Investing.com’s stocks of the week

I’ve got to tell you, I’m frustrated. You know how bearish I’ve been about crude oil. Day after day, this has been an incredibly consistent market. I'd give anything for the S&P 500 chart to look anything like crude's. The equivalent percentage drop in the Dow 30 would be about 4,100 points -- just to give you some perspective. And that’s only since June 9!

But energy stocks are just barely moving along. They’re down a little bit, sure, but why are they acting so strong? And what’s worse, when crude inevitably does get a bid, will energy stocks simply explode higher? It’s driving me absolutely nuts.

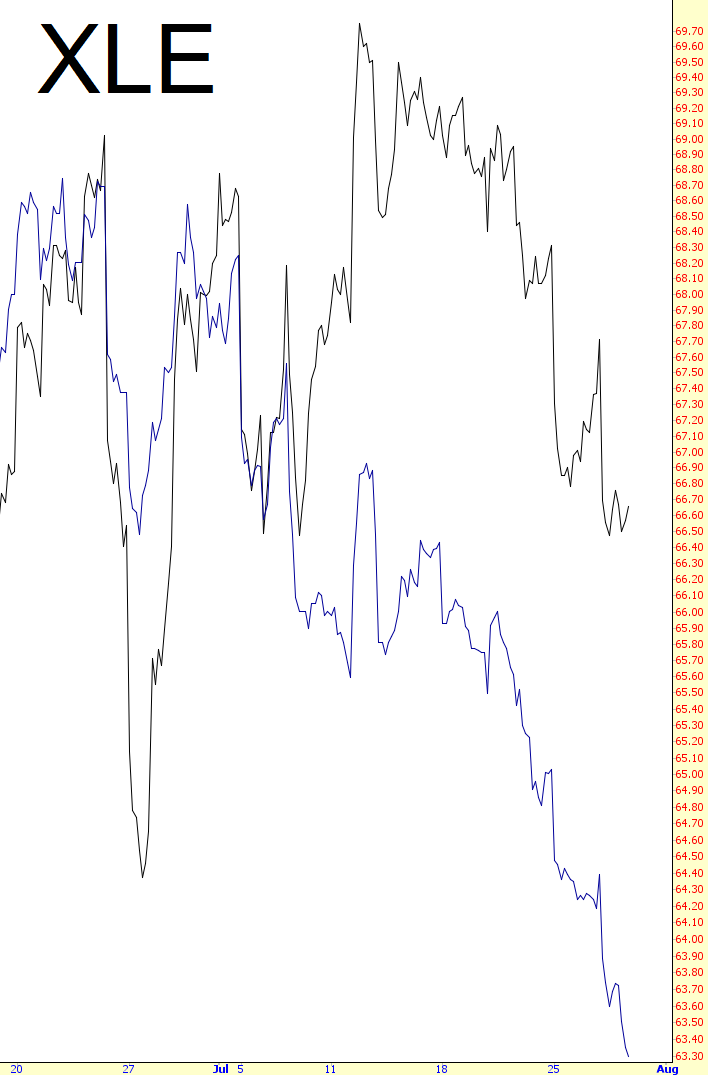

Look at how the energy-sector ETF compares to oil. A bit of a divergence, wouldn’t you agree?

Even worse, oil and gas explorer XOP is actually UP by half a percent.