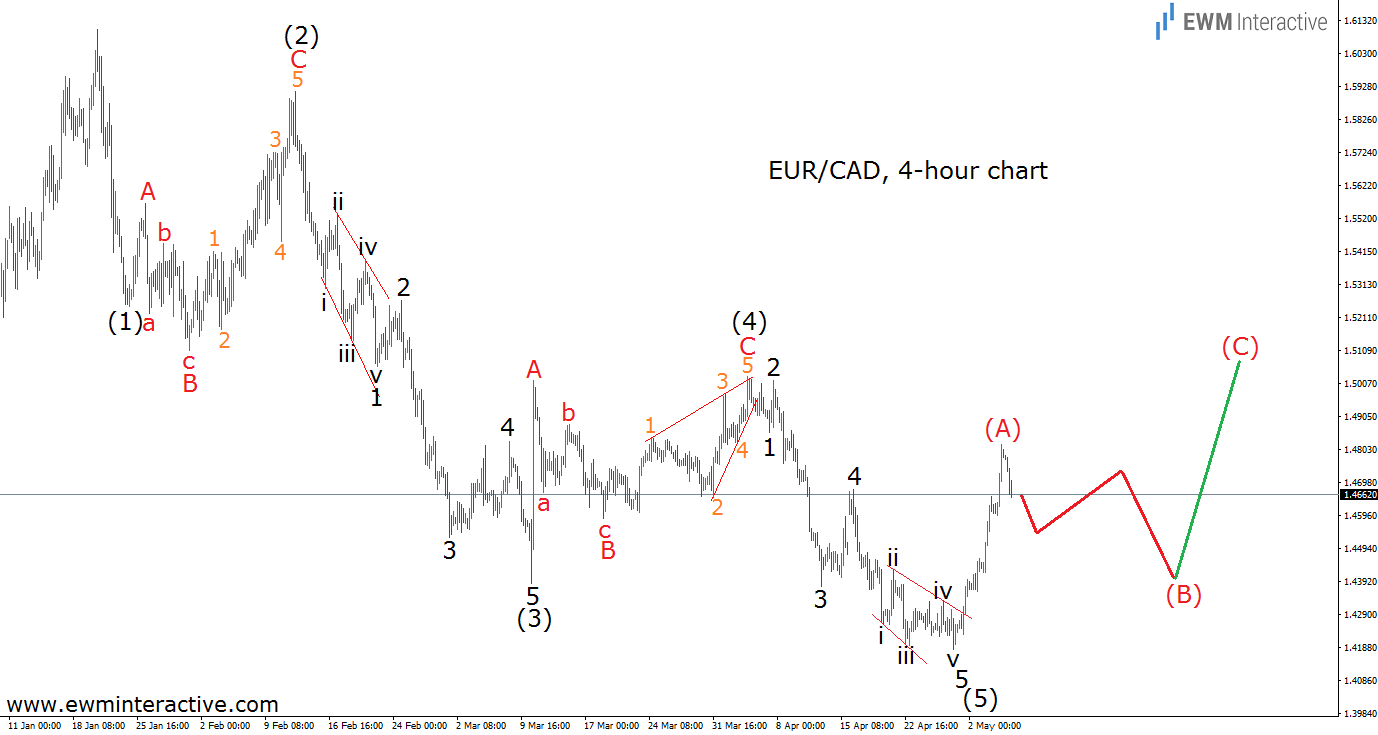

The last time we wrote about EUR/CAD was on May 5th, 2016, while the pair was trading around 1.4660. In “EUR/CAD Elliott Wave Dissection” we thought a three-wave (A)-(B)-(C) zig-zag correction was in progress, so we were expecting a decline in wave (B), followed by another rally in wave (C). The chart below is a reminder of that forecast.

The only reason to make that prediction was the Elliott Wave Principle, which postulates that every impulse is followed by a three-wave correction in the opposite direction. EUR/CAD’s weakness from 1.6100 to 1.4180 was supposed to precede a corrective advance in three waves. As visible, two of those waves were still missing in May.

