Telecom service provider, Ericsson (BS:ERICAs) (NASDAQ:ERIC) , Verizon (NYSE:VZ) , and Qualcomm Technologies, a subsidiary of Qualcomm Inc. (NASDAQ:QCOM) recently exceeded the Gigabit speed barrier. The companies are the first in their industry to come up with commercial silicon and network infrastructure with 1.07 Gbps (gigabits per second) download speed.

During an Ericsson lab trial, these companies used the Qualcomm SnapdragonTM X20 LTE Modem to achieve the feat. These speeds fall under the companies’ current evolution of the LTE technology.

The companies achieved the 1.07 Gbps speed by using three 20MHz carriers of FDD (Frequency Division Duplex using separate transmit and receive frequencies) spectrum. This will enable the companies to reach new levels of spectral efficiency for commercial networks and devices, which in turn will allow the delivery of the Gigabit class experience to more customers and support new wireless innovations.

The Gigabit LTE solution for Ericsson and Cable & Wireless Communications includes carrier aggregation, higher order modulation (256-QAM) and 4X4 MIMO (Multiple Input Multiple Output) which uses optimized data speeds for wireless broadband subscribers.

Ericsson, being one of the premier telecom services providers, is much in demand among operators to expand network coverage and upgrade networks for higher speed and capacity. Notably, Ericsson is the world’s largest supplier of LTE technology with a significant market share and has established a large number of LTE networks worldwide. As operators continue to invest in telecom core networks for the deployment of new service offerings such as Voice over LTE, Ericsson stands to benefit significantly from it.

The company is also investing in R&D to increase its competitiveness in Networks business. As a matter of fact, Ericsson is enthusiastic about the turnaround of the Chinese market in terms of 4G deployment and believes this will be a significant growth driver, going forward. The company is witnessing immense interest for the new Ericsson Radio System – its new platform which enables customers to upgrade to narrow band IOT and 5G just through software upgrade.

However, uncertain markets, reduced consumer telecom spending and delayed auctions of spectrums pose significant threats to Ericsson. Unfortunately, these conditions are expected to persist through 2017. Also, the company is facing an increased risk of market and customer project adjustments, which can have a huge negative impact on its operating income in the quarters ahead.

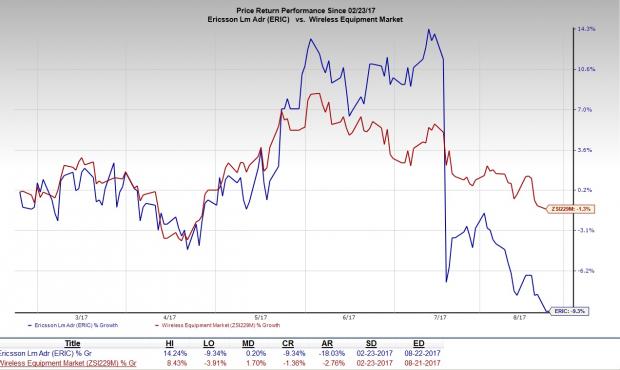

In light of the above concerns, Ericsson’s shares have lost 9.3% over the past six months, much worse than the industry’s average decline of 1.4%.

Considering the growth drivers and the risks that the company faces, we have a Zacks Rank #3 (Hold) on Ericsson.

Stock to Consider

A better-ranked stock in the industry is Motorola Solutions, Inc. (NYSE:MSI) , with a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Motorola Solutions delivered an average positive earnings surprise of 14.5% for the last four quarters, having beaten estimates all through.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month. Learn the secret >>

Ericsson (ERIC): Free Stock Analysis Report

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Motorola Solutions, Inc. (MSI): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Original post