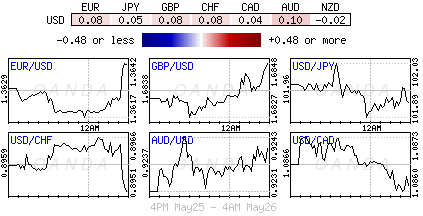

On this Bank holiday Monday either side of the pond, the two biggest market fears, the Euro and Ukraine parliamentary election results, combined with the ECB meet in Sintra, Portugal could have had an adverse effect on these thin markets. So far, the liquidity-deprived trading seems to be taking the election results and ECB's Draghi in its stride.

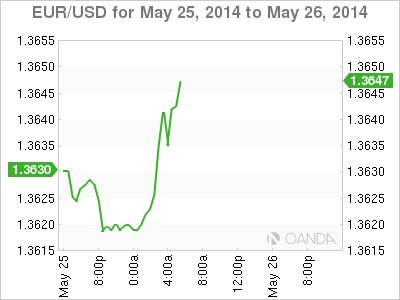

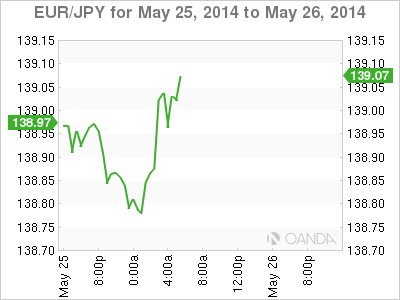

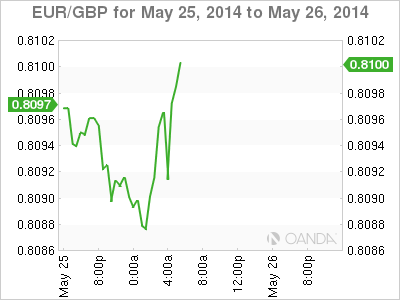

Euro equity markets have even managed to push higher, brushing off strong gains for "antiausterity" parties in the European parliamentary elections over the weekend. Heading into the event risk last Friday, the market had already priced in a strong Eurosceptic showing. This morning's EUR/USD push higher is mainly the 'relief' effect.

In France, the National Front (+25% national vote) appeared to score an historic victory. In Germany, Chancellor Merkel's Christian Socialists looked in control, while the Eurosceptic AfD took +7%. Greece radical left and the UK's Independent Party gained considerable support. It remains unclear whether the results will have a lasting effect on the markets beyond the beginning of this week.

The repercussions are to be felt more at domestic levels rather than at EU/National levels. UK PM Cameron understands clearly that the electorate is deeply disillusioned with the EU, but he will not shorten the timescale for negotiating any Europe deal. Despite the European antiausterity voice growing, it's not enough to impact the policy trend, as major political equilibrium remains unchanged. The market would have been short the EUR ahead of the results and what we have seen so far is a relief rally.

In the Ukraine, candy tycoon Petro Poroshenko declared victory in the first round of their presidential election. This is a result not unexpected – the pro-European tycoon took more than half of the vote. The morning's fading geo-political uncertainty is supporting both the Russian stock market (MICEX +1%) and the ruble (USD/RUB 34.03 and EUR/RUB 46.37) especially after Russia gave the nod to Kiev's new government last Friday. With many uncertainties out of the way, the RUB is expected to restore its correlation with EM currencies.

ECB's Draghi in Portugal delivered nothing new this morning. His comments left the EUR little changed (€1.3840). Not surprisingly, he sees a risk that expectations for ultralow inflations may delay consumer and business purchases. The latest sign that Euro-policy makers are prepared to take further easing measures when the ECB meets next week (June 5th). Again, he signaled that the ECB is weighing a "wide variety of steps from interest rate cuts to new bank loans or broad-based asset purchases" to prevent low inflation from undermining the regions promising economic recovery. Euro policy makers fear that disinflation expectations could take hold.

Since Draghi commented earlier this month that June 5th could see easing steps – backed up since by regular 'dovish' rhetoric from voting members – the event risk is that the ECB stands "pat". The ECB cannot afford to do so at this well telegraphed meeting, otherwise Euro-policy makers will lose what's left of their market credibility. The real fear is that the cuts, or whatever, do not go deep enough for the market. If that's the case, the dollar strength that the market has been pricing in since the May 8th meeting will be quickly given up and then some. In addition to using conventional interest rate tools, options include long-term loans to banks and purchases of asset-backed securities.

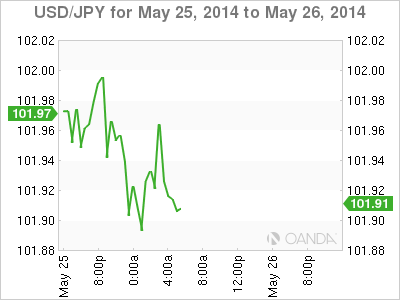

The EUR initially lost ground early Monday on the back of strong gains for the antiausterity parties, however, their fear of threat is not imminent allowing equities to rally to new highs since 2008. Obviously, thin holiday conditions play a part, but limit volumes. The 18-member single currency remains precariously perched ahead of the presumed option barriers and psychological support at €1.3600 (€300m), 15, 20. More are seen above €1.3650 (€350m). Stop-losses are supposedly large sub-€1.3600 and €1.3550. On the crosses, the EUR has been underperforming and this vulnerability could garner further support for the currency.

With both London and New York out today, the market may not have the will to entertain much interest. Expect action to likely pick up tomorrow into ECB Draghi's speech.