EssilorLuxottica (SIX:ESSI) came into existence in October 2018 after the French Essilor acquired the Italian Luxottica in a $24 billion deal. The merger resulted in the world’s largest eyewear company with a market cap of roughly 60 billion euro.

Listed on the Euronext Paris stock exchange, EssilorLuxottica is part of the French CAC 40 and the Euro Stoxx 50 indices. The company is the very definition of a European blue chip. Unfortunately, even the best company can be a bad investment if bought at too high a price. Is EssilorLuxottica a good choice with the stock near 136 euro a share? We think the Elliott Wave principle can help us answer that question.

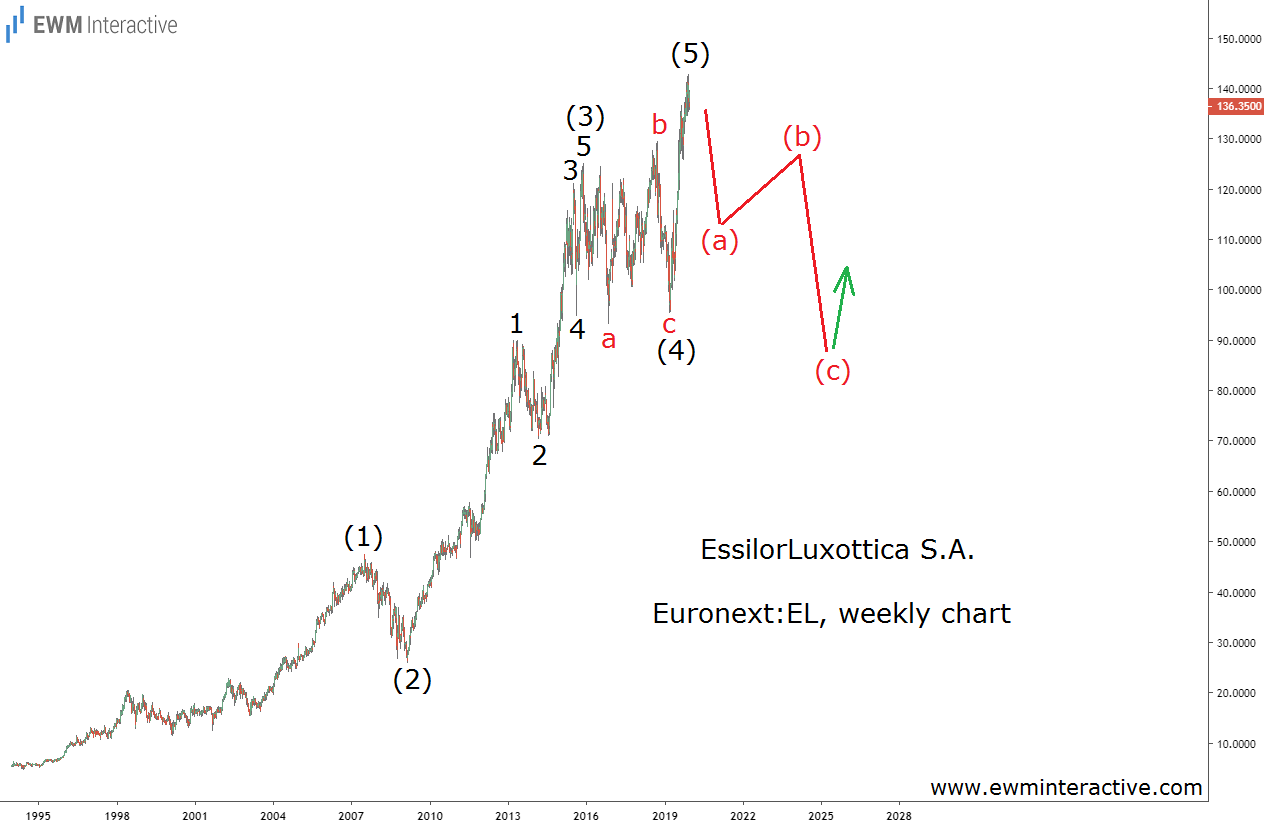

With a price to earnings ratio higher than 30, the stock is definitely not cheap. Its weekly chart, however, reveals something even more worrying. It shows that the entire uptrend since 1994 can be seen as a complete five-wave impulse. The pattern is labeled (1)-(2)-(3)-(4)-(5), where the five sub-waves of wave (3) are also visible.

The problem with this pattern is that every impulse is followed by a correction in the opposite direction. The corrective phase of the cycle typically erases all the gains of the fifth wave. In the case of EssilorLuxottica, this means a decline to roughly 90 euro a share can now be expected. This translates into a 34% drop from current levels.

If this count is correct, investors might want to keep their powder dry. A much better opportunity to buy shares in this world-class company should present itself in a couple of years. Better be patient.