance, UK May Construction PMI, Euro-Zone May CPI Estimate y/y & May (Prelim) CPI Core y/y, US May ISM New York, US April Factory Orders and US June IBD / TIPP Economic Optimism.

Currency Tech

EUR/USD

R 2: 1.3735

R 1: 1.3646

CURRENT: 1.3602

S 1: 1.3584

S 2: 1.3477

GBP/USD

R 2: 1.6882

R 1: 1.6780

CURRENT: 1.6754

S 1: 1.6693

S 2: 1.6661

USD/JPY

R 2: 103.02

R 1: 102.50

CURRENT: 102.33

S 1: 101.45

S 2: 100.80

USD/CHF

R 2: 0.9082

R 1: 0.9005

CURRENT: 0.8984

S 1: 0.8933

S 2: 0.8882