Market sentiment improved drastically during the Asian session today, following comments by Dallas Fed president Robert Kaplan, who said that he does not expect interest rates to rise until next year. In the FX world, the pound was one of the main gainers among the G10 currencies, with its traders perhaps locking their gaze on tomorrow’s UK inflation numbers.

Overnight Comments By Fed's Kaplan Lift Market Sentiment

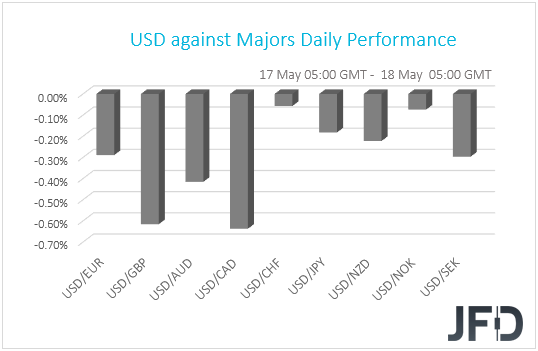

The US dollar was found lower against all the other G10 currencies in the early European morning Tuesday. It underperformed the most versus CAD, GBP, and AUD, while it lost the least against CHF and NOK.

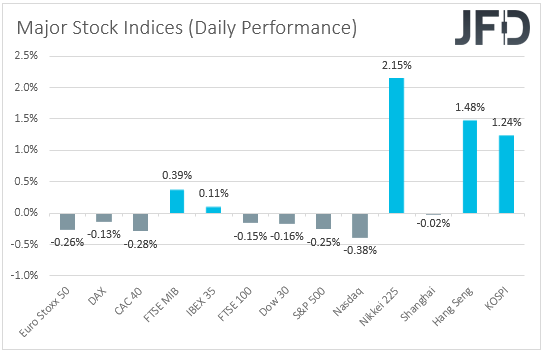

The weakening of the US dollar and the strengthening of the commodity-linked Loonie and Aussie suggest that markets traded in a risk-off fashion yesterday and today in Asia. However, looking at the performance in the equity world, we see that EU indices were mixed, while all three of Wall Street’s main indices finished lower, with NASDAQ losing the most ground. Market sentiment improved only during the Asian session today.

Yesterday, investors stayed reluctant to add to their risk exposure, perhaps as the Empire State manufacturing survey showed that prices paid rose to a record, with the respective index hitting 83.5, the highest since the data series began in 2001. Following last week’s largest-than-expected surge in both the headline and core US CPIs for April, this may have added to speculation that the Fed may indeed need to consider withdrawing some policy support soon.

However, overnight, Dallas Fed President Robert Kaplan said that he does not expect interest rates to rise until next year, reassuring markets that he and his colleagues will not tighten early. With that in mind, today, investors may pay extra attention to remarks by Atlanta Fed President Raphael Bostic. Just after the CPIs surprised to the upside last week, Bostic appeared a bit skeptical, noting that it’s too soon to judge whether the inflation trend is worrisome, avoiding to say confidently that the surge is due to transitory factors. Thus, it remains to be seen whether he will reiterate that view, or whether he will also appear reassuring that it is not the time to start discussing policy normalization yet.

Taking all this into account, we stick to our guns that where financial markets may be headed next is likely to depend on what other Fed officials have to say moving forward. If more of them appear a bit skeptical following last week’s inflation data, the stock market is likely to pull back again, while the US dollar may rebound. On the other hand, if the consensus among them is still that the inflation spike will prove to be temporary and that it is still too early to start discussing withdrawing policy support, risk appetite is likely to improve. Equities and other risk-linked assets are likely to edge further north, while the US dollar and other safe-havens are likely to come under renewed selling interest.

Overnight, we also got the minutes from the latest RBA policy gathering, with the report confirming officials’ concerns over inflation. According to the minutes, officials believe that wages would need to expand “sustainably above 3%” to generate inflation. With wage growth currently running at just +1.4% yoy, and expected to stay there tonight, when the data for Q1 is due out, this underscores how long interest rates could remain near zero, and that the chances for more bond purchases at the July meeting are very high.

