RenminBOOM!

For those wondering if China’s 8% decline in export growth was a concern for the Chinese government, today’s record CNY exchange rate fixing provides an emphatic ‘yes’. Today saw the biggest cut to the CNY fixing on record, with the PBOC weakening the CNY daily reference rate by 1.9%. This has seen panic buying of the USD across Asian markets, and the offshore USDCNH market has gapped up almost 1000 pips. The question on everyone’s mind is whether this is the awakening of the dragon -ushering in a new global currency war?

The CNY has suffered in recent months, as its partial peg to the USD has seen it appreciate with the increasing prospects of a Fed rate hike. In contrast to just a few years ago, the CNY has recently been 10-15% overvalued on real effective exchange rate measures. Continued easing programs from the BOJ and the ECB have seen the CNY strengthen against both their currencies respectively, dinting China’s export competitiveness - exports to Japan have declined 10.5% and exports to Europe have declined 2.5%.

This state of affairs has continued for most of the year, but many believed that the Chinese government would not risk devaluing the currency. China wants to support industrial upgrading and a move up the value chain, and a stronger currency supported this by forcing companies to increase their competitiveness. This is obviously no longer a primary concern.

The weakening of the currency also leads to major risks of increased capital outflows. China has seen a steady flow of capital out of the country throughout 2015, and the rate fixing now provides the stimulus for this to significantly ramp up. Chinese demand for overseas assets denominated in other currencies are likely to increase in the second half of the year as continued slow growth is going to keep further pressure on the CNY to depreciate. Foreign property markets may well see increased Chinese buying off the back of this move.

This also definitively marks the end of the China carry trade. The multi-year steady appreciation of the currency lead to a plethora of ingenious methods to exploit currency restrictions through Chinese commodity financing deals (CCFDs). Commodities like gold, silver and nickel were used as collateral while letters of credit (LOCs) were booked from Hong Kong to the mainland to profit from the CNHCNY differential. With the collapse of this trade, questions remain over how much of these commodities remain stockpiled and ready to flood the market. The massive one-day selling of gold out of China in July that pushed the commodity down to record lows was theorised to be some of these stockpiles being released onto the market.

If this move ushers in a new era where the CNY fixing is increasingly reflective of the spot market, it could be positive for its prospects being included in the IMF’s special drawing rights basket of currencies this year. However, the PBOC has explicitly come out and said that this is a one-off move, whether this means a one-off move of such magnitude or a one-off move of any further weakening in the currency remains to be seen.

The yen has strengthened 1.5% against the CNH in today’s trading and hit the Nikkei 225 hard (down 0.23%). Japanese companies are having an excellent earnings season with over 67% of companies beating expectations, and much of this has been driven by exporters benefiting from the weak yen. Japanese corporates will now suffer much tougher competition with the newfound yen strength against the CNY.

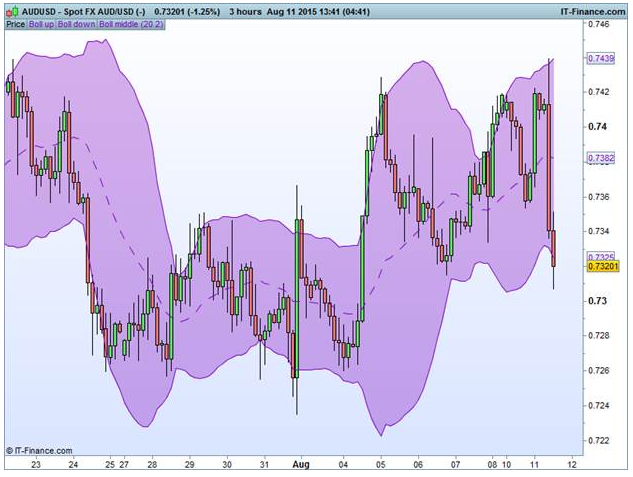

Strong US dollar buying has also seen major USD appreciation against the KRW, MYR and SGD. Assets priced in US dollars like gold and oil have also seen price declines. The Aussie has seen a 1.5% decline against the USD as well today, knocking it down well below the 0.7400 level.

The ASX has given up all of yesterday’s gains today down -0.53%, with the market unhappy with earnings reports from Cochlear (ASX:COH) and Domino’s Pizza (ASX:DMP). Cochlear came in below expectations on most earnings metrics, with slow growth not as strong as hoped out of the US and quite slow from EMEA, both accounting for 40% of sales, respectively. Given the stock was trading at a 35.2 P/E ratio, it was primed to move downward on any disappointment and its stock has declined 10.2%. The healthcare sector has been the biggest loser in Australia today driven by Cochlear, and no doubt there are nerves over how the market will react to star performer CSL’s earnings report tomorrow.

Domino’s, despite beating estimates on almost all metrics, saw its stock down -2.45% today. Domino’s was similarly tracking on a high P/E ratio of 64.38, and it was thought its guidance for only 20% net profit growth in FY16 after achieving 40% in FY15 turned off investors who perceived it as a high growth stock.

Banks were down 1.2% today, with Bendigo and Adelaide Bank (ASX:BEN) seeing a 5.6% decline, with the markets taking a bit to digest its earnings report from yesterday, but clearly concerned about APRA’s moves against the mortgage market. ASX:CBA has managed to stay in the green today, up 0.28%. This bodes well for its earnings report tomorrow, with the market pricing in an expected capital raise to shore up its CET1 ratio requirements; however, there is still plenty of opportunity for it to head downwards if there is a worse than expected bad and doubtful debts number from its resource sector exposure.

The surprise CNY fix has seen declines in Asian markets today, and we are looking for this negativity to lead the European markets down.