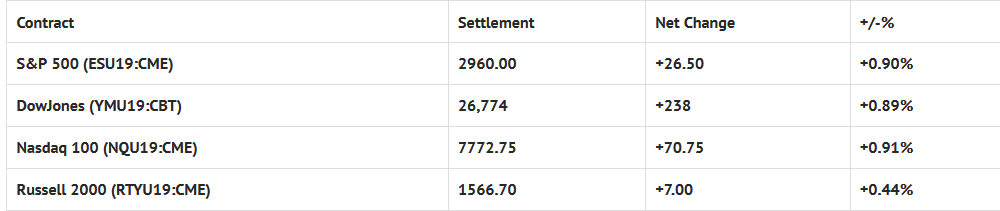

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed lower: Shanghai Comp +0.50%, Hang Seng -0.27%, Nikkei -0.95%

- In Europe 7 out of 13 markets are trading lower: CAC +0.01%, DAX -0.11%, FTSE +0.175%

- Fair Value: S&P +4.80, NASDAQ +29.61, Dow +10.40

- Total Volume: 1.85 million ESU & 331 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes Quadruple Witching, Eric Rosengren Speaks 3:30 AM ET, PMI Composite FLASH 9:45 AM ET, Existing Home Sales 10:00 AM ET, Patrick Harker speaks on Sunday Speaks 10:00 AM ET, Lael Brainard Speaks 12:00 PM ET, Loretta Mester Speaks 12:00 PM ET, Mary Daly Speaks 12:30 PM ET, and the Baker-Hughes Rig Count 1:00 PM ET.

S&P 500 Futures: Headlines Killed The Vibe

Yesterday was definitely a negative headline day. After rallying up to a new all time high at 2964.50 on Globex, and then trading 2960.50 on the 8:30 CT bell, the S&P 500 futures (ESU19:CME) were bogged down by Iran headlines all morning. By 11:30, the futures had traded all the way back down to 2936.25, nearly 30 handles off the Globex high.

Once the headline bombardment slowed down, and the algos had squeezed out all the weak longs, buy imbalances started to show up. With the help of the MiM, and nearly $1.5 billion to buy MOC, the ESU rallied to close near the highs of the session.

The futures went on to print 2958.25 on the 3:00 cash close, and 2960.75 on the 3:15 futures close, up +27 handles on the day.