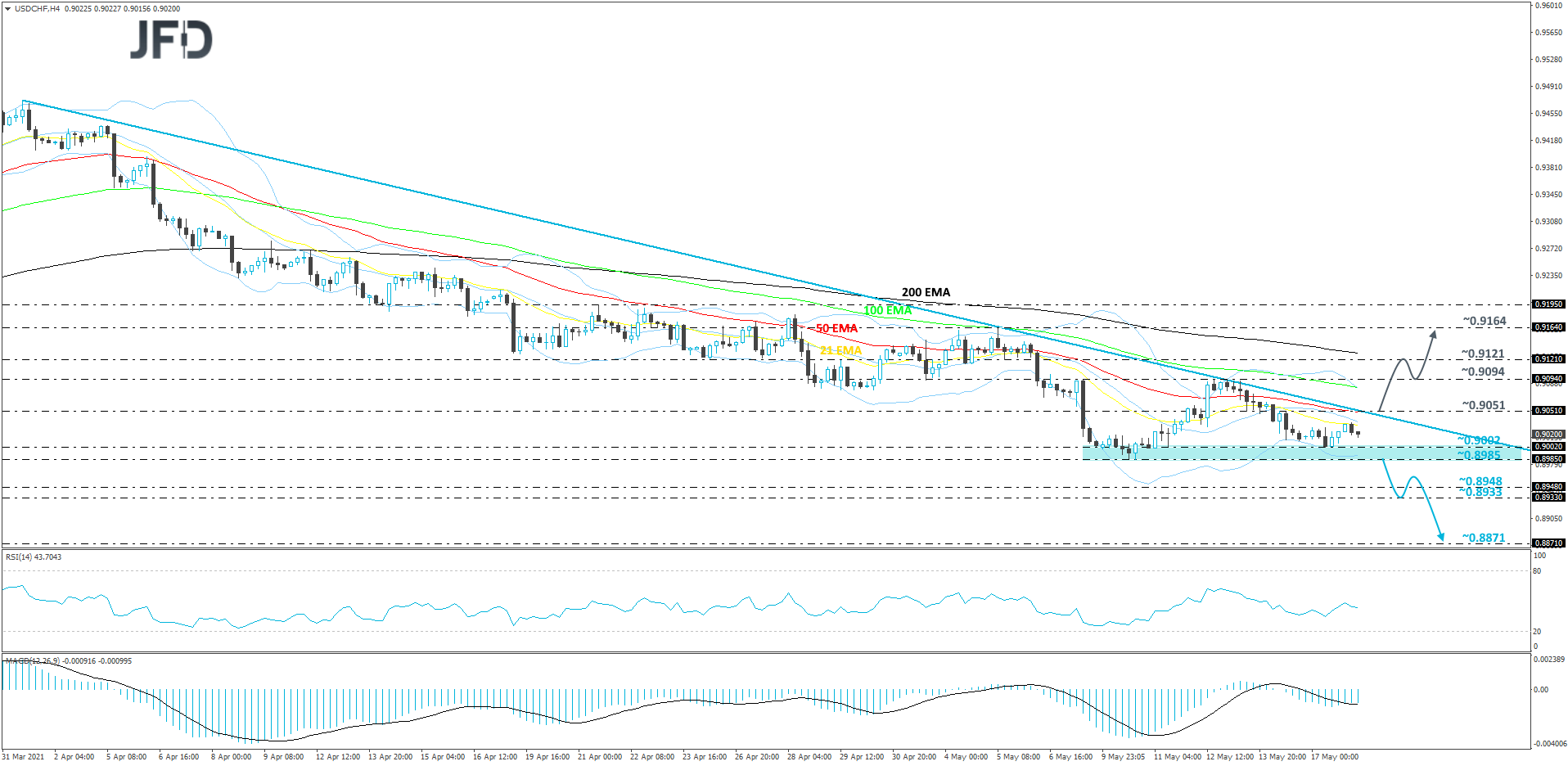

USD/CHF Technical Outlook

USD/CHF continues to trade below a short-term downside resistance line taken from the high of Apr. 1. However, the pair remains above its support area between the 0.8985 and 0.9002 levels, marked by the lows of May 10 and 17. To aim lower, we would need to see a break below that support. Until then, we will take a cautiously-bearish approach.

