Pre-open market analysis

Last week was a bull doji inside bar on the weekly chart. Since it followed a strong four-week rally, last week is a buy signal bar on the weekly chart. But, it was a doji and the chart is at the 20-week EMA. Therefore, this is a weak buy setup. There are probably sellers not far above.

The Emini has rallied in a parabolic wedge buy climax on the daily chart over the past four weeks. This typically results in exhausted bulls and about a ten bar pullback. Traders are deciding if the pullback has begun or whether there will be one more brief high before the pullback begins.

The December 12 high is a magnet above. That was the start of the December crash. Therefore, the bulls might be able to break above it before they finally exhaust themselves.

Can the rally break strongly above that December 12 high? Unlikely. The odds favor a retracement of at least a third of the January rally beginning within a couple weeks.

Overnight Emini Globex trading

The Emini is down 16 points in the Globex session. If it gaps down today, it will create a one-day island top. Island tops and bottoms are minor reversals. I said that on Friday when Friday gapped up and formed a two-day island bottom.

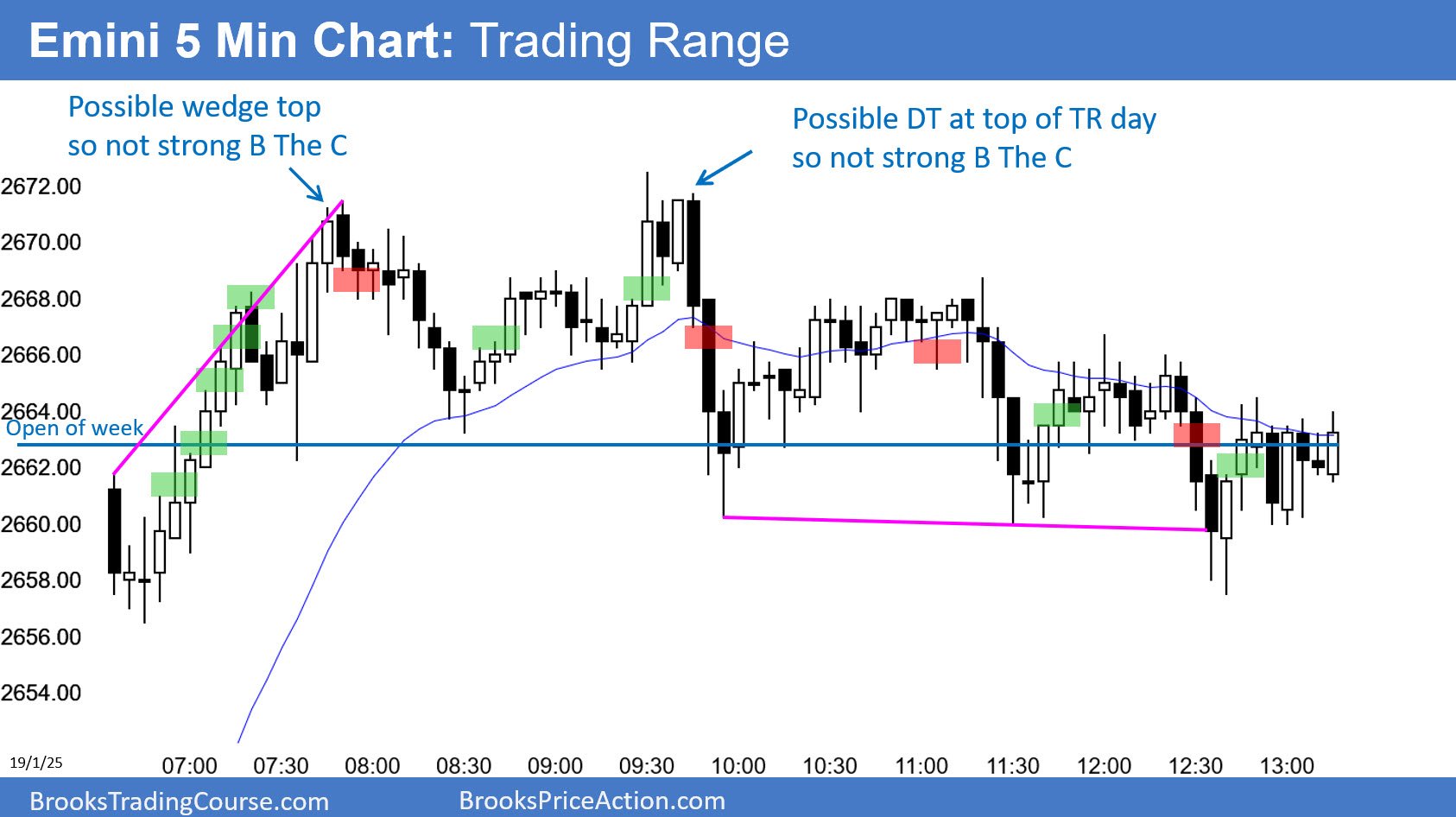

The Emini has been sideways for six days. It spent most of the time on the five minute chart within trading ranges. That is likely again today.

With the gap down, the bears hope that today will be the start of a small double top with the January high and a bigger double top with the December 12 high. However, the bulls hope that today is simply a pullback from Friday’s break above a four-day bear flag.

The six-day trading range is a sign of balance. Traders are deciding if a 50% pullback from the January rally has begun or if there will be a brief break above the December 12 high first. Until there is a strong breakout, traders will expect that trends up and down will last a couple hours and then enter a trading range or reverse for a couple hours.

Friday’s setups

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.