April is a seasonally strong month for stocks. A consensus carried out from 1950 to 2016 shows that April ended up offering positive stock returns in 46 years and negative returns in 21 years, per moneychimp.com, with an average return of positive 1.34%.

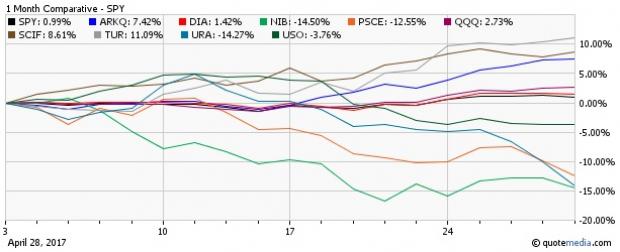

This year too, the broader market did not fool investors in April, though it started the month on a somber mood. The S&P 500-based fund (AX:SPY) , the Dow Jones Industrial Average-based ETF (V:DIA) and the Nasdaq 100 based ETF QQQ gained about 1%, 1.4% and 2.7%, respectively in the last one month (as of April 28, 2017) Still, there are always laggards in an upbeat market.

Below we highlight three top and flop ETFs for the month of April.

Top ETFs

iShares MSCI Turkey (MC:TUR) – Up 11.1%

Turkey held a referendum on Sunday, April 16, 2017 per which President Recep Tayyip Erdogan gained approval from 51.3% voters. The result of the referendum has strengthened his power over fiscal policy.

The broader market views this as the start of stability in a country which has been “under a state of emergency introduced after last year's failed coup” (read: Political Instability Puts Turkey ETF in Focus).

As a result, the lone Turkey ETF TUR gained about 10.8% in the last one month (as of April 28, 2017), with most of the gains coming after the referendum (see all European Equity ETFs here).

VanEck Vectors India Small-Cap ETF SCIF – Up 8.6%

India ETFs are on a tear this year on economic optimism. Solid GDP data defying demonetization, the victory of the pro-growth prime minister’s party in some state elections, implementation of goods-and-services tax or GST from July, a weaker greenback and still-subdued U.S. Treasury bond yields driving foreign inflows benefited India investing (read: 5 Reasons to Buy India ETFs Now).

Indian stocks touched a two-year high in early April. Thanks to solid optimism over the Indian market, this small-cap India ETF gained about 9.7% in the last one month.

ARK Industrial Innovation ETF ARKQ – Up 7.4%

Maintaining the upbeat momentum, the U.S. manufacturing sector grew in March for 94 months in a row. Though the manufacturing index slowed a bit last month sequentially, it beat economists’ expectations.

The fund looks to offer long-term growth of capital. It is an actively managed ETF that invests primarily at least 80% of its assets in domestic equity securities and U.S. exchange traded foreign equity securities of companies that are focused on industrial innovation. The fund is heavy on 3D Printing, Robotics and Autonomous Vehicles (read: US Manufacturing in the Pink: ETFs & Stocks to Play).

Flop ETFs

iPath Bloomberg Cocoa SubTR ETN (BE:NIB) – Down 14.5%

Higher global cocoa supplies have weighed on cocoa prices lately. As per the source, supply of cocoa is expected to outdo demand in the near term. This has put a lid on cocoa prices this year and hurt cocoa ETNs heavily in the last one month.

Global X Uranium ETF (V:URA) – Down 14.3%

Uranium prices have been under pressure for quite some time now due to oversupply conditions. As per Bloomberg, “after the 2011 Fukushima disaster, safety concerns led big uranium buyers including Japan and Germany to shut down or decommission reactors.”

The fund URA gives exposure to the uranium mining industry. The largest component of the fund – Cameco Corp which has about 20% exposure in URA – reported a higher-than-expected quarterly loss, partly weighed on by “the termination of a contract by Tokyo Electric Power Co.” Extremely low uranium prices also hit the company hard, as per management. This kind of operating environment was responsible for the fund’s underperformance in the last one month.

PowerShares S&P SmallCap Energy ETF (NYSE:XLE) PSCE – Down 12.6%

With energy prices still struggling, this small-cap energy ETF had every reason to struggle in the month. Notably, United States Oil (NYSE:USO) USO was down about 3.8% in the last one month (as of April 28, 2017) (read: Oil Service ETFs Down on Mixed Earnings & Oil Price Worries).

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Get it free >>

SPDR-DJ IND AVG (DIA): ETF Research Reports

SPDR-SP 500 TR (SPY (NYSE:SPY)): ETF Research Reports

PWRSH-SP SC EGY (PSCE): ETF Research Reports

ISHRS-MSCI TURK (TUR): ETF Research Reports

GLBL-X URANIUM (URA): ETF Research Reports

VANECK-INDIA SC (SCIF): ETF Research Reports

IPATH-BB COCO (NIB): ETF Research Reports

ARK-INDUS INNOV (ARKQ): ETF Research Reports

Original post

Zacks Investment Research