A drop below the 0.8985 hurdle would confirm a forthcoming lower low, potentially opening the path for a move further south. USD/CHF could then drift towards the 0.8948 and 0.8933 levels, marked by the lows of Feb. 19 and 23 respectively, where the pair might stall for a bit. That said, if the sellers are still in control, they may send the rate further down, possibly targeting the 0.8871 level, marked by the lowest point of February.

On the other hand, if the aforementioned downside line gets broken and the rate pushes through the 0.9051 barrier, marked by an intraday swing high of May 14, this might spook the bears from the field for a bit, allowing more bulls to run in. GBP/NZD may then travel to the 0.9094 obstacle, or to the 0.9121 hurdle, marked by the inside swing low of May 5. If the buying does not stop there, the next possible target could be at 0.9164, marked by the highest point of May.

GBP Traders Await Tomorrow's Data

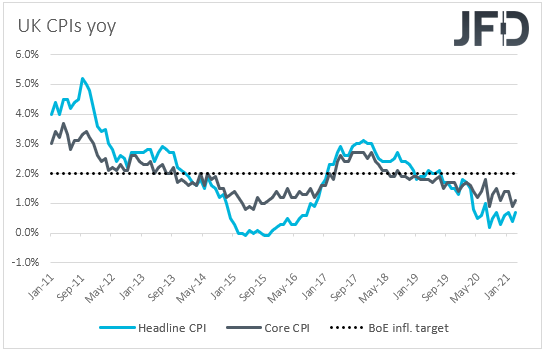

The British pound was the second winner in line among the G10s, with its traders now locking their gaze on tomorrow’s CPI data, due out during the early European morning. The headline rate is forecast to have doubled, to +1.4% yoy from +0.7%, while the core one is anticipated to have ticked up to +1.2% yoy from +1.1%.

At its prior meeting, the BoE decided to scale back the pace of its bond purchases, although it added that monetary policy remains accommodative. Despite officials noting that any spike in inflation is likely to prove to be temporary, combined with last week’s better than expected GDP, IP and MP data, this may add more credence to the Bank’s decision and may help the pound gain further, especially if Friday’s retail sales for April are also on the decent side.

