We are watching oversold crude oil prices building a bottom

Source: Short Side of Long

It is not easy to stick your neck out and make a major call on an asset class, but we here at Short Side of Long have done it in the stock market on 25th of August. About a week after that call, we also gave readers a heads up as to why we think commodities are finally close to forming an important low. Finally, just before the month of October started, we discussed the potential for a precious metals rally, anticipating a falling probability of FOMC hiking rates in 2015.

One of the major stock purchases we made in both late August as well as late September were the beaten down energy stocks (sector via Energy Select Sector SPDR (NYSE:XLE)). We jumped at great value and very high dividend yields in individual names such as ConocoPhillips (NYSE:COP) and Chevron (NYSE:CVX) amongst others, as well as the overall Oil & Gas sector (SPDR S&P Oil & Gas Exploration & Production (NYSE:XOP)).

The reasoning behind this purchase is our view that Crude Oil has most likely bottomed, together with the fact that Energy stocks just suffered one of the worst bear markets and liquidation panics in two decades.

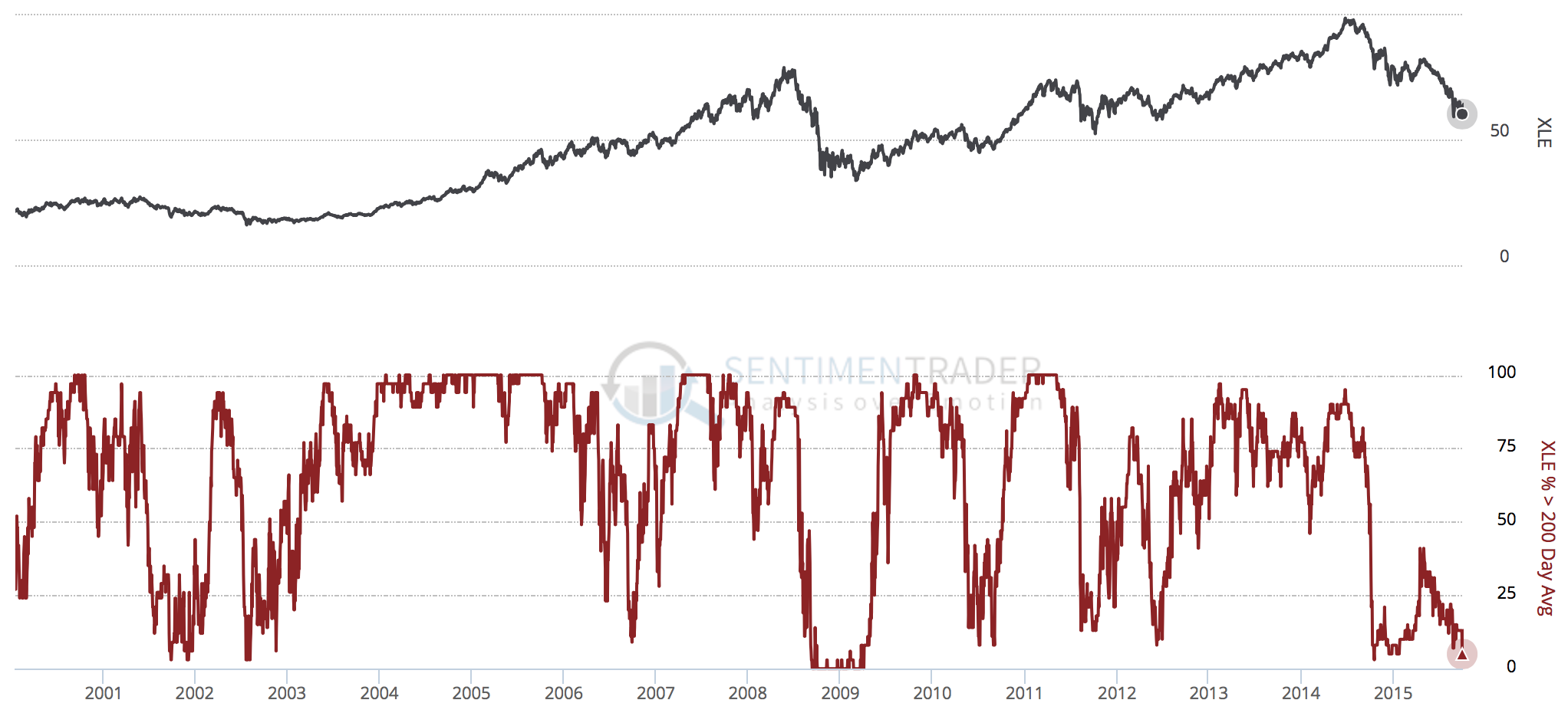

August panic in the energy stocks was 2nd worst in two decades

Source: SentimenTrader (edited by Short Side of Long)

The type of the liquidation we saw in crude oil throughout the 2014/15 period has certain similarities to other historical crashes from 1986 and 2008. Both of these are selling climaxes, and once the bottom is reached one should buy all one can. We finally see a change in supply and demand dynamics, with oil rig count rapidly declining in recent quarters, which almost guarantees a noteworthy fall in future supply. Furthermore, corporate insiders (smart money) have been busy buying energy stocks, while hedge funds and speculators (dumb money) are extremely bearish with worst sentiment reading in two decades.

