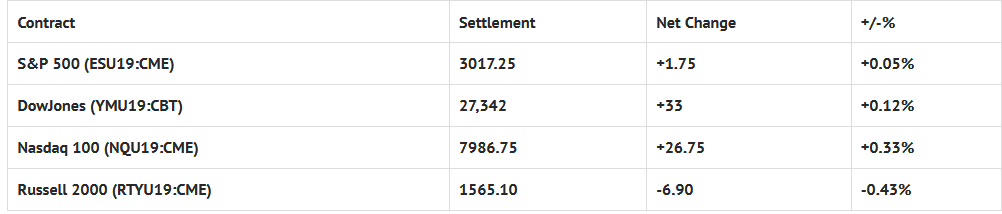

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed lower: Shanghai Comp -0.16%, Hang Seng +0.23%, Nikkei -0.69%

- In Europe 11 out of 13 markets are trading higher: CAC +0.45%, DAX +0.18%, FTSE +0.46%

- Fair Value: S&P +3.77, NASDAQ +21.09, Dow -8.67

- Total Volume: 823k ESU & 126 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes the 8-Week Bill Settlement, Michelle Bowman Speaks 8:15 AM ET, Raphael Bostic Speaks 8:15 AM ET, Retail Sales 8:30 AM ET, Michelle Bowman Speaks 8:30 AM ET, Import and Export Prices 8:30 AM ET, Redbook 8:55 AM ET, Industrial Production 9:15 AM ET, Raphael Bostic Speaks 9:20 AM ET, Business Inventories 10:00 AM ET, Housing Market Index 10:00 AM ET, Raphael Bostic Speaks 10:05 AM ET, Robert Kaplan Speaks 12:20 PM ET, Jerome Powell Speaks 1:00 PM ET, Charles Evans Speaks 3:30 PM ET, and Treasury International Capital 4:00 PM ET.

S&P 500 Futures: Low Volume Chop

Chart courtesy of Scott Redler @RedDogT3 – $spx closer look as it rises the trend and we manage our positions.

After printing a new record high at 3023.50 during Sunday nights Globex session, the S&P 500 futures (ESU19:CME) eased off a little to open Monday’s regular trading hours (RTH) at 3021.50.

The futures turned weak out of the gate after the 8:30 CT bell, and broke down to 3014.50 in the first 15 minutes of trading. From there, the ES did a little back-and-fill up to 3018.75, but for the most part, it was a slow and choppy start to the week.

With the exception of the initial move lower, the futures traded in a 6 handle range for the rest of the morning, and into the afternoon. There was no news, and volume was very low.

Going into the close, when the MiM reveal came out showing $850 million to buy MOC, the ES traded up to 3018.00. It would then go on to print 3017.00 on the 3:00 cash close, and 3017.25 on the 3:15 futures close, up +2.25 handles on the day.