Historically, when the U.S. dollar surges, forward S&P 500 earnings plummet. In the same vein, the last two times that the world’s reserve currency skyrocketed, the U.S. economy slipped into a recession.

Come on, Gary. Do you really think that we have already dipped into recession territory? No, I do not. Yet the idea that the Federal Reserve can permanently prevent an economy (or a stock market) from succumbing to cyclical forces is foolish. In fact, Federal Reserve Open Market Committee (FOMC) members now have to deal with byproducts of six-plus years of zero percent rate policy, including unfamiliar volatility in market-based securities as well as the impatient ascent of the greenback.

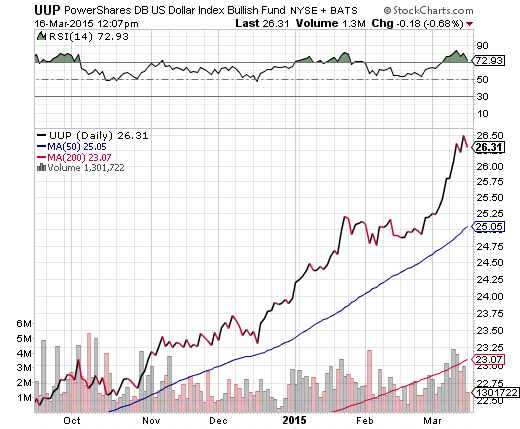

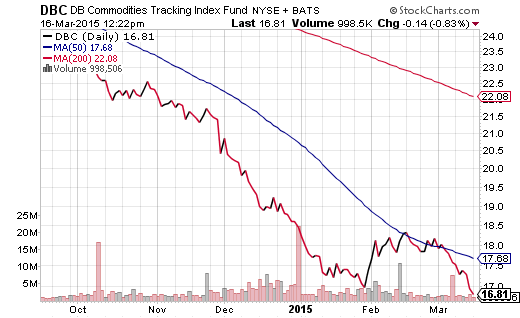

Indeed, chairperson Yellen faces a bigger challenge than whether or not to remove the word “patient” from Wednesday’s rate policy statement. The inexorable rise of the U.S. dollar has wreaked havoc on U.S. manufacturing output, future new orders as well as commodity prices. And we’re not just talking about oil prices here. Investors are abandoning virtually all of the commodities essential to healthy economic activity.

If the Fed misinterprets purportedly strong job growth and hikes overnight lending rates on several occasions in 2015, we won’t simply bear witness to a domestic slowdown. We will see outright contraction. It would happen because extraordinary dollar strength isn’t just the stuff of financial speculation; rather, it is the unfortunate reality of currency wars gone awry.

I continue to recommend exposure to less volatile U.S. stocks via Vanguard Dividend Appreciation (NYSE:VIG), Vanguard Mid-Cap Value (NYSE:VOE) and iShares MSCI USA Min Volatility (NYSE:USMV). Increasingly volatile price movement can bee sen in virtually any exchange-traded basket. Nevertheless, funds like USMV are still holding above both the 100-day and 200-day moving averages. Higher-lows are also a positive indication.

In spite of maintaining a classically moderate level of exposure to U.S. equities, I am remarkably cognizant of the risks associated with the late-stage stock bull. The business cycle? Not only is it long by historical standards, but honest efforts to tighten monetary policy could prompt its expiration. The almighty buck? If it does not level off soon, U.S. corporate profits earned abroad will be eviscerated by dramatically lower currencies. That leads to lower earnings estimates, higher valuations and, eventually, a stock bear.

In the current year, I do not believe we will see honest monetary tightening endeavors. Job data have been misleading. The U.S. economy has been decelerating. And the current FOMC members are more likely to endorse a Kentucky Wildcat “one-n-done” hike in 2015, as opposed to obliterating the apple cart. Saving face by declaring some sort of moral victory on leaving zero percent rate policy behind? That they will do. Genuinely push for normalization of interest rates in a rapidly rising dollar environment? In a decelerating economy? That’s not likely.

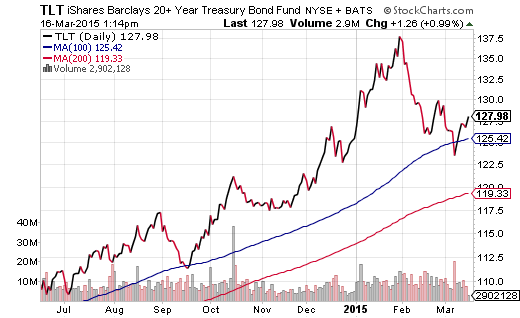

Even though I reduced exposure to Vanguard Extend Duration (NYSE:EDV) due to the execution of stop-limit loss orders, long-maturity treasuries are still worth acquiring in funds like iShares Lehman 10-20 Year Treasury (NYSE:TLH) and iShares Barclays (LONDON:BARC) 20+ Year Treasury (ARCA:TLT). Both benefit from economic weakness and/or market-based uncertainty. Both exhibit enormous relative value against comparable sovereign debt around the globe. Both held respective 100-day intermediate-term trendlines. And both effectively hedge stock risk.

Ironically, risk in late-stage bull markets typically becomes an ill-fated notion of missing the rally. People are people, subject to the psychology of fantastical fervor. In truth, risk is the probability that something will go wrong and endanger one’s capital. Protecting against the devastation associated with bearish declines – financial, mathematical, psychological – is the primary task in risk management. If you’re leaving the role of risk management to the diversification gods, you’re nearly certain to find yourself in a hole that is too deep for anything more than prayer.