EUR/CAD was flying above 1.6100 in January this year. A little over 4 months later – in the end of April – the pair almost completed a 20-figure crash, when it fell to 1.4180. EUR/CAD is currently hovering around 1.4680, but simply mentioning these price levels is not going to tell us anything about the rate’s future prospects. So, in order to get an idea of what is most likely to happen next, we need to dive into the charts and see what the Elliott Wave Principle has to say about it.

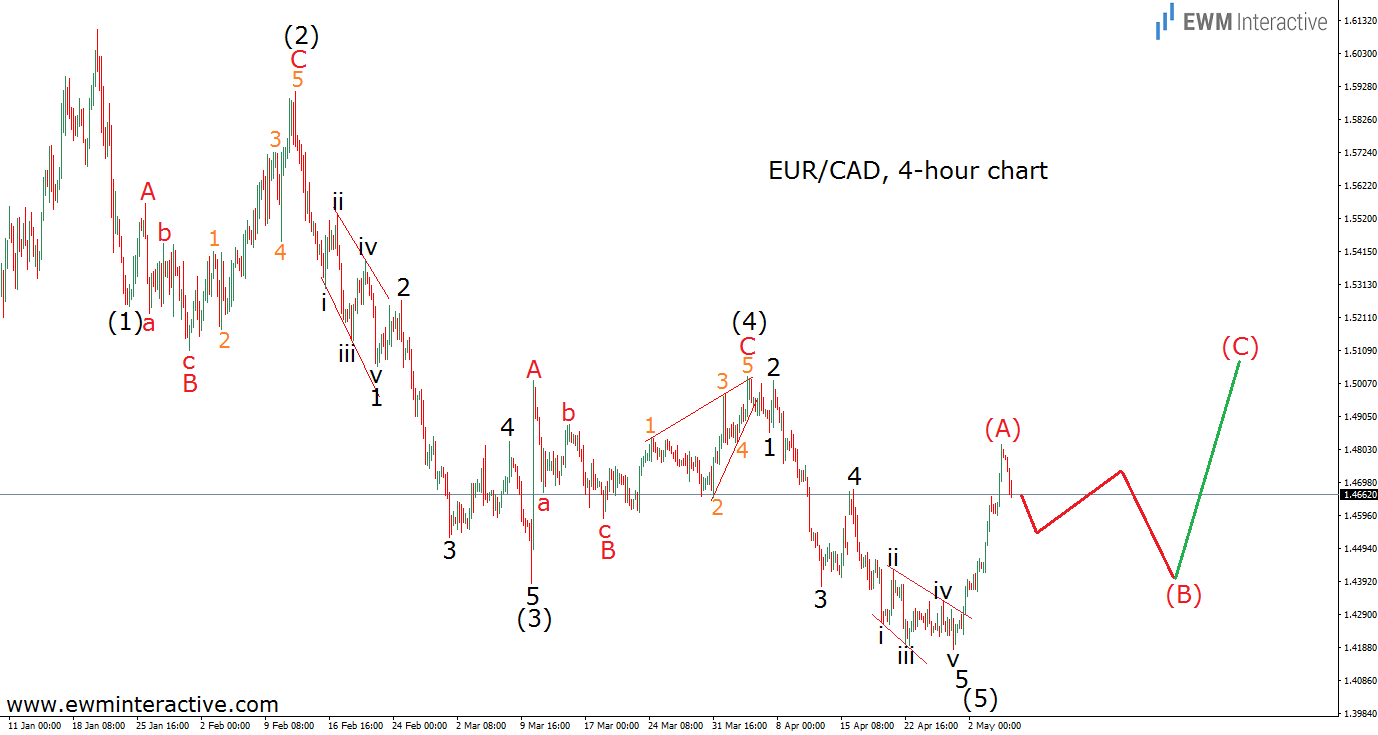

The 4-hour chart is showing the entire sell-off from 1.6104 to 1.4180. The Wave principle states that trend move in repetitive pattern, called waves. Impulsive waves consist of five sub-waves and determine the direction of the larger trend. The chart above seems to be depicting just that – a five-wave impulse to the south. There are several interesting aspects of EUR/CAD’s five-wave sequence, for those, who want to learn the details. For example, the two corrective waves appear to obey the rule of alternation.

Wave (2) is a typical sideways expanding flat correction, while wave (4) is a sharp zig-zag with an ending diagonal in wave C. On the other hand, expanding diagonals are quite rare, but EUR/CAD has provided us with two of them on the 4-hour chart. An expanding leading diagonal in wave 1 of (3) and an expanding ending diagonal in wave 5 of (5). So, there is a textbook impulse to the downside, so EURCAD should be considered to be in a downtrend. However, every impulse is followed by a three-wave correction in the opposite direction, before the trend resumes. And, as you can see, as soon as wave (5) terminated, the pair rose sharply to 1.4818 on May 4. In our opinion, this should be the first part – wave (A) – of the corresponding three-leg corrective recovery. If this is the correct count, wave (B) to the south could take the pair lower, before the bulls wake up again in wave (C). According to this scenario, as long as 1.4180 holds, the resistance of wave (4) near 1.5000 is supposed to be EUR/CAD’s next bullish target, once wave (B) is over.