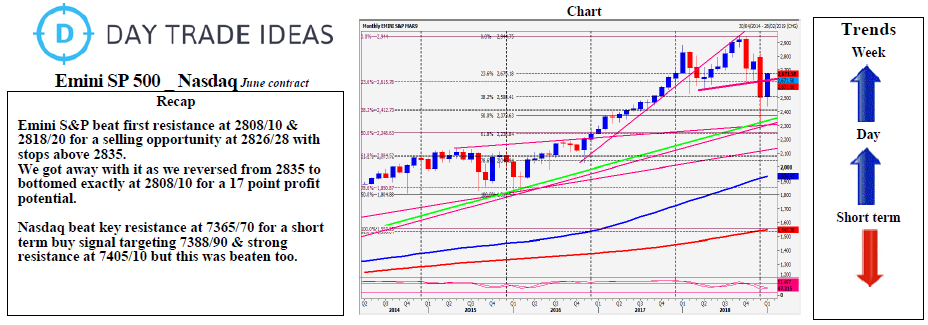

Emini S&P 500 - Nasdaq Daily Forecast - March 27, 2019

Emini S&P holding first support at 2808/10 sees a bounce back to resistance at 2826/28. Above 2830 retests resistance at 2835. Be ready to buy a break higher today targeting 2846/49.

Minor support at 2810/08 and 2803/02 but below 2800 targets 2796/95 and this week's low at 2790 before strong support at 2786/84. Longs need stops below 2780. The next target is 2767/64.

Nasdaq risks are to the downside at this stage. Below the 3-week trend line at 7335 tests support at 7306/02. A break below 7300 retests the low last week at 7290 then support at 7260/55.

Minor resistance at 7505/10 A break above 7520 retests 7445/50. A break above 7460 targets 7466/69 and 7487/90.