This week is set to be a big week for US equity markets, not because of earnings for a change, but instead because of the Federal Open Market Committee (FOMC) meeting in Washington D.C. It's where the head of the Federal Reserve, Janet Yellen, is set to give her usual update on the economy to Congress, as well as the direction that the Fed is intending to take in the coming months in regards to monetary policy.

Analysts and traders sit there salivating over each word and trying to make sense of just the general tone of the Fed, like it's some sort of financial code for the markets. Many come up with interesting suggestions of what they are really saying based on key words. But for the most part, FOMC is just that, an update on the economy with no hidden meanings behind it. Direction is generally clear and when the Fed has something to say they make sure it’s heard.

What is a little surprising as of late is all of the bearish talk in the markets about a rate hike, which in theory will lead to a pullback on the charts. I’m not going to say that I am against market sentiment as it’s generally self-fulfilling, and the market has so far reacted in a bearish manner when rate hikes are bought up. But when looking at the long term picture, you have to ask a few basic economic questions about rate hikes.

The Chart below shows the S&P 500 (yellow line) compared to the Federal Funds Target Rate (blue line); what is clear here is that the interest rate hikes have not led to massive periods of selling off. In fact, what we see is that rate hikes generally are the start of bull markets in the long run. The reason for this is that rate hikes are brought into effect in an effort to put the brakes on an overheating economy. Good economic data is a sign that the economy is picking up so the stock market looks to be a good indicator of the economy taking off, yet we are currently sitting with one of the longest and most aggressive bull runs in history.

So with rate cuts we actually saw sharp selling in the market. The reason for this is that the Fed is reactionary rather than proactive. So in this case the market hits turbulence and starts to sink and the Fed slashes rates in order to soften the blow for investors and consumers.

Will there be a selloff in the market? Most certainly there will be as the Fed talks up the prospect of rate hikes. As I said before, market sentiment is a powerful thing and something you just can’t ignore. But at the same time, the American economy is looking healthy and it’s not too unreasonable that after a pullback that we see a strong resumption of the bull market.

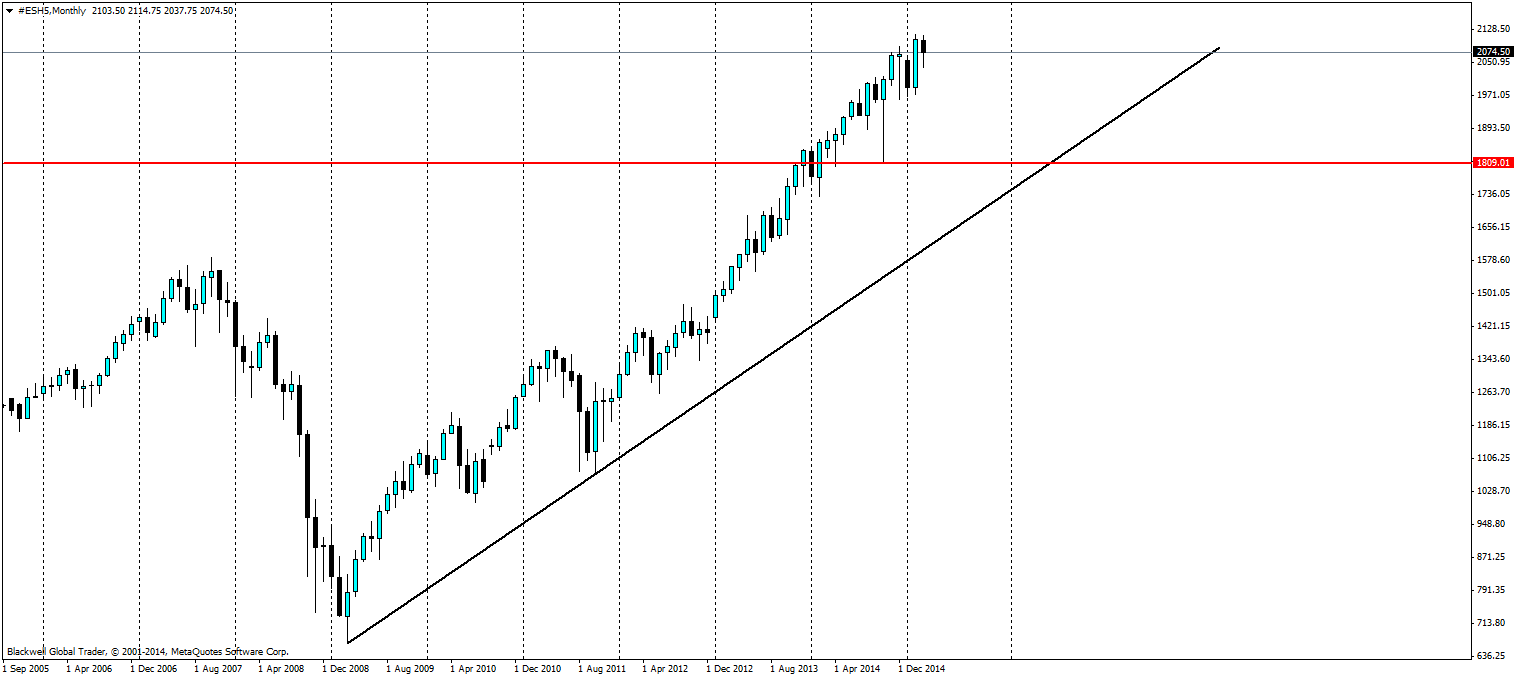

On the long term monthly chart, there is a line in the sand that I like to use for reference. This trend line is likely to be the telling point for the markets and if a real bearish market comes into play. I believe that a breakthrough of this trend line would be a very bearish signal, but to get here we would need to lose 200-300 points from the current price. This is possible on a corrective pullback, but the market will dig its heels in here if the American economy is still pushing along strongly.

