One benefit to writing blog content is it serves as a record of one's past thinking and the results of any decisions made from the prior analysis. With that in mind I reviewed some of the topics written over a year ago, that is, in June/July of 2016.

A few of the topics at that time had to do with valuations, PEG ratios and the fact the market was trading at an all time record high. In fact one article was titled, Is It Right To Be Bullish Near A Record Market High? The conclusion at that time was to stay invested in equities as I wrote then:

"Being bullish after a double digit market decline seems a lot easier than being bullish near market tops. Knowing the market does not move up or down in a straight line, are there factors we see that would support higher equity prices? In the intermediate and long run, we believe fundamental company and economic factors are key drivers of stock price returns."

That last sentence above was an important factor in our firm's bullish posture last year.

Fast forward to today and just about all of the same concerns being expressed last year are being expressed again this year and valuations are higher now versus a year ago. At the same time, the S&P 500 Index is up over 16% in the last 12-months. Value investors are struggling with these high valuations. An interesting article/interview appeared in Barron's this weekend where Barron's spoke with a member of Grantham Mayo van Otterloo (GMO), founded by the well respected investor Jeremy Grantham. One response from the interview relating to valuation,

"The U.S. market is at its second or third most expensive point in history. So people are saying, “I either don’t understand the world anymore, or I don’t think that valuation matters anymore,” which is a really weird thing to say. You’re giving up the one piece of information that you know helps determine your long-term returns. You cannot describe yourself as an investor if you are going passive. You are welcome to call yourself a speculator, but you honestly can’t say you care about expected returns if you are going passive at this time."

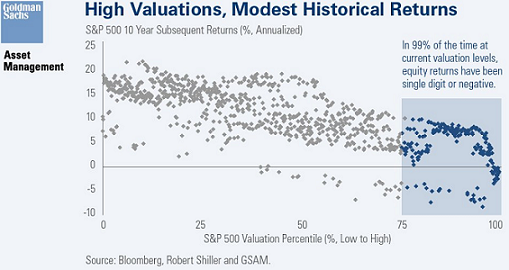

Today (Sunday), Abnormal Returns featured the below chart from Goldman Sachs on valuations and subsequent 10-year returns. As one can clearly see, given current market valuations, one should consider tempering their expectations for future equity returns.

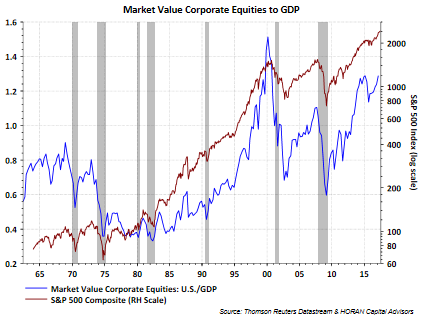

Even Warren Buffett seems to be rethinking his valuation metrics. A favorite valuation measure that has served Warren Buffett well over the years is comparing the market value of equities to nominal GDP. As can be seen in the below chart, this measure is approaching levels seen at the height of the technology bubble in 2000. At that time Mr. Buffett was warning investors about the market's extended valuation. Similarly, during the financial crisis, Warren Buffett used Berkshire Hathaway (NYSE:BRKa)'s financial strength to invest in companies facing difficulties at that time. Now though, Warren Buffett told CNBC in March of this year,

"We're not in a bubble territory or anything of the sort." In fact, he argues, "measured against interest rates, stocks actually are on the cheap side compared to historic valuations."

Jim Paulsen, formerly of Wells Fargo Capital Management and now chief investment strategist with Leuthold Group, noted in a report last week and highlighted by Dave Wilson of Bloomberg radio,

“There are good reasons to suspect that a new valuation range may have evolved” for U.S. stocks, Jim Paulsen, Leuthold Group Inc.’s chief investment strategist, wrote in a report Monday...The shift reflects a less cyclical domestic economy, more stable inflation, a more growth-oriented stock market, a wider range of investors and the growing popularity of index funds, he wrote.

I would say it is a negative that many are tossing valuation aside during this equity market run. On the other hand, we do agree equities can trade at higher valuations in a low interest rate environment. The room for error though is decidedly smaller.

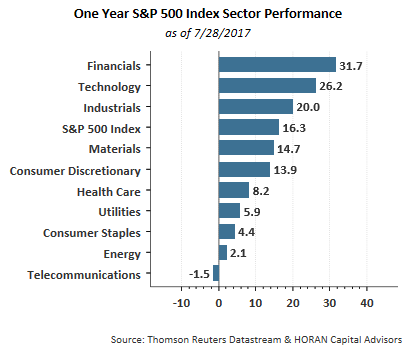

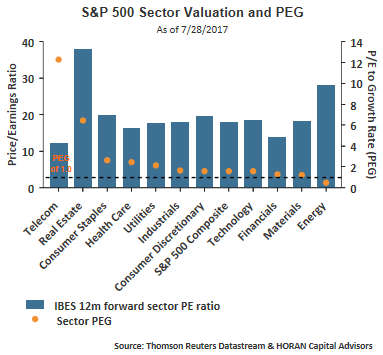

Looking back at some of the June/July 2016 posts reveal some interesting outcomes a year later. Those sectors that had the highest absolute P/E ratios a year ago had some of the weakest returns, albeit positive. Those sectors were Energy, Consumer Staples and Utilities. Conversely, the sectors with the lower valuations generated the best returns a year later, Financials, Technology and Industrials.

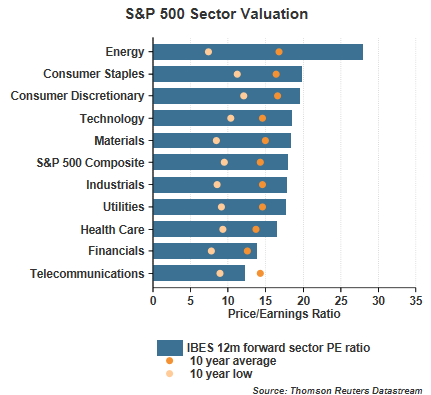

Below are two charts showing S&P 500 Index sector forward P/Es, PEG ratios (P/E to earnings growth rate), 10-year sector average P/E and 10-year sector low P/E. Those sectors with lower P/Es that are near or lower then the 10-year average P/E may be sectors in which investors might look in for investment opportunities.

So valuations do not matter? Not necessarily true. Valuations do matter; however, markets tend to not correct simply because valuations are elevated. As we noted in our 2017 Summer Investor Letter, the more overvalued the market though, the greater the potential for a more significant pullback.