Emini Trump Rally Exhaustion Gap On Weekly Chart

I will update around 6:55 a.m.

Pre-Open Market Analysis

The Emini gapped up yesterday. Since yesterday was a Monday, there is now a gap up on the weekly chart. Because of the extreme buy climax, the gap will probably be an exhaustion gap. That means it will probably close within a few weeks, and possibly this week. Most Monday gaps close before the end of the week. That makes gaps on the weekly chart even more rare.

The buy climaxes on the daily, weekly, and monthly charts are accelerating up in parabolic rallies. A parabolic rally can go a long way before it ends. Dow 25,000 is a Big Round Number that is just above, and therefore a magnet. However, since this rally is an extreme type of buy climax, the odds are 70% that it will end soon. A buy climax usually has to transition into at least a small trading range before the bears can get a bear trend. Because the monthly chart is so strong, a bear trend on the daily chart would still be a bull flag on the monthly chart. Consequently, the downside risk over the next several months is small.

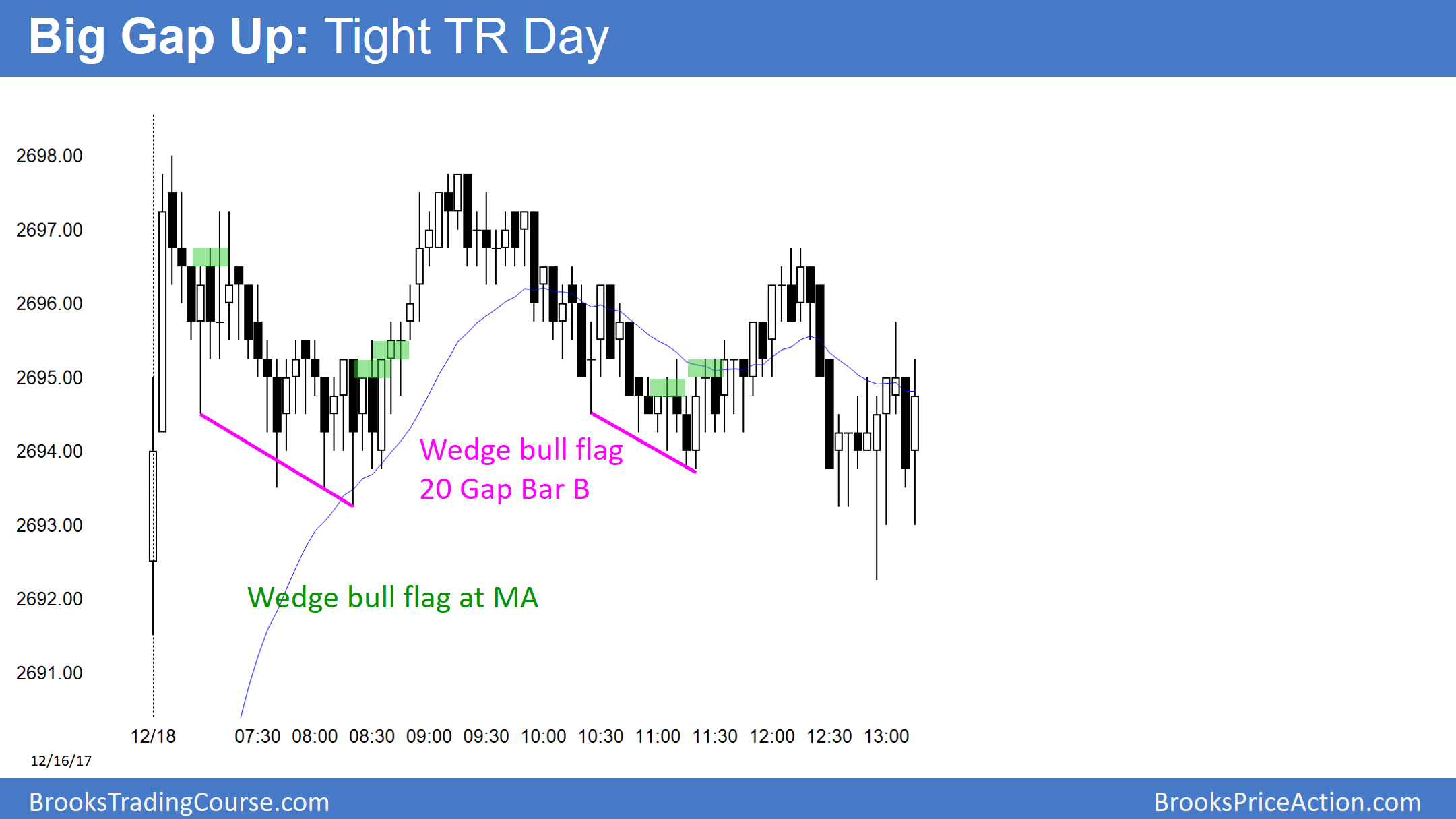

When there is a big gap up on the daily chart, the Emini usually goes sideways for several days. The bulls then try for trend resumption up. The bears want a failed breakout and a reversal down. A gap down at any point in the next several weeks will create an island top with yesterday’s gap up.

Because of the holidays, there is an increased chance that the markets will have mostly small ranges for the next 2 weeks.

Overnight Emini Globex Trading

The Emini is up 3 points in the Globex market. Yesterday was a strong breakout for the bulls. However, it was probably too strong to get good follow-through buying today. When there is a big gap up to a new high, the Emini often has to go sideways for several days. That is likely here.

In addition, this week and especially next week will probably have “Holiday Trading.” This means that most governments and institutions will avoid news. There will therefore be fewer catalysts. Furthermore, many traders will be distracted by the holidays. They therefore will have less energy to trade aggressively. As a result, most days will be in tight trading ranges. This will limit the number of good trading opportunities for day traders.

Yet, it is a chance to work on discipline and patience. Traders need to be selective in choosing their trades. In addition, if there is no good reason to exit, they should hold for their profit target. Because the market will probably move slowly, they will often have to hold onto a day trade much longer than they expect. In addition, the final profit will usually be less.

While the odds favor a lot of quiet trading until January, the computers are always looking for trades. Consequently, if there is a strong breakout up or down, traders should trade it and not deny that it is possible.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.