Employment figures were released today and job growth was much softer than expected, representing the third weakest monthly job figures in 3 years. Unemployment remains at 3.6%, a 50 year low. The economy is still expanding slightly but losing momentum leading investors to believe that we may be hitting a peak. All the major indexes are up on the anticipation that the Fed will decrease interest rates sooner than later with weak employment numbers being the catalyst.

Below is the CME FedWatch Tool, from the CME Group (NASDAQ:CME) website. You can see that an interest rate cut went from a 58.4% chance of a rate cut in 2019 to a 99% chance in the course of just one month. There is currently a 56% chance of 3 rate cuts this year as economic figures slow.

.jpg)

The 10 Year US Treasury Note yield has fallen 36% in 8 months and is flirting with the 2% level which the markets haven’t seen since 2016. Now, as an investor, you are wondering how this will affect your portfolio and what ways you can hedge against adverse impacts.

When interest rates fall so does the cost of capital rate in which all companies are discounted at (at varying degrees depending on the amount of leverage), meaning that equity analysts will be coming up with higher valuations as interest rates drop.

Market Tracking ETFs

Market tracking ETFs are a perfect way to diversify your portfolio without having to buy 50 different stocks. This reduces the diversification risk in your portfolio but not market risk. In a bull market though these are the investments that you need.

This market tracking ETF follows the S&P 500 and as interest rates drop most equity positions will see an increase as long as the underlying economy doesn’t fall out from underneath. IVV is still 3% off its highs and as interest rate optimism increases I think that this ETF could bust through the $300 level. I believe the tariff anxiety is overplayed. At the end of the day Trump wants to be reelected and that is only going to happen if he can keep the economy and the markets positive.

Banking ETFs

Banks are one of the few industries that don’t benefit as interest rates drop. A substantial portion of banks’ top-line is driven by interest income and as interest rates decrease so does this figure. The rate at which banks borrow will decrease as well but when interest rates drop the margins between the cost of debt and interest income shrinks, shrinking the firm’s overall margins and shaving down both top and bottom lines. I would limit my exposure to financial firms in a decreasing interest rate environment.

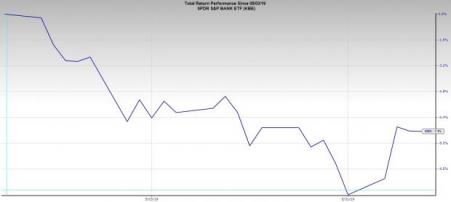

SPDR KBW Bank KBE

This is an ETF that is made up of all the top banks and financial stocks. Over the past month, KBE has fallen over 7% and I believe that this could continue if more negative economic data starts to hit the fan.

Look to buy this ETF if the signs of an economic slowdown diminish and if the Federal Reserve takes a more hawkish position on interest rates.

Growth Stock ETFs

Growth stocks have a larger upside that may not be as apparent as high-yield stocks in a decreasing interest rate environment. When analysts do a model using the cost of capital to discount cash flows, the huge cash flows expected far out in the future for these growth firms will be discounted and should give a good bump to the value.

iShares Russell 3000 Growth Index IUSG

This stock tracks all your favorite FAANG stocks along with other fast-growing firms. IUSG could see some substantial gains if interest rates continue to fall and the economy is able to keep its form. IUSG is up 16% this year so far, outperforming the market as a whole and is likely to continue its drive if the markets can sustain in the face of economic uncertainties.

Utility ETFs

Utility stocks are typically high-yield and offer investors a solid hedge in adverse market conditions. This type of ETF not only has low diversification risk but also low market risk. A utility ETF is the perfect investment for a rising interest rate environment with a large amount of economic uncertainty and I would highly recommend you add one to your portfolio.

iShares Dow Jones US Utilities IDU

This ETF offers a 2.6% yield on a highly diversified low beta underlying portfolio. This ETF has outperformed the market since the beginning of the year on the heels of a dovish Fed. The market is predicting an end to the economic cycle in the near future and what better investment for your portfolio than a solid utility ETF hedge.

Take Away

This is a very uncertain time for both the economy and the equity markets as tariffs and global slowdowns weigh on the US. The soft employment numbers released today has almost confirmed investors’ estimation of interest rate cuts in 2019. Interest rates are falling and equity positions are looking better and better. Consider the ETFs that I have discussed above and decide what work for you and your portfolio. Like I mentioned I would highly recommend adding a utility ETF into your portfolio.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

iShares Core S&P 500 ETF (IVV): ETF Research Reports

iShares U.S. Utilities ETF (IDU): ETF Research Reports

iShares Core S&P U.S. Growth ETF (IUSG): ETF Research Reports

SPDR S&P Bank ETF (NYSE:KBE): ETF Research Reports

Original post

Zacks Investment Research