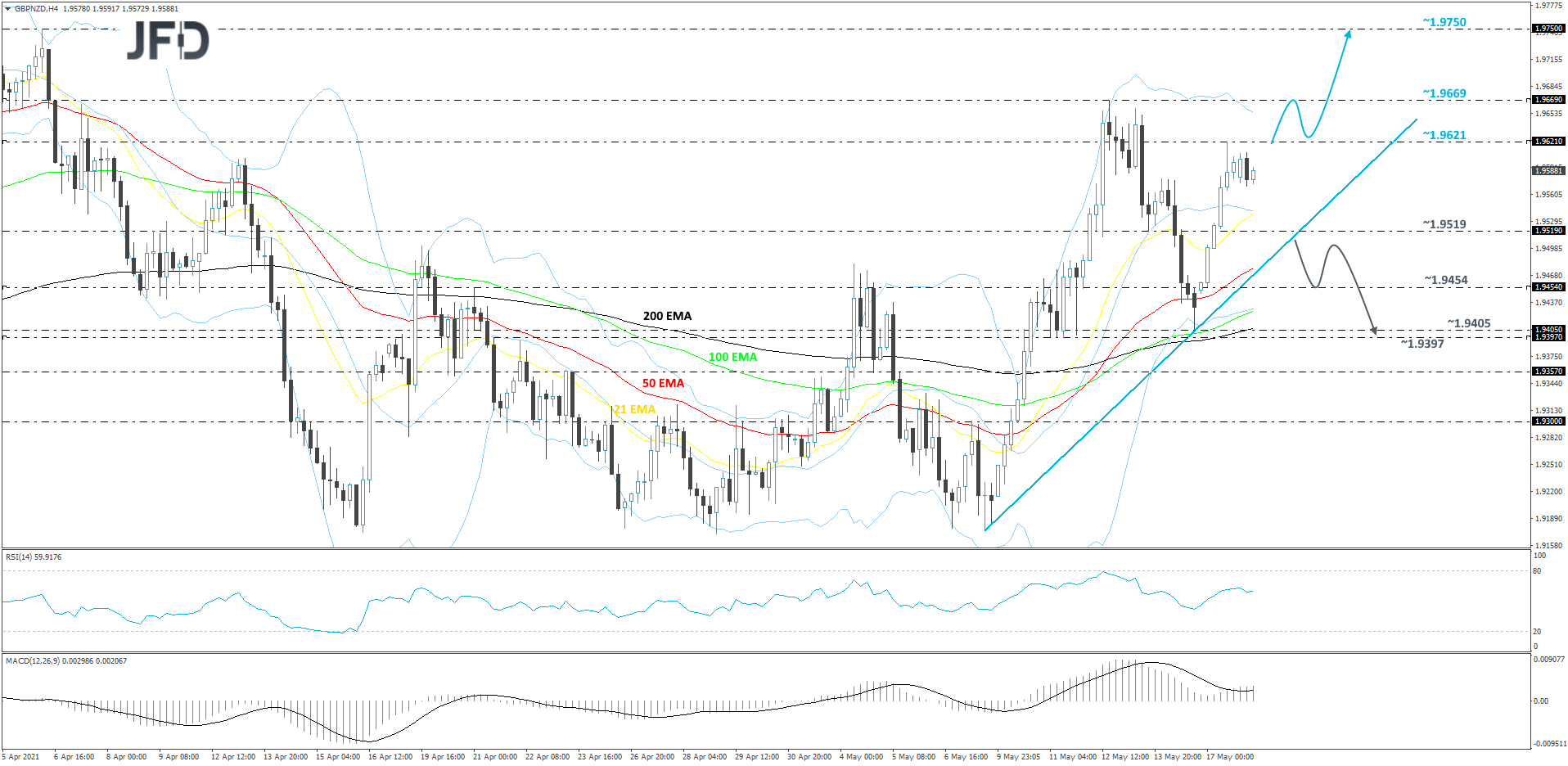

GBP/NZD Technical Outlook

After Friday’s reversal, GBP/NZD made its way higher again and the rate is now trading above a short-term tentative upside support line taken from the low of May 7. It looks like the pair is on track towards reaching the current highest point of May, at 1.9669. But before it could do that, GBP/NZD would have to overcome yesterday’s high first. For now, we will take a somewhat positive approach.

If, eventually, the rate gets lifted above the 1.9621 barrier, this may attract a few extra buyers into the game. The pair might then drift to the current high of May, at 1.9669, where a temporary hold-up could occur. However, if the bulls are still feeling comfortable, they may push GBP/NZD further north, potentially clearing the way to the 1.9750 level, marked by the highest point of April.

Alternatively, if the aforementioned upside support line breaks, this may result in a change of the direction of the short-term trend, possibly leading towards lower areas. GBP/NZD could fall to the 1.9454 obstacle, a break of which might open the way to the next potential support area between the 1.9397 and 1.9405 levels, marked by the lows of May 11 and 14 respectively.

As For Today's Events

During the European session, we get Eurozone’s second GDP estimate for Q1, which is expected to confirm the initial print of -0.6% qoq, as well as the bloc’s employment change for the quarter, for which no forecast is currently available.

Later in the day, from the US, we have the building permits and housing starts, both for April. Building permits are expected to have increases somewhat, but housing starts are forecast to have slightly declined.

As for the speakers, apart from Atlanta Fed President Raphael Bostic, we will also get to hear from SNB President Thomas Jordan.