Despite heightened COVID-19 caseloads and hospitalizations in the U.S., growing inflationary concerns, and a decline in consumer confidence, the average equity fund posted a 2.00% return in August—the strongest one-month return since April 2021. Investors cheered a better-than-expected Q2 earnings season, along with improving economic reports during the month.

At time of writing, according to Refinitiv’s Proprietary Research team, of the 489 companies in the S&P 500 that have reported earnings to date for Q2 2021, 87.7% reported earnings above analyst estimates. This compares to a long-term average of 65.6% and the prior four-quarter average of 83.4%.

In addition, 87.1% of companies have reported Q2 2021 revenue above analyst expectations, which compares to a long-term average of 60.9% and an average over the past four quarters of 73.7%.

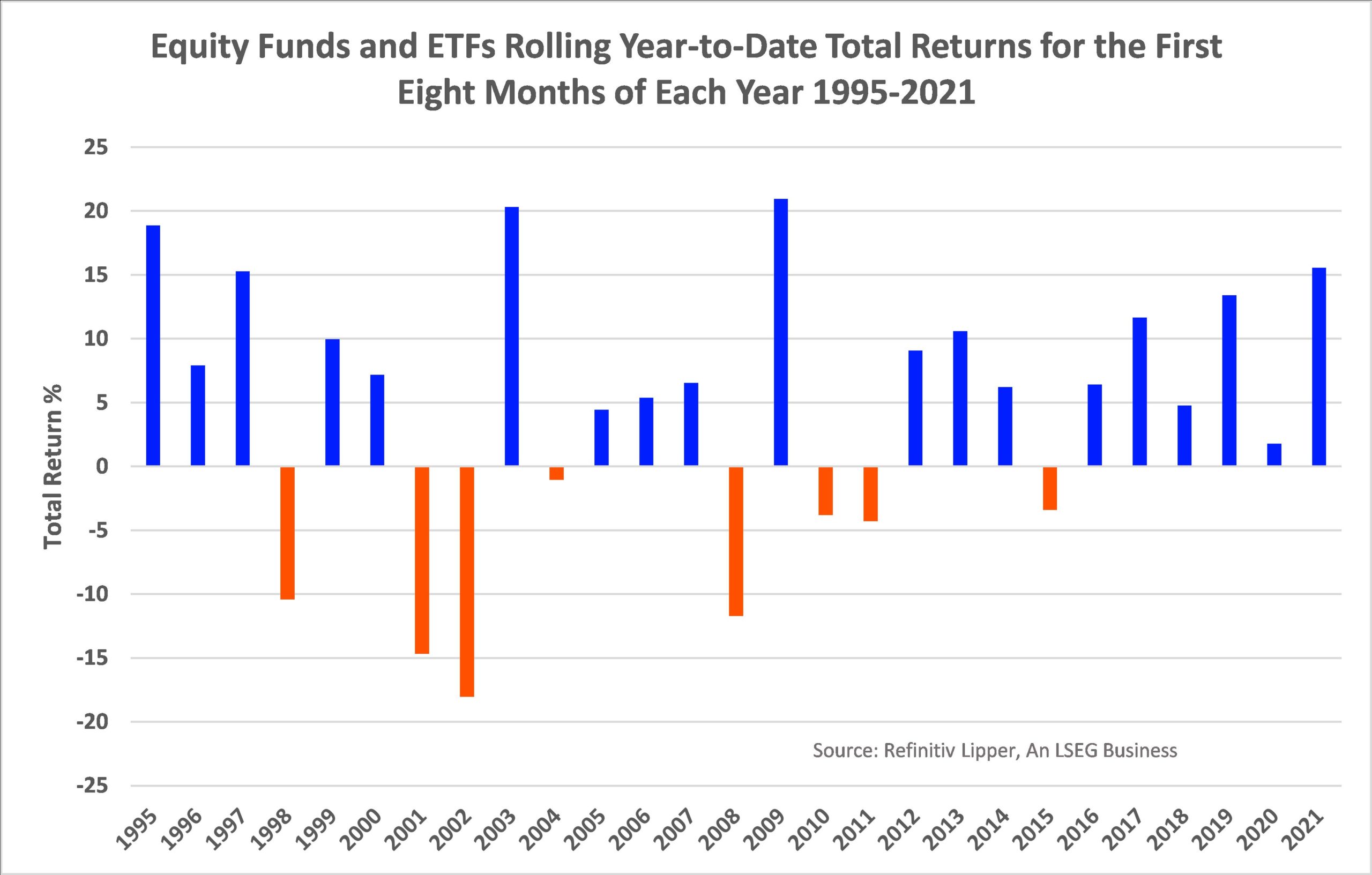

Equity funds managed to string together their eleventh consecutive month of plus-side returns in August, pushing the average equity fund (+15.55%) to its best year-to-date return, through Aug. 31 of any given year, since 2009 (+20.94%).

Monthly Returns

For August, Refintiv Lipper’s U.S. Diversified Equity (USDE) Funds (including ETFs) macro-group, posted the strongest returns (+2.37%) of the six broad-based equity macro-groups, followed by World Equity Funds (+2.08%), Sector Equity Funds (+1.96%), World Sector Equity Funds (+1.05%), Alternative Equity Funds (+0.22%), and Commodities Funds (-0.13%).

Despite some movement back to the stay-at-home and growth-oriented issues in August as concerns rose around a spike in COVID-19 cases, continued rotation into more cyclically-focused and out-of-favor issues contributed to India Region Funds (+7.86%), Frontier Markets Funds (+4.79%), Financial Services Funds (+4.61%), and Health/Biotechnology Funds (+3.54%) rise to the top of the leader board for the month.

