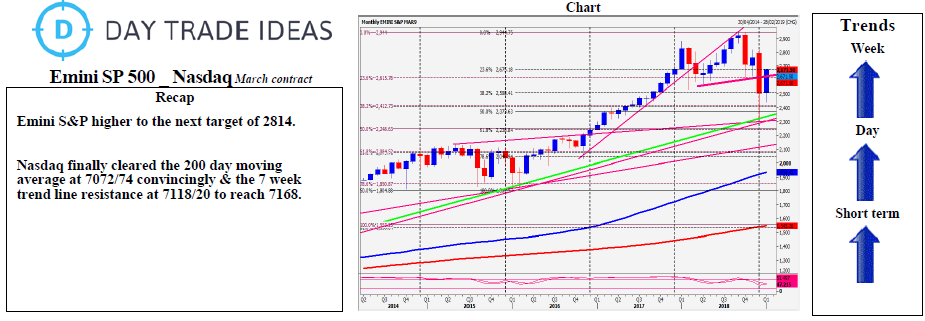

Emini S&P 500 - Nasdaq Daily Forecast - 26 February 2019

Emini S&P should have key support at 2789/87. Longs need stops below 2782. A break lower targets 2774/73 then support at 2771/70. Longs need stops below 2765.

Holding key support at 2789/87 targets 2793/94 and then 2798/99. Above 2800 look for 2805 then a retest of 2814. A break higher targets 2818 and 2822/24.

Nasdaq's first support is at 7090/80 and then strong support at 7060/50. Either of these levels could see a low for the day. However below 7040 targets 7015/05.

There is minor resistance at 7120/25 but above 7130 targets 7145 before the recovery high at 7165/68. A break higher targets 7200/10 and 7230.