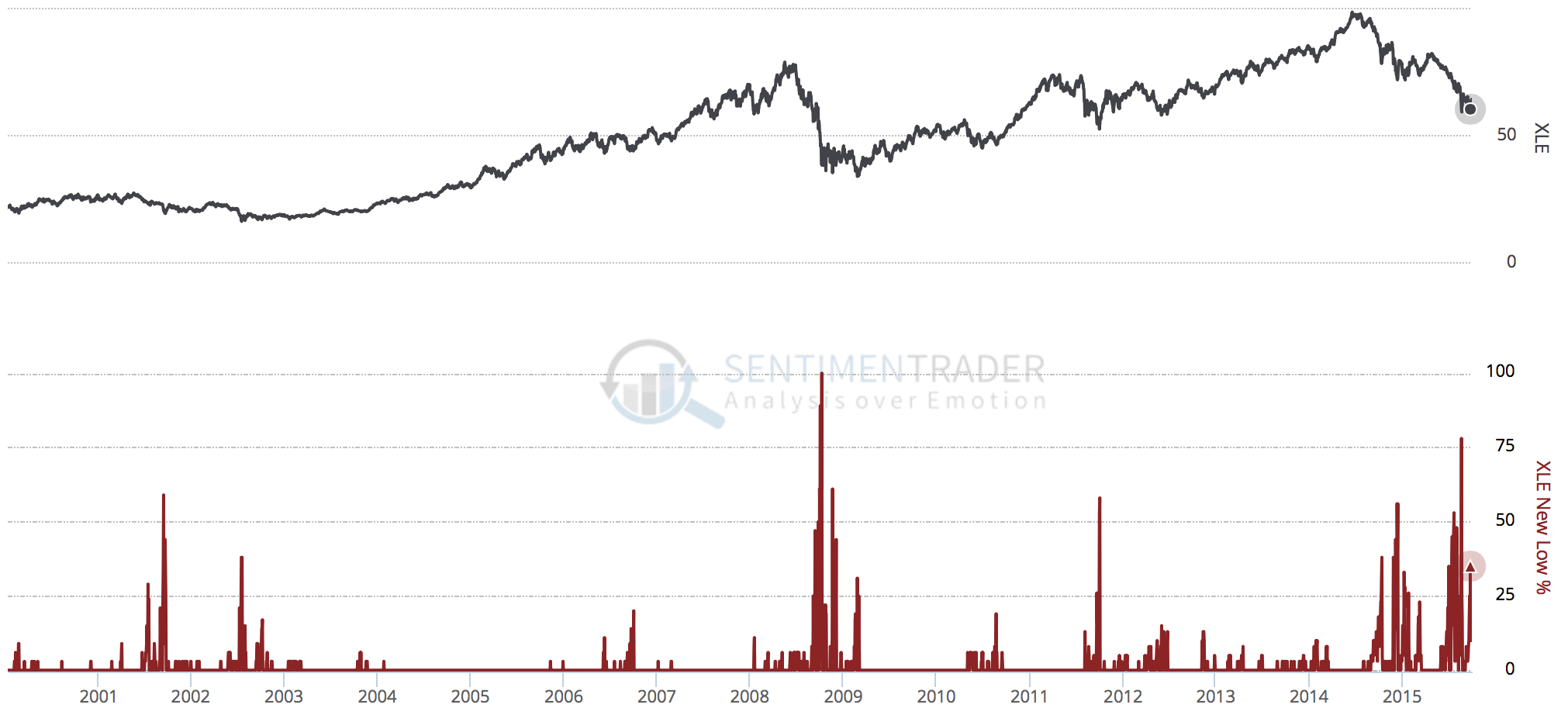

During the 25th of August, now also known as Black Monday, market participants reached a boiling point, as they completely dumped energy stocks. Percentage of components in the S&P Energy sector (NYSE: XLE) spiked over 75%, which was the second worst selling climax, only outdone by the Lehman panic of October 2008. Furthermore, percentage of energy components trading above the 200 day moving average has been depressed (oversold) for the longest stretch in almost two decades. We haven’t seen neutral readings (above 50%) in over 52 weeks, which shows just how incredible the selling pressure in this sector has been.

Energy sector has been in a strong bear market for over 14 months

Source: SentimenTrader (edited by Short Side of Long)

We believe capitulation has occurred, as the whole energy sector turns a corner. As Oil prices stabilise and start their road to a recovery, Oil & Gas earnings should finally start to improve while dramatic cost-cutting will make the overall sector more lean and competitive.

HT: Thanks to SentimenTrader for great charts, which we slightly edited for better presentation.