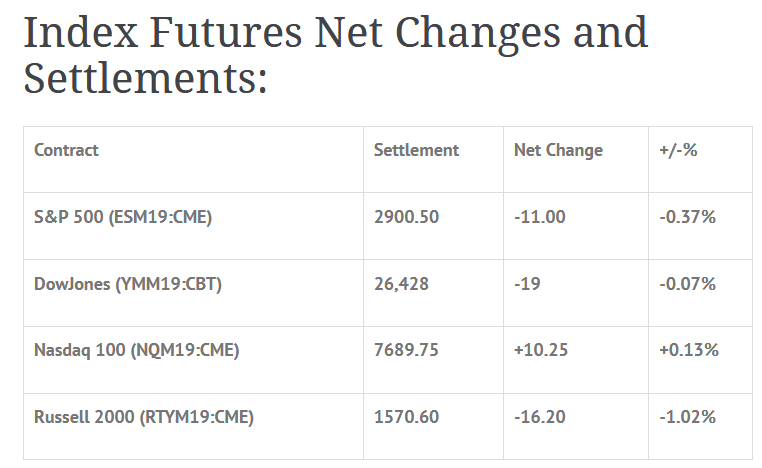

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed lower: Shanghai Comp -0.40%, Hang Seng -0.54%, Nikkei -0.84%

- In Europe 8 out of 13 markets are trading higher: CAC +0.30%, DAX +0.39%, FTSE -0.18%

- Fair Value: S&P +3.37, NASDAQ +20.27, Dow -1.13

- Total Volume: 1.38 million ESM & 387 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Jobless Claims 8:30 AM ET, Philadelphia Fed Business Outlook Survey 8:30 AM ET, Retail Sales 8:30 AM ET, PMI Composite FLASH 9:45 AM ET, Business Inventories 10:00 AM ET, Leading Indicators 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Fed Balance Sheet & Money Supply 4:30 PM ET.

