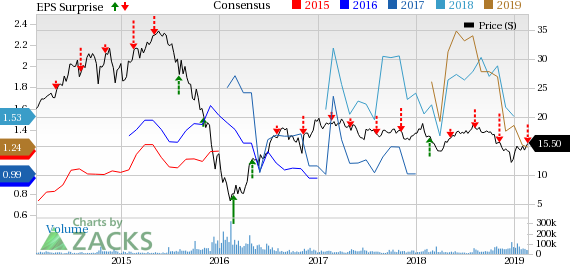

Energy Transfer LP (NYSE:ET) delivered fourth-quarter 2018 earnings of 26 cents per unit, which lagged the Zacks Consensus Estimate of 33 cents by 21.21%. However, earnings improved from the year-ago quarter’s tally of 22 cents by 18.2%.

In 2018, Energy Transfer reported earnings of $1.15 per unit, up from 83 cents in 2017.

Total Revenues

In the quarter under review, Energy Transfer’s total revenues amounted to $13,573 million, which lagged the Zacks Consensus Estimate of $14,845 million by 8.5%. However, total revenues were up 18.5% from the year-ago quarter’s figure of $11,451 million.

In 2018, the partnership generated revenues of $54,087 million, up from $40,523 million in 2017.

Operational highlights

Total costs and expenses amounted to $12,154 million, up 8.8% from $11,161 million in the year-ago quarter. The increase can be primarily attributed to higher cost of products sold.

Operating income came in at $1,419 million in the fourth quarter, up 389.3% from the year-ago quarter’s figure of $290 million.

Total interest expenses increased 12.8% to $544 million from $482 million in the year-ago quarter.

Financial Condition

As of Dec 31, 2018, Energy Transfer had current assets of $6,750 million, down from the 2017-end level of $10,683 million.

On Dec 31, 2018, the company had long-term debt (excluding current maturities) of $43,373 million, down from $43,671 million at the end of 2017.

Other Releases

Murphy Oil Corporation (NYSE:MUR) delivered fourth-quarter 2018 adjusted earnings of 31 cents per share, which beat the Zacks Consensus Estimate of 26 cents by 19.2%.

CNX Resources Corporation (NYSE:CNX) delivered adjusted earnings of 67 cents per share in fourth-quarter 2018, which surpassed the Zacks Consensus Estimate of 28 cents by 139.3%.

Anadarko Petroleum Corporation’s (NYSE:APC) fourth-quarter 2018 adjusted earnings of 38 cents per share missed the Zacks Consensus Estimate of 57 cents by 33.33%.

Zacks Rank

Energy Transfer currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

CNX Resources Corporation. (CNX): Free Stock Analysis Report

Anadarko Petroleum Corporation (APC): Free Stock Analysis Report

Murphy Oil Corporation (MUR): Free Stock Analysis Report

Energy Transfer LP (ET): Free Stock Analysis Report

Original post

Zacks Investment Research