As might be expected with some investors taking a more sanguine view of the economy in light of the previous nonfarm payroll reports improving, annualized gross domestic product growth rising to 6.6%, and Federal Reserve Chair Jerome Powell delivering what some pundits felt were dovish comments from the Federal Reserve Board’s Jackson Hole Economic Policy Symposium, contrarian and some traditionally defensive issues fell out of favor—Precious Metals Equity Funds (-5.50%) posted the largest equity-related declines for August, bettered by Dedicated Short Bias Funds (-3.58%) and Commodities Precious Metals Funds (-2.39%).

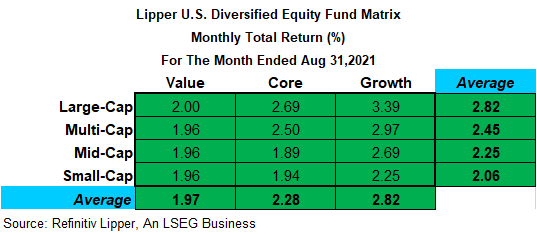

That said, growth-oriented USDE funds (+2.82%) outpaced their core- (+2.28%) and value-oriented (+1.97%) brethren in August. Large-cap funds (+2.82%) outperformed the other capitalization groups, with small-cap funds (+2.06%) being the relative laggard.

Fund Flows

Lipper’s preliminary August 2021 fund-flows numbers showed mutual fund investors were net purchasers of fund assets for the month, injecting an estimated $12.3 billion into the conventional funds business (excluding ETFs). Investors were net sellers of conventional equity funds for the fifth consecutive month (-$10.1 billion), shunning domestic equity funds (-$19.9 billion) while warming to nondomestic equity funds (+$9.9 billion).

But for the 17th consecutive month, investors were net purchasers of taxable bond funds (+$14.2 billion). Municipal bond funds, for the 16th month in a row, witnessed net inflows, taking in $7.2 billion. And for the first month in three, investors were net purchasers of money market funds (+$984 million).

ETF investors (authorized participants [APs]) were net purchasers for August (+$75.2 billion), injecting $57.5 billion into equity ETFs (their 15th consecutive month of net inflows), $16.5 billion into taxable fixed income ETFs, and $1.3 billion into municipal debt ETFs. On the equity side, APs appeared to prefer domestic equity ETFs (+$47.2 billion) over their nondomestic counterparts (+$10.3 billion).

For August, the largest attractor of investors’ assets was SPDR® S&P 500 (NYSE:SPY, +$5.0 billion), followed by Vanguard S&P 500 ETF (NYSE:VOO, +$4.6 billion), Vanguard Total Stock Market Index ETF Shares (NYSE:VTI, +$4.2 billion), and Invesco QQQ Trust (NASDAQ:QQQ, +$4.2 billion).