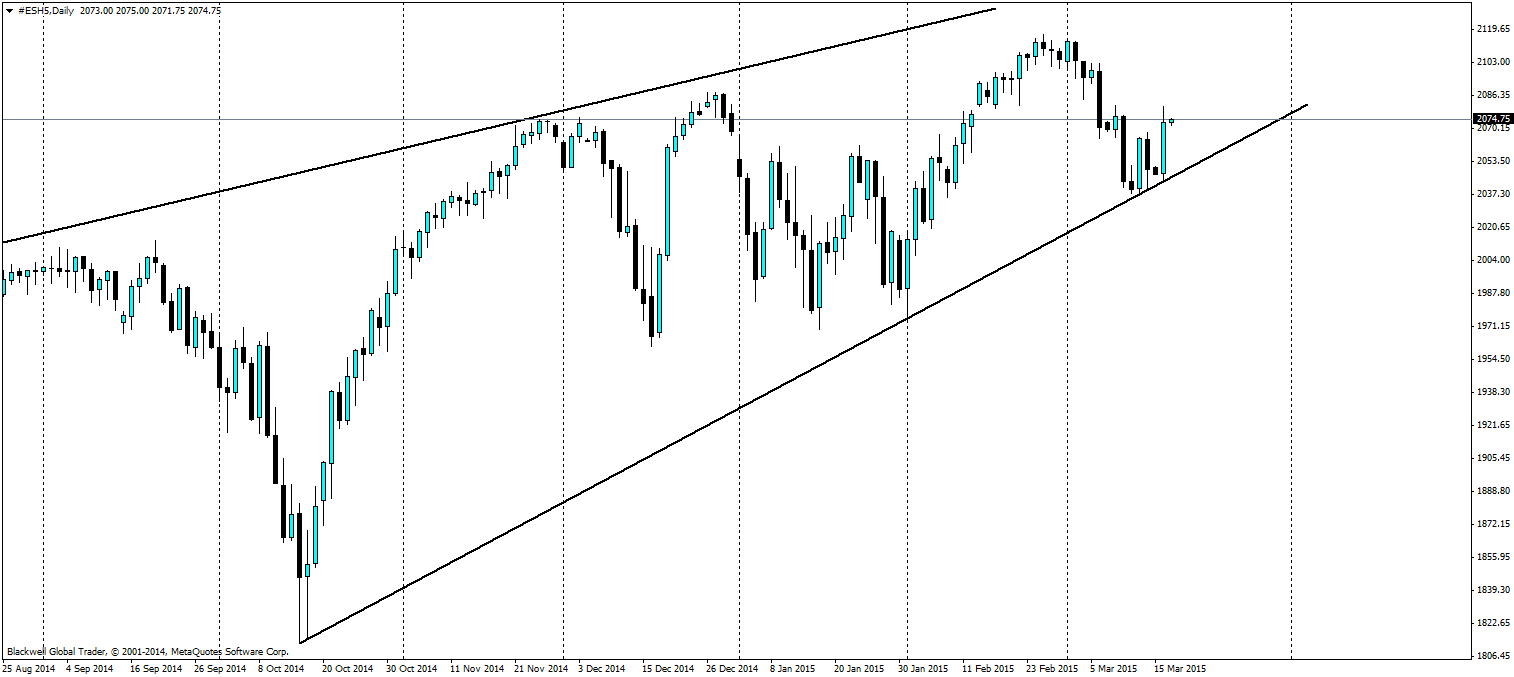

Shorter time frames (daily – I know it’s not that short) have so far shown that the trend lines are something to be obeyed and currently the market has made good use of the short term one on the daily as it plays off it in the lead up to FOMC.

While people are talking up the rate hike by Yellen it's also worth noting current interest rates in America. The current inflation rate is at -0.1. No central banker is going to lift rates until they see inflation push back up near the 2% range y/y, and at present that inflation figure has looked a little far off with the massive drop in energy prices (oilspecifically). I feel that a rate hike is coming this year (June – July), but not until the oil market bottoms out and we see prices pushing higher helping to boost inflation instead of having the current deflationary effect that we are seeing at present.

But long term, be aware of the US equity markets and the effects it will have, but also be aware of the long term historical movements in line with rate hikes, which do show that you can happily have a bull market at the same time. While some money may move into fixed interest, it will essentially be a redistribution and long term the market will continue to push higher if the American economy is booming.