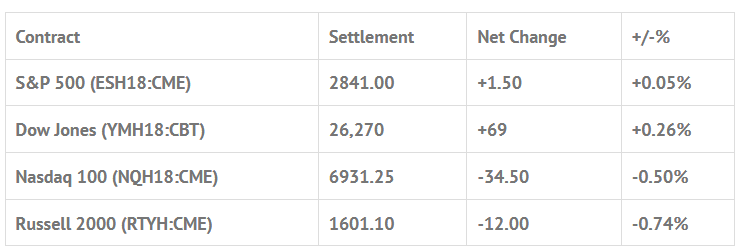

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed lower: Shanghai Comp -0.31%, Hang Seng -0.92%, Nikkei -1.13%

- In Europe 8 out of 12 markets are trading higher: CAC +0.49%, DAX +0.16%, FTSE +0.14%

- Fair Value: S&P +0.95, NASDAQ +10.84, Dow -15.68

- Total Volume: 1.8mil ESH & 415 SPH traded in the pit

Today’s Economic and Earnings Calendar:

Weekly Bill Settlement, Jobless Claims 8:30 AM ET, Bloomberg Consumer Comfort Index 9:45 AM ET, New Home Sales 10:00 AM ET, Leading Indicators 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Kansas City Fed Manufacturing Index 11:00 AM ET, Fed Balance Sheet and Money Supply 4:30 PM ET.

S&P 500 Futures: How High Is High? Let The VIX Answer The Question

It had to happen eventually, and it finally did yesterday. After being up 14 of the first 16 trading sessions in 2018, and up 187.75 handles (+7%), the S&P 500 futures (ESH18:CME) gave way to the downside after U.S. Commerce Secretary Wilbur Ross accused Beijing of ‘employing protectionist actions under the guise of free trade’. While speaking in Davos, Switzerland the U.S. Treasury Secretary Steven Mnuchin followed up saying that the Trump administration supports “bilateral trade agreements,” and that a weaker dollar was good for trade… Down went the S&P.

On yesterday’s 8:30 futures open the ES traded 2848.00, and then traded up to ‘another’ new all-time contract high at 2855.25, up +16.25 handles on the day. While the ES was rallying, the dollar was hitting a three year low, and the VIX was rallying. After the ES made its high, the futures buckled down to 2851.50, and then in came a wave of sell programs pushing it down to 2839.75.

After a small bounce, another wave of sell programs hit, pulling the ES down to 2833.00, 22.50 handles off its high. From there, it bounced up to 2841.50, then in came several more sell programs, taking the ES down to 2829.75, and eventually down to 2825.50, 30 handles of the high of the day. The was a nice short covering rally up to 2838.00, then up to the vwap at 2841.50, and then up to 2845.50, 21 handles off its low.

After 2:00 the ES made four lower lows at 2839.50, 2839.00, 2838.75 and 2838.00 as the MiM went from buy $252 million to buy to $405 million. On the 2:45 cash close the final MiM showed buy $1 billion. On the 3:00 cash close the ES traded 2840.00, and went on to settle at 2841.50, up 3.25 handles, or +0.11%.

In the end the S&P was up, it was down, and it was all around, but at the end of the day, it still finished higher. It was a big day in terms of the overall trade, 1.75 million ES traded, and there was not much damage, other than running a bunch of sell stops.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.