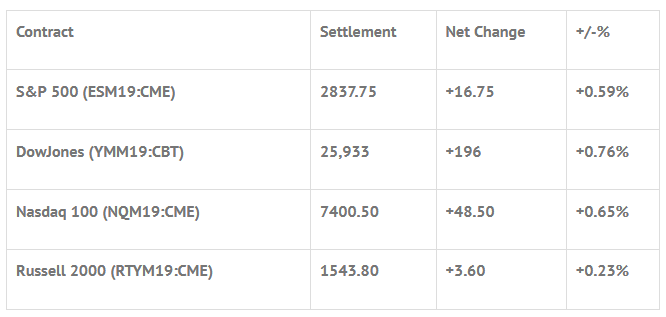

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia out of 11 markets closed er: Shanghai Comp %, Hang Seng %, Nikkei %

- In Europe 13 out of 13 markets are trading higher: CAC +0.68%, DAX +1.03%, FTSE +0.68%

- Fair Value: S&P +4.16, NASDAQ +24.37, Dow +7.63

- Total Volume: 1.47mil ESM & 231 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Retail Sales 8:30 AM ET, PMI Manufacturing Index 9:45 AM ET, Business Inventories 10:00 AM ET, ISM Mfg Index 10:00 AM ET, and Construction Spending 10:00 AM ET.

S&P 500 Futures: NHOTC #ES 2841 (New Highs On The Close)

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F Squeezed into a new session high against 2840. Intraday heavy with gap up, buyers having trouble expanding above opening high. Below 2830 opens door to test intraday pivots.

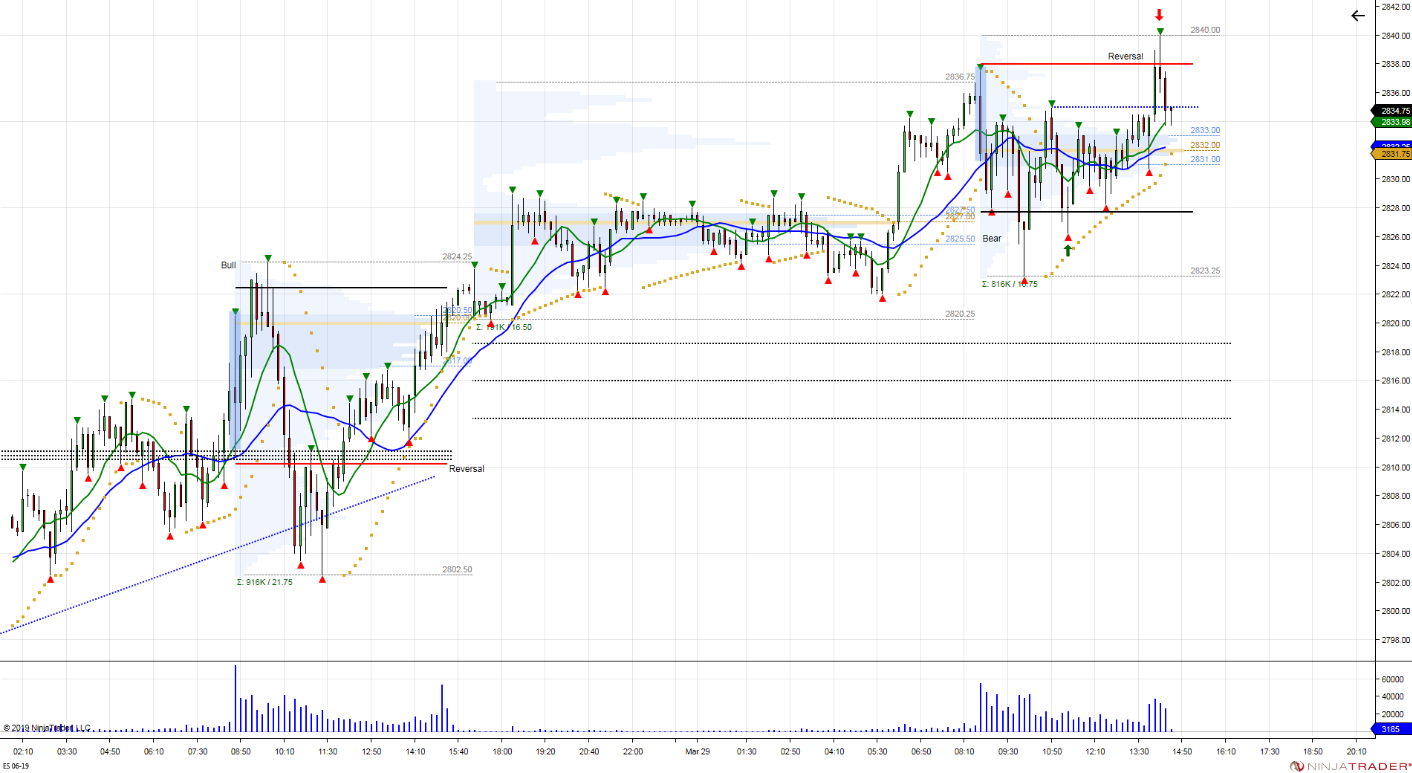

During Thursday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2836.75, a low of 2820.50, and opened Friday’s regular trading hours at 2835.75.

The ES was weak following the 8:30 CT bell, and opening sell imbalances forced prices down to an early RTH low at 2828.00. After a pullback up to 2834, the second leg of selling took the futures down to a new RTH low at 2823.25. From there, the ES began to consolidate for the rest of the morning, first trading back up to 2835.00, then down to 2826.25. This wound up being the range for the next few hours.

At 1:30, Larry Kudlow went on CNBC and said the fed should lower interest rates 50 basis points, and the ES rallied up to a new high at 2840.00. Going into the close the futures started trading back down. On the 2:45 cash imbalance reveal the ES traded 2835.75, then rallied on the end of quarter rebalance, making a new high at 2840.50, then printed 2838.00 on the 3:00 cash close, and settled the day just off the highs at 2839.75 on the 3:15 futures close.

In the end, the overall tone of the ES was firm all day. In terms of the days overall trade, total volume was above average for a Friday due to the end of the quarter rebalance, with 1.47 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.