As the post-“crash” recovery lurches to another high, the mainstream media and bulls are spewing left and right:

I am surprisingly nonplussed about the entire affair. I remain extraordinarily short and although I covered some nice money-makers (WDC, MTW, STX) and had a couple of profitable intraday ETF trades (DIA, EEM), both on the short side, incredibly, I have simply held on to the vast majority of my individual shorts.

I want to share six ETFs and my disposition toward each: short and sweet. First up is the triple-bearish-on-miners symbol (N:DUST), on which I am bullish, as we appear to be heading toward a quadruple bottom:

On Emerging Markets, I am bearish, as we approach the underside of a pattern failed pattern:

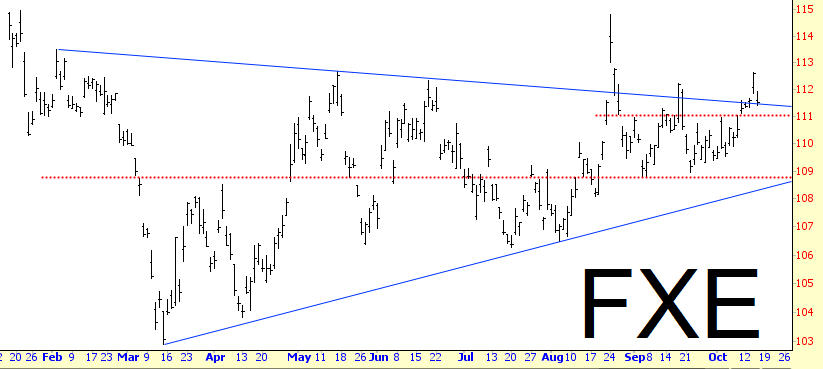

On the euro (and the yen, for that matter), I am bullish, with an eye toward a full-velocity escape of the triangle pattern:

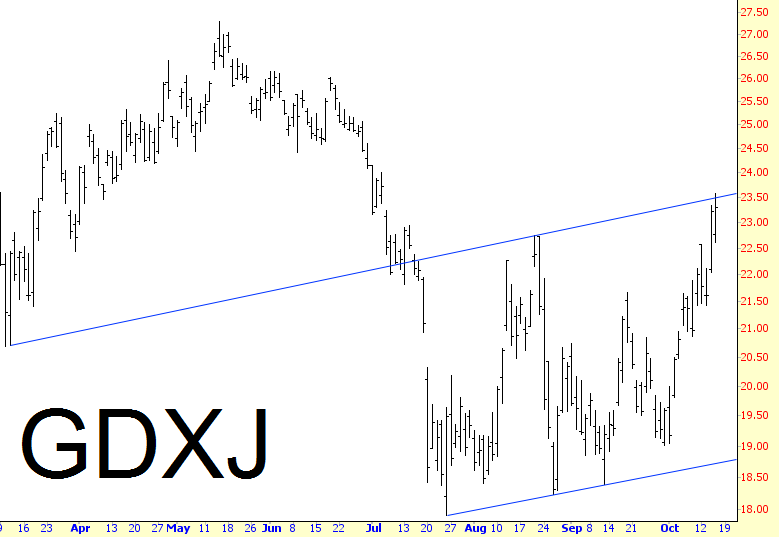

On junior miners, I am bearish:

I am bearish on the Dow Industrials “diamonds”:

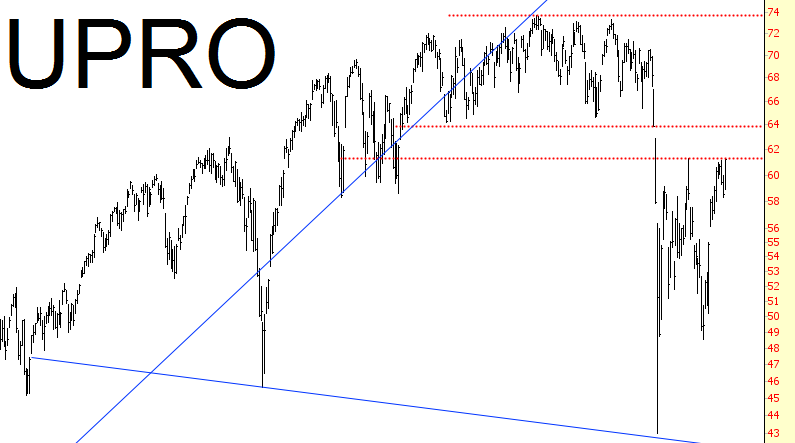

On the UltraPro S&P500, I am also bearish (no surprise, eh?):

We are getting very close to the “2020” level on the ES that I’ve been watching. I obviously hope that once OPEX is done, we can resume some equity weakness immediately next week. I’ll see you folks here Friday morning.