- Mixed movements in equities as markets prepare for CPI

- Strong possibility for a downside surprise in inflation

- US presidential debate dominates headlines

- Bitcoin suffers while gold and yen rally

Stocks Are in Anticipation Mode

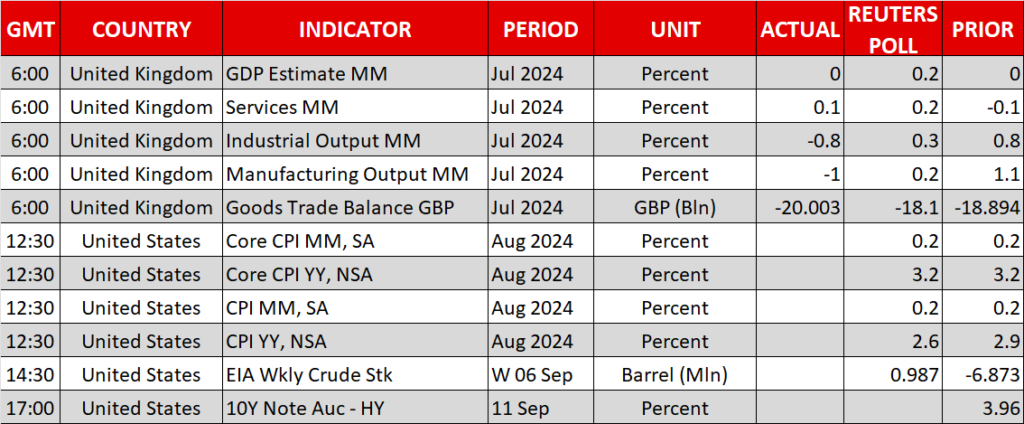

US equity indices were mixed yesterday with the Nasdaq 100 index recording another green day and the Dow Jones mimicking the European stock indices’ negative performance. Market participants are most likely preparing for a period that includes key market events, like next week’s Fed meeting, starting today with the US inflation report and continuing tomorrow with the ECB rate setting meeting.

At 12:30 GMT the August CPI report will be published. Economists are forecasting a slowdown in the headline figure to 2.6% from 2.9% recorded in July, which, if confirmed, will be the lowest annual growth rate since April 2021. The core indicator, which excludes food and energy prices, is expected to show another 3.2% yearly increase and hence confirm its recent stickiness.

However, there is a sizeable risk of a downside surprise in the headline CPI figure due to oil’s performance. In 2023, oil prices increased by 2.3% on a monthly basis but dropped by 7% last month. This means that headline inflation could ease even more aggressively, opening further the gap from the core indicator and hence complicating somewhat next week’s discussion at the Fed meeting.

Presidential Debate Is Over, Questionable Market Impact

The first presidential debate between Trump and Harris took place on Tuesday with both sides claiming victory. Trump focused on immigration and the weak fiscal stance of the Biden administration while Harris highlighted Trump’s criminal record and his chaotic style of management.

It was an arguably better performance from the Democratic party candidate compared to Biden’s June disastrous appearance, which could explain Harris' request for another debate ahead of the November election.

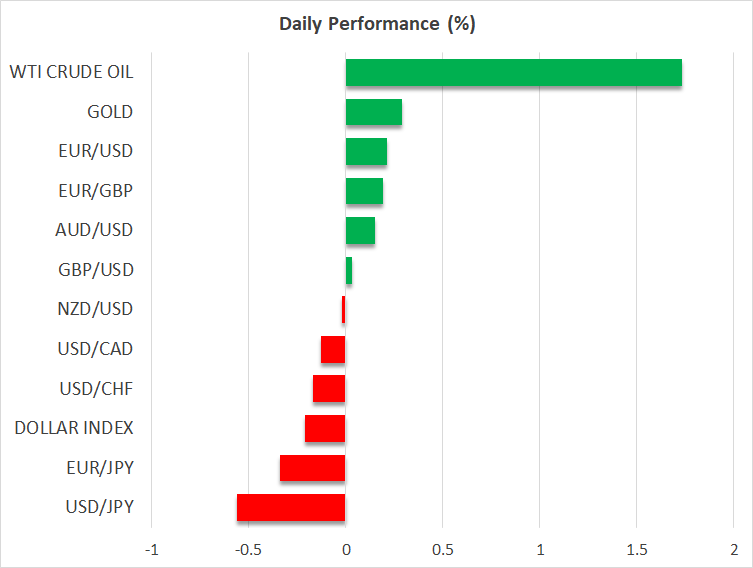

There are some early indications that the debate drew more viewers than the 51m that tuned in the Trump-Biden discussion, which makes sense considering the hype made when Harris became the official Democratic presidential candidate, and the fact that the presidential election is less than 60 days away. Marketwise, the impact seems to be limited with bitcoin and gold going in opposite directions.

Bitcoin Drops, Gold Rallies

Cryptocurrencies are under pressure again with bitcoin being in the red again today after four green sessions. The king of cryptos is still around 33% higher in 2024 with September, similar to US equities, being a traditionally weak performance month. The opposite appears to be happening in gold where September is perceived as one of the stronger seasonal months. As such, gold is edging higher again towards the all-time high of $2,532.

Yen on the Move, Pound on the Back Foot

Japanese Yen crosses are in the red again today as the yen is most likely benefiting from BoJ member Nakagawa’s comments that the Bank of Japan will continue to raise interest rates if inflation moves in line with its forecast. This remark comes after reports on Tuesday that BoJ officials see little need to raise interest rates next week, and the market pricing in only 8bps of additional tightening in 2024.

Finally, the positive run of UK data ended abruptly today with both the July GDP print and production data disappointing. Chances of another 25bps rate cut on September 19 remain low but next week’s CPI inflation could prove decisive.