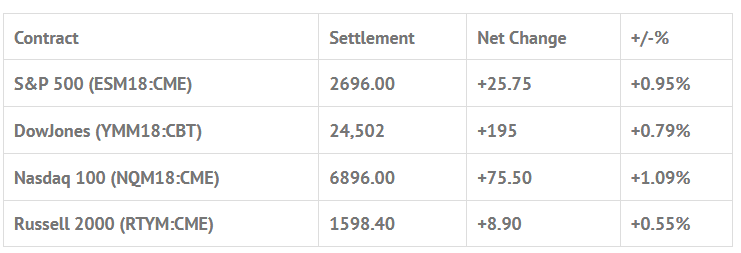

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Comp +0.51%, Hang Seng +0.89%, Nikkei +0.39%

- In Europe 7 out of 13 markets are trading higher: CAC -0.01%, DAX +0.38%, FTSE +0.14%

- Fair Value: S&P -1.90, NASDAQ +1.38, Dow -34.17

- Total Volume: 1.24mil ESM & 617 SPM traded in the pit

Today’s Economic Calendar:

Weekly Bill Settlement, Consumer Price Index 8:30 AM ET, Jobless Claims 8:30 AM ET, Bloomberg Consumer Comfort Index 9:45 AM ET, EIA Natural Gas Report 10:30 AM ET, Treasury Budget 2:00 PM ET, Fed Balance Sheet and Money Supply 4:30 PM ET.

S&P 500 Futures: #ES Upside ‘Breakout’ Buy Energy and Tech

Yesterday started with a globex range of 2666.75 to 2884.50, on volume of 156,000. The ‘money maker’ ES imbalance chart we use had a buy signal at 2666.25 just after 4:00 am CT. On Wednesday mornings 8:30 CT open the ES traded 2677.25, and then back and filled in a narrow range from the 2681.00 area to the 2674.50 area for first the hour and fifteen minutes. The futures finally sold off to a new low at 2672.00 at 10:02, and then in came a big buy program / stop run that pushed the ES all the way up to 2695.00 at 12:00 CT.

After a 9.5 handle pullback down to 2690.50, the ES traded up to the big figure at 2700.00. The futures then pulled back to 2693.00, made a lower high at 2699.50, and pulled back to 2696.25. The ES traded 2691.50 on the 2:45 cash imbalance reveal, which showed $45 million buy, made a low at 2691.00, and then traded 2696.00 on the 3:00 cash close. On the 3:15 futures close the futures settled at 2696.75, up +26.50 handles on the day, or up +0.96%.

In the end, yesterday’s push to ES 2700.00 was a giant stop run, supported by the energy and tech sectors. The shorts have been sitting back taking advantage of all the failed rallies, but got squeezed out during the big run up. Adding to this was the total lack of volume. Only 156,000 ES traded on Globex, and at the end of the day, there was only 1.19 million futures traded. That’s not much considering the size of the rally.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.