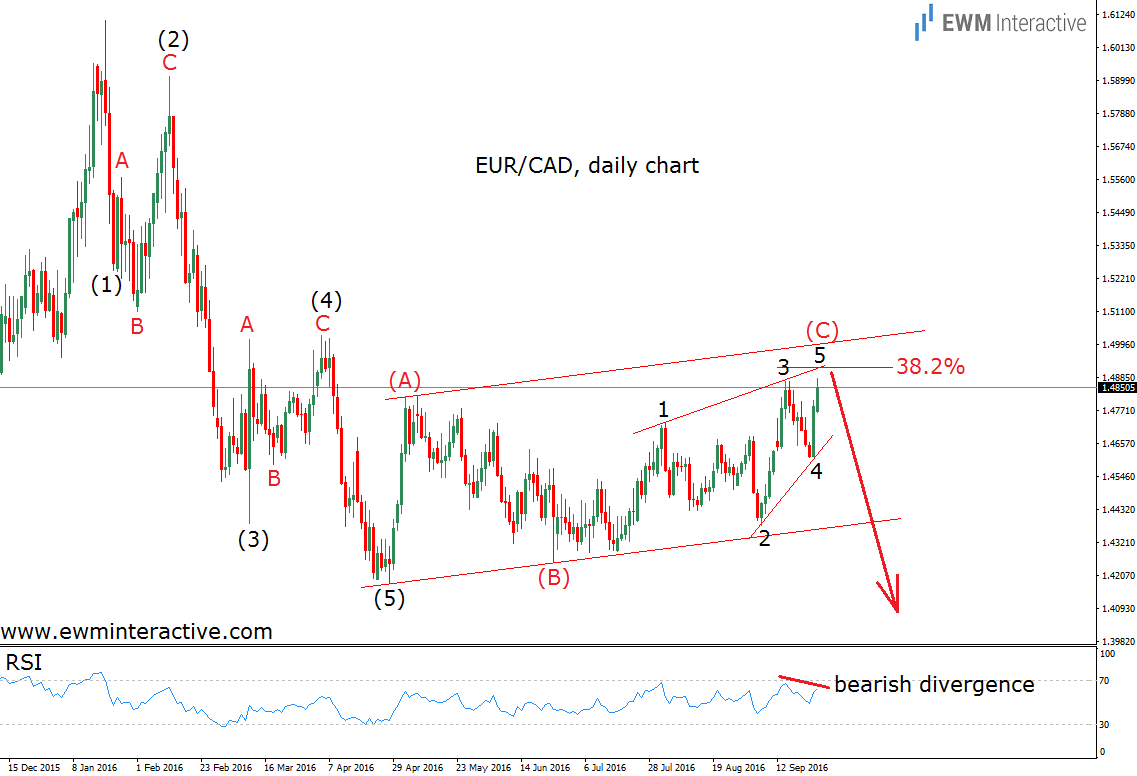

Today, over four and a half months later, the last two pieces of the 5-3 Elliott wave puzzle have been found.

Wave (B) dragged EUR/CAD down to 1.4254, when the bulls returned to lift the exchange rate to 1.4880. So far so good. Right now, there are at least four reasons to expect a significant decline very soon.

First, the trend should resume in the direction of the five-wave sequence. In addition, wave (C) is shaped as an ending diagonal and its final wave 5 appears to be in its final stages.

Second, the 38.2% Fibonacci level could serve as resistance.

Third, the entire (A)-(B)-(C) retracement has been developing between the parallel lines of a corrective channel, whose upper line is likely to discourage the bulls.

And fourth, the Relative Strength Index shows a bearish divergence between waves 5 and 3 of the diagonal in wave (C).

If our analysis is correct, we should prepare for a selloff of at least 700 pips in EURCAD, because the anticipated weakness should reach levels below the bottom of wave (5) at 1.4180. In our opinion, now is not the time to be a bull in EURCAD.