The 30 companies that comprise the Dow Jones Industrials collectively failed to increase sales in 2013. Yet the price of the Dow surged more than 25%. And while that price appreciation for the big-time benchmark may be slowing, the Dow still managed to eclipse 17,000 without generating much in the way of actual revenue growth.

Sales at S&P 500 corporations have also been unimpressive. According to Howard Silverblatt, a senior index analyst at S&P Capital IQ, aggregate sales per share for S&P 500 constituents registered $2.49 billion in Q1 of 2014. Back near the last bear market’s inception in Q1 of 2008 that number was $2.65 billion. If Silverblatt is correct, one method of measuring revenue strength (i.e., sales-per-share) is less vibrant today than during the beginning of the Great Recession.

Of course, analysts keep drilling home the notion that the bull market rests on the trajectory of corporate earnings. The problem with relying on the profitability data alone is that the data is being manipulated. Record low interest rates since the end of 2008 have fostered binge borrowing by corporations and the subsequent financing of nearly $2 trillion in stock buybacks (Q1 2009 – Q1 2014). The effect? A misguided perception that earnings are barreling forward. In truth, earnings-per-share appear strong because buybacks reduce the number of shares in existence, artificially reducing the trumpeted price-to-earnings (P/E) ratio.

It is also worth noting that the current price-to-sales (P/S) ratio for the S&P 500 (1.77) is roughly 25% higher than the median P/S in the 21st century (1.42). The historical mean since the market benchmark began? Around 0.9. It follows that most folks can reasonably assume that U.S. stocks are quite expensive in the context of the revenue that corporations have been generating.

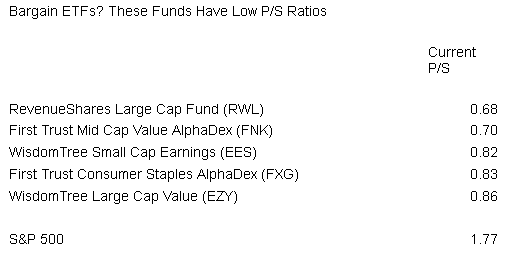

The concern led me to identify a handful of broader-based U.S. ETFs with substantially lower price-to-sales numbers than the S&P 500. The ratios in the table below come from the most recent Morningstar data feed and/or a provider’s web site:

Let’s consider WisdomTree Small Cap Earnings Fund (NYSE:EES). Not only is its price-to-sales a better “deal” than the S&P 500, but EES boasts a trailing 12-month P/E that is 12.3% lower than that of the S&P 500 and 24.7% lower than iShares Russell 2000 Small Cap Index (ARCA:IWM). Sales-per-share might not be the only metric, but perhaps we should not ignore it either.

Some might wonder whether there is any evidence to support whether the sales data even matters. This may be difficult to quantify. However, over the last three years, EES has produced 10 percentage points more than its benchmark competitor. Perhaps 1000 basis points is worthy of additional investigation.

What if we bring the 2007-2009 bear market collapse into play? After all, if a potential investment is a bargain, shouldn’t it hold up better than its competitors under extreme pressure? Unfortunately, EES did not show a capacity to “lose less” in the bearish collapse. On the other hand, the outperformance by EES over IWM across seven-and-a-half years jumps to 20 percentage (2000 basis) points.

Let’s take a look at another example from the table above, RevenueShares Large Cap (NYSE:RWL). This ETF trades close to a 10% P/E discount to the S&P 500, in addition to its formidable P/S bargain. Unfortunately, RWL did not provide inherent downside protection in the 2007-2009 bear. Yet one can point to longer-term benefits of fundamental value, including a 15 percentage point (1500 basis point) spread above the S&P 500 SPDR Trust (ARCA:SPY) in the period investigated.

In sum, if you are less concerned about extreme depreciation over the shorter term, and you’re comfortable with holding-n-hoping over the next decade, lower P/S ETFs show an ability to outperform. On the other hand, if you’re like me, you believe in the importance of protection. My clients certainly want me to minimize damage to account values during a bearish downtrend. That’s why I use stop-limit orders and trendlines to raise cash levels in unusually dangerous times. Equally important, I employ hedges and non-correlated assets to lessen the impact of sharp sell-offs.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.