The U.S. stock market has finally hit a speed bump after more than six years of a Fed- and QE-driven rally. The S&P 500 is up 232% since March of 2009, despite this unprecedented stimulus in the feeblest economic recovery in history.

But since late December 2014, U.S. stocks have gone nowhere, as investors face some growing realities.

GDP, retail sales, production and exports are slowing.

The dollar’s sharp rise in recent years has crushed global exports.

Long term interest rates are rising consistently… what I call the beginning of the end of stimulus policies designed to keep rates low forever.

Meanwhile, in just six months, Germany saw its key stock market, the DAX, rise nearly 50% from mid-October into early April.

Germany’s bubble has shot up 245% since March 2009 — greater than the U.S., despite its slower economy.

It won’t last!

As I’ve explained many times, starting last year, Germany has the worst demographic trends of any country in the world lasting through 2022. It’s even worse than Japan’s demographic cliff in the 1990s!

There’s one reason Germany has held up as well as it has in the last year: the euro.

When the euro falls, German exports soar. Between April 2014 and March 2015, the euro fell 25%. Its long-term peak was in July 2008 at 1.60 dollars. It hit 1.05 in March — 34.5% lower!

Consider that Germany exports 50% of its GDP. That’s one of the highest ratios in the world.

Hence, the falling euro gives it a huge advantage. But the euro has barely budged for three months…

That explains why the DAX has fallen 10% since early April, which is when I believe it reached its long-term peak. When the next great crash hits, it’s likely to take the DAX down to its early 2009 low, at least — a 72% crash likely by early 2017.

But if Germany looks bad, there’s nothing short of “terrible” to say about China. China’s stock market makes Germany’s late-stage bubble look pathetic!

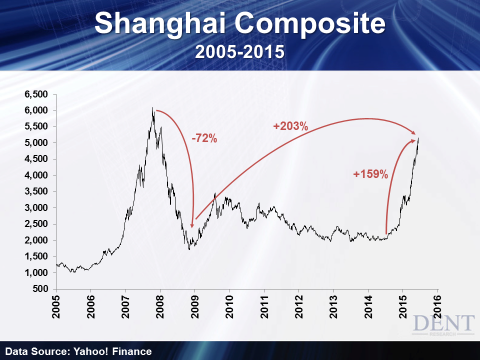

China saw the shortest and steepest bubble from early 2005 to late 2007, up over 500% in less than two years. Its crash into 2008 was one of the largest, down 72%.

After a “dead” market from 2010 into mid-2014, China’s stocks have literally exploded again… up 159% in a straight shot in one year, while its economy and exports have continued to slow!