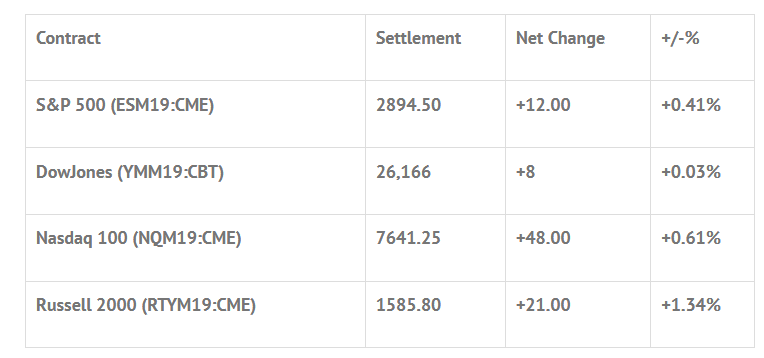

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Comp -1.60%, Hang Seng -0.93%, Nikkei +0.11%

- In Europe 11 out of 13 markets are trading higher: CAC +0.79%, DAX +0.28%, FTSE +0.13%

- Fair Value: S&P +3.74, NASDAQ +22.34, Dow -3.10

- Total Volume: 970k ESM & 59 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Jerome Powell Speaks, Import and Export Prices 8:30 AM ET, Consumer Sentiment 10:00 AM ET, and the Baker-Hughes Rig Count 1:00 PM ET.

S&P 500 Futures: No Need to Change Rates This Year

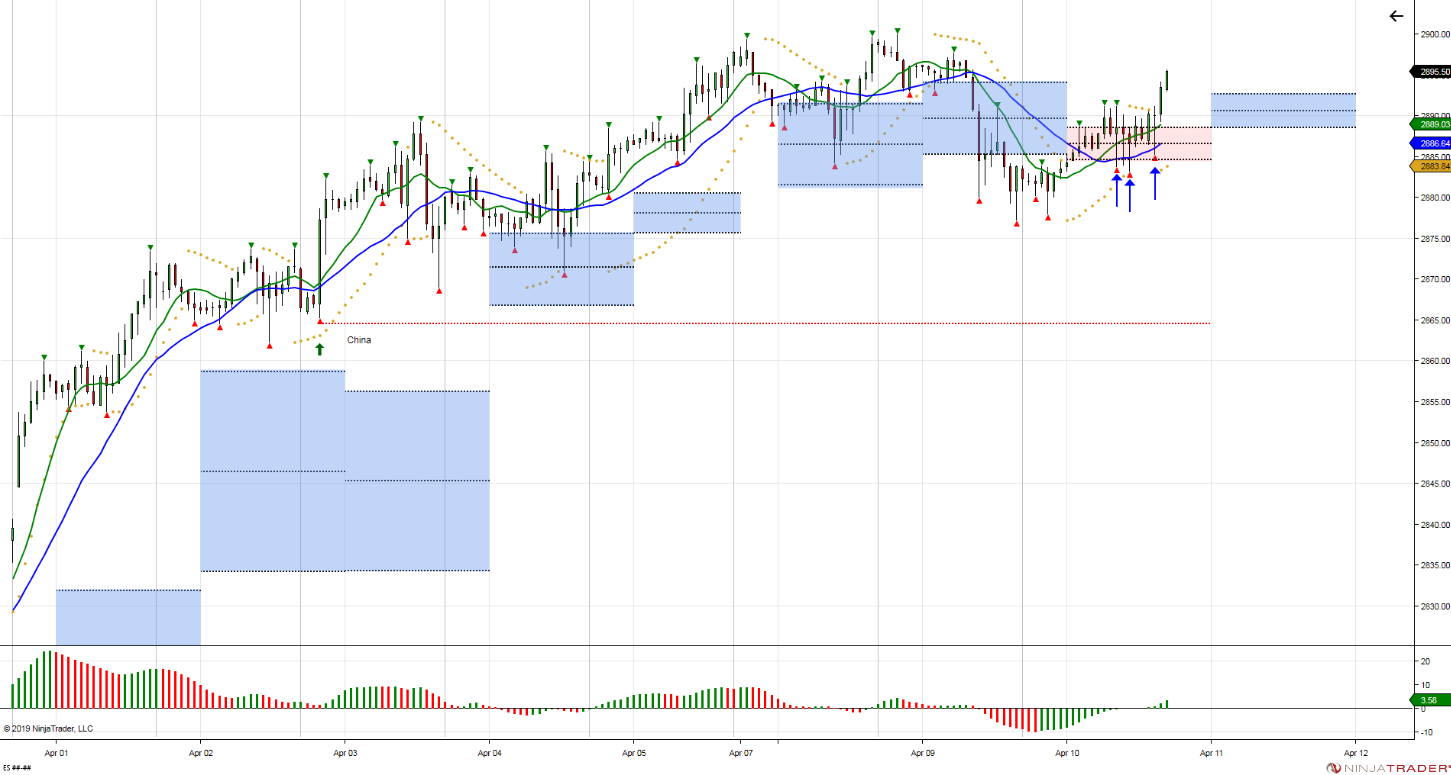

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F This is what we talked about in yesterday’s scope. Although pivot above resistance, need follow through from sellers or opportunity to trap shorts. Sellers attempted to defend, however failed to expand below, leaving shorts from yest trapped, forcing squeeze into close.

After eight higher closes in the #ES, the futures sold off Tuesday, and came flying back up on Wednesday as the March FOMC minutes showed no need to raise interest rates in 2019.

In the ‘Our View’ portion of the premium Opening Print, I pointed out that the minutes may give the futures a boost, and it did, leaving the ES up 9 of the last 10 sessions, and on track for new year highs. I am trying to be more patient and follow the trend, it helped me make nearly 60 points on a Nasdaq 100 futures trade, my guess is I will regret getting out.

During Tuesday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2891.25, a low of 2878.00, and opened Wednesday’s regular trading hours at 2887.75.

The first move after the 8:30 CT bell was a quick pop up to 2890.25, followed by a drop back down to 2883.25. From there, the futures started a long, slow, low volume grind higher, eventually double topping at 2897.25.

As the fed minutes were released at 1:00 CT, the ES began to back off a little, trading down to 2885.25, before once again taking a run at the highs. By 2:15 the futures had topped out at 2894.25 and started to ease off.

On the 2:45 cash imbalance reveal the ES traded 2892.25 as the final MiM showed $415 million to buy, then popped up to 2893.50 on the 3:00 cash close, and settled at 2894.75 on the 3:15 futures close, up handles +12.5, or +0.43%, on the day.

In the end, the overall tone of the ES was firm, but there wasn’t much firing power until late in the day. In terms of the days overall trade, total volume was low, with only 943,000 million futures contracts traded, and 145,000 of that coming from Globex.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.