Market Brief

EUR crosses traded mostly sideways ahead of today’s ECB meeting. Traders were reluctant to take risky positions before Mario Draghi’s speech and the release of fresh growth and inflation projections. We do not expect the ECB to rush to increase its quantitative program. However, the central bank should extend its program beyond March 2017 to around September, giving it more time to better assess the consequences of the Brexit vote, especially now that the UK seems to have done fine so far. EUR/USD treaded water between 1.1235 and 1.1258 in Tokyo. On the medium-term, the single currency continues to trade within its uptrend channel as the US dollar remains unable to take off amid fading rate hike expectations. The euro edged slightly higher against the Japanese yen, with EUR/JPY trading at around 114.35.

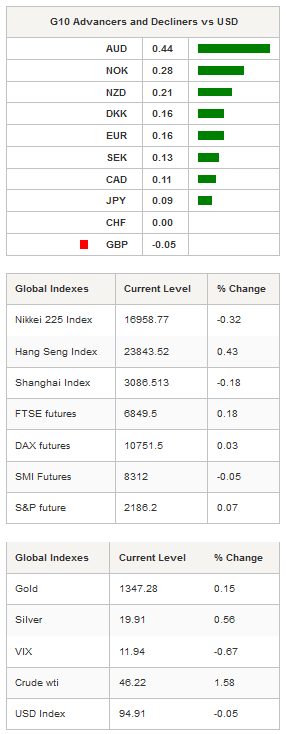

During the Asian session, investors stayed away from equities but pushed the yellow slightly higher. With the exception of Hong Kong’s Hang Seng, Asian regional markets were mostly trending in negative territory. Gold rose 0.15% to $2,186.20 and was unable to escape its long-term downward channel to the upside. Japanese shares were down 0.32% as the yen consolidated yesterday’s gains. In spite of better-than-expected GDP figure for the second quarter, USD/JPY traded range-bound in Tokyo and moved between 101.41 and 101.92. The Japanese economy grew 0.2%q/q in the June quarter, beating median forecasts and first estimates of 0.0%. However, we don’t think that this changes anything for the BoJ as inflation remains anemic and the growth outlook weak.

Commodity currencies surged further as the chase for yields continues. After surging 2.35% since August 31th, AUD/USD rose another 0.45% on Thursday hitting 0.7713 in Sydney. The Norwegian krone found solid buying interest as crude oil prices continued to rally. USD/NOK fell 0.25% to 8.1590, while the Brent crude rose 1.80% to $48.85 a barrel.

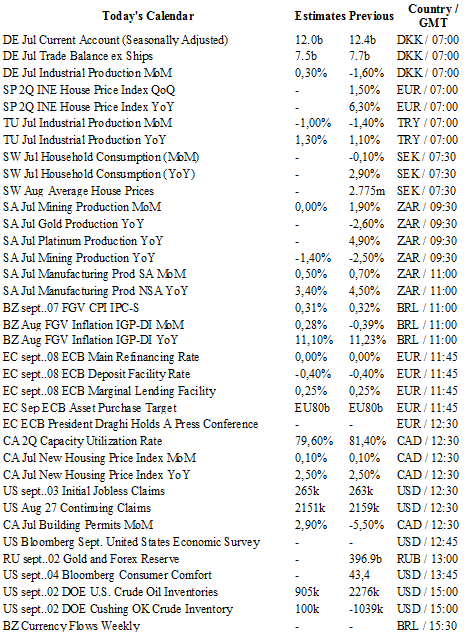

Today traders will be watching manufacturing production from South Africa; inflation report from Brazil; ECB interest rate decision and press conference; initial jobless claims and crude oil inventories from the US.

Currency Tech

EUR/USD

R 2: 1.1616

R 1: 1.1428

CURRENT: 1.1258

S 1: 1.1046

S 2: 1.0913

GBP/USD

R 2: 1.5018

R 1: 1.3534

CURRENT: 1.3343

S 1: 1.3024

S 2: 1.2851

USD/JPY

R 2: 107.90

R 1: 104.32

CURRENT: 101.63

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 0.9956

R 1: 0.9885

CURRENT: 0.9698

S 1: 0.9522

S 2: 0.9444