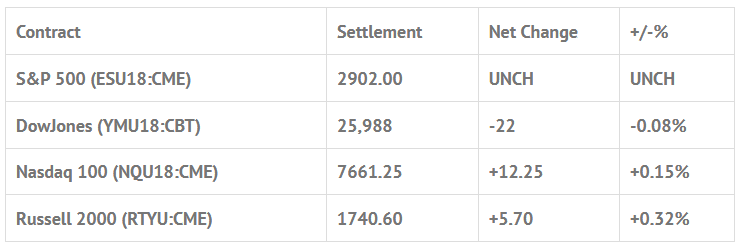

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed higher: Shanghai Comp +1.10%, Hang Seng +0.94%, Nikkei -0.05%

- In Europe 12 out of 13 markets are trading lower: CAC -1.41%, DAX -1.15%, FTSE -0.47%

- Fair Value: S&P +0.71, NASDAQ +5.03, Dow +14.92

- Total Volume: 1.30mil ESU & 826 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes PMI Manufacturing Index 9:45 AM ET, ISM Mfg Index 10:00 AM ET, and Construction Spending 10:00 AM ET.

S&P 500 Futures: ES Dip & Rip

After trading down to 2895.00 on Globex early Friday morning, the S&P 500 futures opened at the 2896.60 level on the 8:30 bell, rallied up to 2907.50 at 9:16 am, and then flunked down to a new low at 2893.00. From there, the ES rallied up to 2896.50, and then sold off to a new low at 2891.75 at 11:30. After the low the ES rallied up to 2897.75, sold off to a higher low at 2892.25 going into 1:30 CT, and then spent the rest of the day going up. The early MiM started to show over $400 million to buy, and ended up over $800 million buy, which saw the ES trading up to 2902.00 on the 3:15 futures close.

In the end it was all about the end of the month buying that pushed the ES back up late in the day. We have not seen too many back to back MOC buys recently, but we did on Thursday and Friday. In terms of the days overall trade 1.30 million ES contracts traded, which is pretty good for a end of the summer holiday weekend. In terms of the markets overall tone, we think it’s smart to be cautious. We suspect there will be a big pick up in the China tariff headlines this week.

Mondays Action : After settling at 2902.00 on Friday, the ES opened Sunday nights Globex session at 2906.50, made a low at 2902.50 and rallied up to 2912.50, 20.75 handles off Fridays 2891.75 low. Total volume over the holiday abbreviated session was 121,000 contracts.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.