S&P 500 Futures: #ES Failed Rallies And Broken Hearts

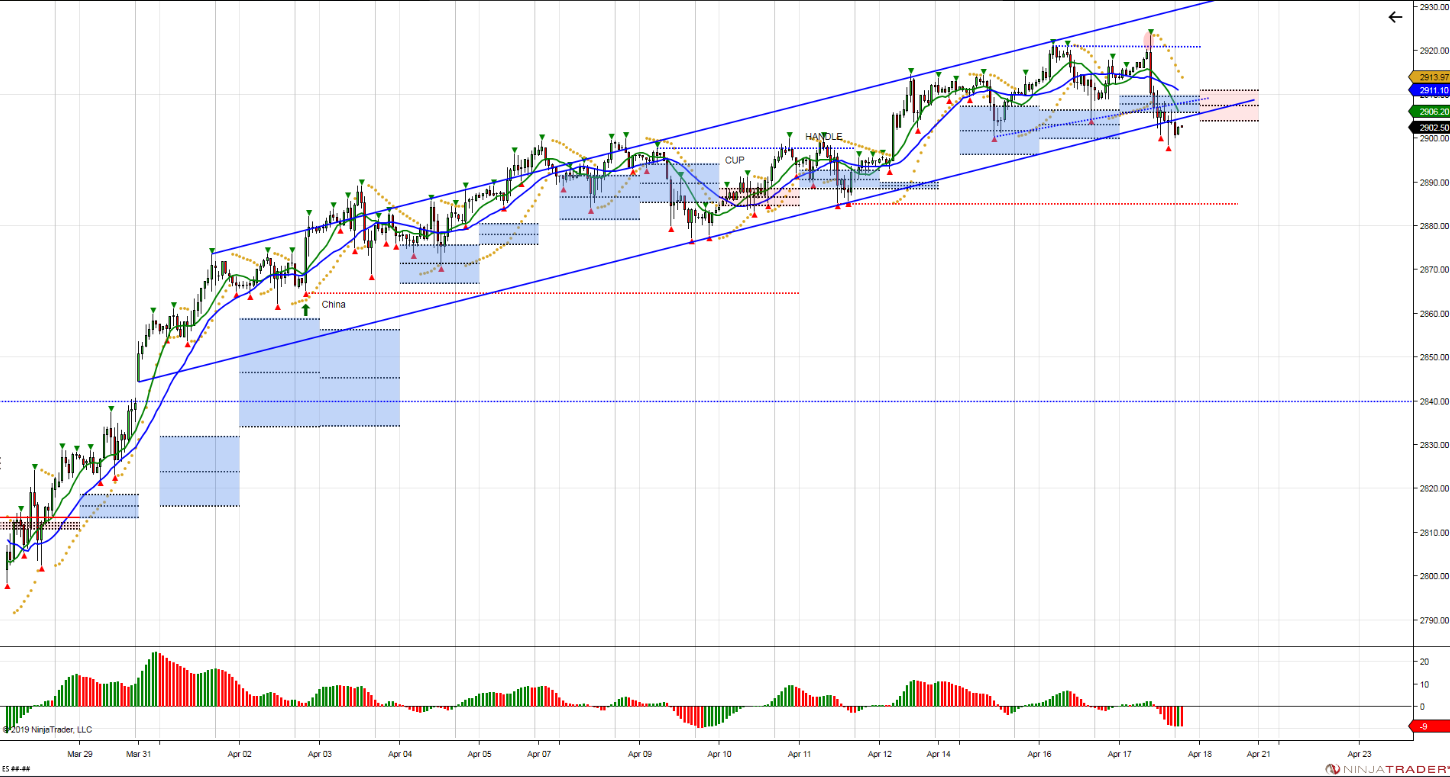

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F 2nd close < 3D pivot since b/o >on March 28. Thursday’s range above = overhead resistance for sellers to defend buyers to overcome. Failure to do so leaves buyers trapped for sellers to tgts sell stops <2885 last Thurs low to reverse b/o. Close above needed to recover.

There is a tug of war going on right now. Do you know what it is? Its call taking some profits. The big ETF’s have been getting out of Dow, S&P and Russell stocks, and buying the Nasdaq (tech stocks). So far the overall markets have been holding, but late Tuesday before IBM (NYSE:IBM) reported, the #ES sold off a quick 10 handles, and yesterday the futures traded below the ‘2900.00 big figure’, down to 2898.50.

Let’s face it, the ES has rallied over 600 handles, or 16%, off its December low. Over the last few days there has been a lot of talk about filling the upside gap set on 10/04/18 at 2924.00, and it fell two ticks shy yesterday.

If you are registered as a premium user of the Opening Print, you know that yesterday I talked about the ES being overbought, and how the bullish sentiment is at an extreme high. I also talked about CNN’s “fear and greed’ index trading 70%, and the PitBull saying, “if the ES doesnt make a new high it could be a problem.” I went on to say that our overall lean was to continue to buy weakness, but to be more cautious.

The ES has to get above 2924 and hold to run the buy stops up to 2938-2940. On the other side, a close under 2908-2906 could be a short term bearish signal. As I have always said, I am not an economist or an analyst, I’m just a street guy who thinks the markets could be setting up for a pullback. As the PitBull always says, ‘no gaps go unfilled’ in the ES.

During Tuesday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2923.25, a low of 2908.75, and opened Wednesday’s regular trading hours at 2923.00.

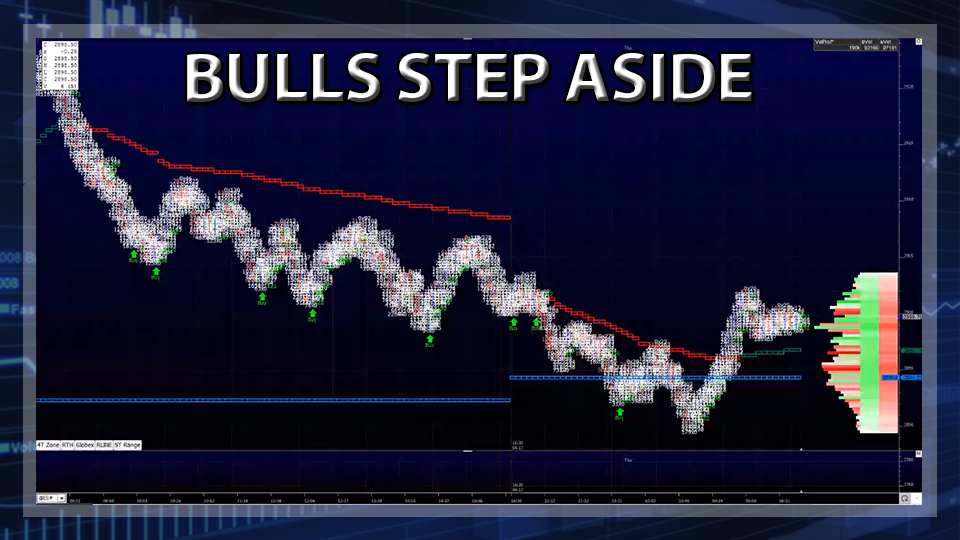

As has been the pattern of late, the ES rallied on Globex, then sold off after the 8:30 CT open. The first leg down saw a low print of 2904.50, which was Tuesday’s low, followed by a pullback up to 2912.00, and then a second leg down to 2900.75, which would remain the low for the rest of the morning.

Heading into the afternoon, the futures had again retraced a little, this time topping out at 2908.50, and then turned back lower to test the low. By 1:30 the ES had printed a new low at 2898.50, and that would remain the low for the rest of the session.

Going into the close, the futures had been pretty much trading sideways for the majority of the day, and when the 2:45 cash imbalance reveal came out showing $368M to sell, the ES was trading at 2906.25. From there, it would go on to print 2903.50 on the 3:00 cash close, and end the day at 2900.50 on the 3:15 futures close.

In the end, the overall tone was one of a weak ES, and a firm NQ. In terms of the days overall trade, total volume was higher, with nearly 1.4 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.