Dear reader, if you like this ES trading plan, find it informative and would like to read more of them then please let me know by leaving a comment below.

Market Context

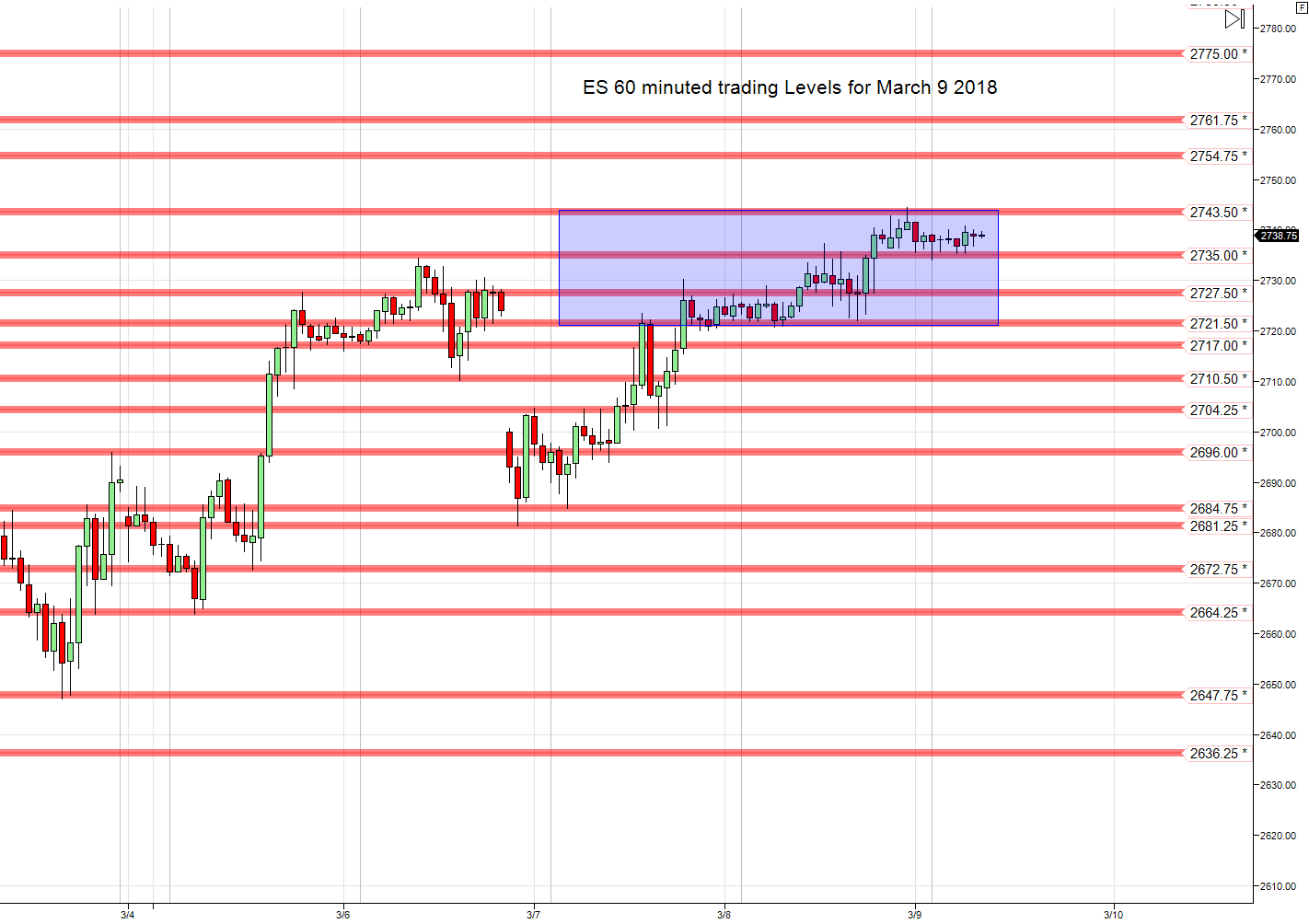

The tone of the day is acceptance. I’m expecting low volatility range-bound sideways action with a slight move higher to 2754.75 unless news is released that moves the market. U.S. stock indexes moved higher yesterday on news that Trump's tariffs would exclude some key trading partners, and that Mexico and Canada could be initially exempt.

As you know, the market can do anything at any time and there is no way to predict what the market will do in advance. My advice is to remain mentally flexible and prepare for change. Watch price action carefully and observe how it responds around S&P 500 levels. Trade accordingly.

Key trading levels

- Resistance - 2743.50, 2754.75, 2761.75, 2775, 2785.50

- Support - 2735, 2727.5, 2721.50, 2717, 2710.50, 2704.25, 2696, 2684.75, 2681.25, 2672.75, 2664.25, 2647.75

- Target high of the day - 2754.75

- Target low of the day - 2727.5

0

0

Predictive analysis

The ES could remain range bound between 2743.5 and 2721.5 however I’m targeting 2754.75 as the high of the day. Be alert for trade sanctions and inflation related news. Markets will move lower if Trump or his administration announce a tightening of sanctions. Conversely, a relaxed sanctions tone will move markets higher.

- If the ES breaks above 2743.50 today then it may continue up to resistance 2754.75, the target high.

- If the ES breaks below 2721.50 then it may retest 2717, 2710.50 and 2704.25

Daily Trading plan

- If the price breaks above 2743.50 then the tone is clearly bullish so long directional trades targeting 2754.75 are recommended

- If the price breaks down below 2721.50 then the tone will be bearish so short directional trades are recommended

- Enter trades at support and resistance, depending on how price responds to those levels. If prices pull back at a resistance level the watch for a retest and go long but be careful of double tops and double bottoms for reversals.