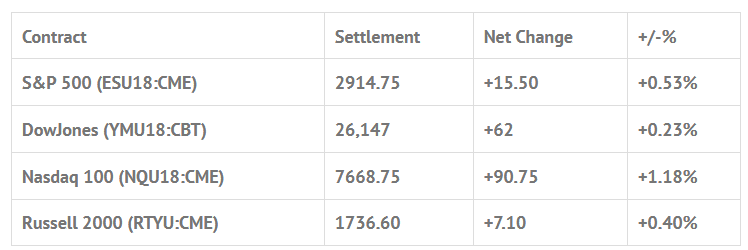

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed lower: Shanghai Comp -1.14%, Hang Seng -0.89%, Nikkei +0.09%

- In Europe 13 out of 13 markets are trading lower: CAC -0.26%, DAX -0.45%, FTSE -0.52%

- Fair Value: S&P +0.54, NASDAQ +6.87, Dow +10.24

- Total Volume: 1.10mil ESU & 435 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Weekly Bill Settlement, Jobless Claims 8:30 AM ET, Personal Income and Outlays 8:30 AM ET, EIA Natural Gas Report 10:30 AM ET, Fed Balance Sheet and Money Supply 4:30 PM ET.

S&P 500 Futures: Pre Labor Day Rise Continues

Yesterday, after trading in a 7.5 handle range in the overnight session with virtually minimal response to the GDP number at 7:30, the S&P 500 futures opened the regular session at 2901.75, up +2.25 handles, and traveled lower, making the session low in the first half hour at 2898.75. Shortly after 9:00 am, buy programs took over the ESU pushing the benchmark index future up to 2916.25, a new all time high, just after 11:00 am, and from there began to chop around at the highs.

The afternoon saw a move down to a 2911.25 low just after 1:00 before rallying late in the day up to a last hour high of 2817.50, and then trailing off into the cash close, printing 2914.50 at 3:00 and settling the day at 2914.5, up +15.50 handles, or +0.54%.

In the end, the day was more of the same that we have seen in recent weeks, a low volume thin to win trade higher. Buy programs controlled the day, leaving those who are waiting for even modest pullbacks to buy left in the dust, as the markets continue to be slow pre-Labor Day weekend.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI